lead

Direct Tax

features sponsored features special focus local insights

-

The UK is losing billions of pounds in revenues each year from online VAT fraud committed by foreign traders. But with Amazon and eBay profiting from the fraudsters, and HMRC not doing enough to tackle the problem, Anjana Haines explores whether collaboration or conviction is the better solution

-

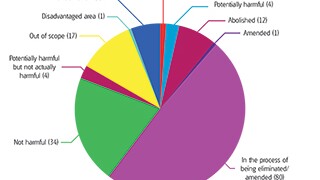

BEPS Action 5 – Countering harmful tax practices more effectively by taking into account transparency and substance is one of the four BEPS minimum standards. To date, 102 jurisdictions have committed to its implementation, and 2017 is a decisive year in translating that commitment into action. Achim Pross, Kevin Shoom and Melissa Dejong of the OECD, discuss the first results of the work under BEPS Action 5, and its significance in achieving the goals of the BEPS project.

-

Like all EU member states, Malta is preparing to transpose the Anti-Tax Avoidance Directive into domestic law. Nicky Gouder and Luana Scicluna of ARQ Group discuss the changes businesses can expect.

Sponsored Features

-

Sponsored by BDO IndiaJoin ITR for a free webinar on February 4 as senior tax practitioners from BDO India analyse a highly significant ruling by the Indian Supreme Court

-

Sponsored by DeloitteInterview with Candy Ye Tang, tax and business advisory leader, Deloitte China

-

Sponsored by DeloitteInterview with Adham Hafoudh, partner, Tax & Legal, Deloitte Czech Republic

Special Focus

-

Sponsored by EY Central AmericaAntonio Ruiz and Alejandra Arguedas of EY Central America, Panama and Dominican Republic explain how tax, geopolitical factors, and trade agreements shape foreign investment in Central America, offering guidance for companies navigating the region

-

Sponsored by DDTC ConsultingDavid Hamzah Damian of DDTC Consulting examines recent procedural changes in Indonesia’s tax disputes process and the Supreme Court’s stance on tax evidence, highlighting key implications for taxpayers facing audits, objections, and appeals

-

Sponsored by DeloitteEddie Morris, Josep Serrano Torres, and Jen Breeze of Deloitte compare transfer pricing controversies in the pharmaceutical and automotive sectors, highlighting how DEMPE functions, regulation, and intangibles drive both common themes and sector-specific challenges

Local Insights

-

Sponsored by Spanish VAT ServicesThe ruling clarifies that Spain cannot restrict VAT exemptions for general services directly necessary to independent groups’ exempt activities, says Fernando Matesanz of Spanish VAT Services

-

Sponsored by MachadoGabriel Caldiron Rezende of Machado Associados comments on the latest developments related to the beginning of the Brazilian consumption tax reform test phase and considers the next steps

-

Sponsored by KPMG SwedenNils Schmid and Isabelle Berking of KPMG Sweden analyse the possibilities for sovereign wealth funds to claim refunds of Swedish withholding tax following a recent proposal referred to the Council on Legislation