lead

Direct Tax

features sponsored features special focus local insights

-

In accordance with China’s 13th five-year economic development plan, which commenced in 2016, new policy tools such as the environment protection tax (EPT) and a reformed resources tax (RT) are being used to promote a ‘green development philosophy’. Jessica Xie, Flora Fan, William Zhang, and Maria Mei explore these new developments and what they mean for China’s greener future.

-

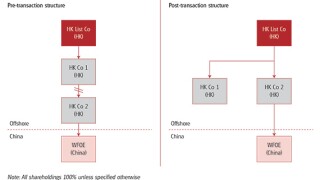

John Gu, Yvette Chan, Chris Mak, and Sam Fan explore the M&A tax challenges arising in hot sectors like TMT and healthcare, and for take-private transactions, establishing how investors can best get prepared. They note how, given the pace of developments and tax uncertainties, there is a need for the China tax authorities to provide greater clarity. More than ever, appropriate tax planning is crucial for M&A transactions.

-

The disparity between China’s rapidly developing and evolving digital economy and its largely traditional economy-based tax administration system is growing, and is creating challenges for both the tax authorities and taxpayers. Sunny Leung, Benjamin Lu, Jessie Zhang, and Grace Luo explore the issues.

Sponsored Features

-

Sponsored by BDO IndiaJoin ITR for a free webinar on February 4 as senior tax practitioners from BDO India analyse a highly significant ruling by the Indian Supreme Court

-

Sponsored by DeloitteInterview with Candy Ye Tang, tax and business advisory leader, Deloitte China

-

Sponsored by DeloitteInterview with Adham Hafoudh, partner, Tax & Legal, Deloitte Czech Republic

Special Focus

-

Sponsored by EY Central AmericaAntonio Ruiz and Alejandra Arguedas of EY Central America, Panama and Dominican Republic explain how tax, geopolitical factors, and trade agreements shape foreign investment in Central America, offering guidance for companies navigating the region

-

Sponsored by DDTC ConsultingDavid Hamzah Damian of DDTC Consulting examines recent procedural changes in Indonesia’s tax disputes process and the Supreme Court’s stance on tax evidence, highlighting key implications for taxpayers facing audits, objections, and appeals

-

Sponsored by DeloitteEddie Morris, Josep Serrano Torres, and Jen Breeze of Deloitte compare transfer pricing controversies in the pharmaceutical and automotive sectors, highlighting how DEMPE functions, regulation, and intangibles drive both common themes and sector-specific challenges

Local Insights

-

Sponsored by Spanish VAT ServicesThe ruling clarifies that Spain cannot restrict VAT exemptions for general services directly necessary to independent groups’ exempt activities, says Fernando Matesanz of Spanish VAT Services

-

Sponsored by MachadoGabriel Caldiron Rezende of Machado Associados comments on the latest developments related to the beginning of the Brazilian consumption tax reform test phase and considers the next steps

-

Sponsored by KPMG SwedenNils Schmid and Isabelle Berking of KPMG Sweden analyse the possibilities for sovereign wealth funds to claim refunds of Swedish withholding tax following a recent proposal referred to the Council on Legislation