lead

Direct Tax

features sponsored features special focus local insights

-

Jasper Korving and Loes van Hulten of Deloitte provide an overview of the MLI, focusing in particular on the principal purpose test (PPT), an anti-treaty abuse measure in the convention, how the PPT might apply in practice, and its potential impact on companies.

-

The taxpayer challenges arising from the EU’s directive on mandatory disclosures for intermediaries (DAC 6) are seemingly countless, writes Christian Kaeser, global head of taxes at Siemens, and Mark Orlic and Arne Schnitger of PwC.

-

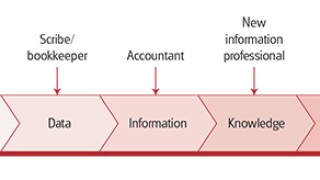

Drawing on China and international experience with the digitalisation of taxation, in particular as it relates to indirect taxation, Lachlan Wolfers, Vincent Pang, John Wang and Grace Luo chart out the possible future of tax rules, tax administration, and the tax profession itself.

Sponsored Features

-

Sponsored by BDO IndiaJoin ITR for a free webinar on February 4 as senior tax practitioners from BDO India analyse a highly significant ruling by the Indian Supreme Court

-

Sponsored by DeloitteInterview with Candy Ye Tang, tax and business advisory leader, Deloitte China

-

Sponsored by DeloitteInterview with Adham Hafoudh, partner, Tax & Legal, Deloitte Czech Republic

Special Focus

-

Sponsored by EY Central AmericaAntonio Ruiz and Alejandra Arguedas of EY Central America, Panama and Dominican Republic explain how tax, geopolitical factors, and trade agreements shape foreign investment in Central America, offering guidance for companies navigating the region

-

Sponsored by DDTC ConsultingDavid Hamzah Damian of DDTC Consulting examines recent procedural changes in Indonesia’s tax disputes process and the Supreme Court’s stance on tax evidence, highlighting key implications for taxpayers facing audits, objections, and appeals

-

Sponsored by DeloitteEddie Morris, Josep Serrano Torres, and Jen Breeze of Deloitte compare transfer pricing controversies in the pharmaceutical and automotive sectors, highlighting how DEMPE functions, regulation, and intangibles drive both common themes and sector-specific challenges

Local Insights

-

Sponsored by Spanish VAT ServicesThe ruling clarifies that Spain cannot restrict VAT exemptions for general services directly necessary to independent groups’ exempt activities, says Fernando Matesanz of Spanish VAT Services

-

Sponsored by MachadoGabriel Caldiron Rezende of Machado Associados comments on the latest developments related to the beginning of the Brazilian consumption tax reform test phase and considers the next steps

-

Sponsored by KPMG SwedenNils Schmid and Isabelle Berking of KPMG Sweden analyse the possibilities for sovereign wealth funds to claim refunds of Swedish withholding tax following a recent proposal referred to the Council on Legislation