lead

Direct Tax

features sponsored features special focus local insights

-

China’s multi-year tax administrative modernisation programme is leveraging big data technology and a restructured tax authority for effective enforcement. Tracey Zhang, Fang Wei, Lilly Li and Anthony Chau explain how this increased collection efficacy is transitioning the tax administration to a more mature and reasonable approach to dealing with the ever more complex commercial issues.

-

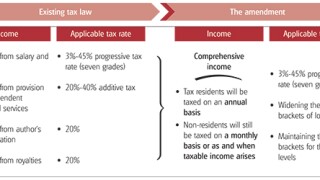

China’s individual income tax (IIT) reform has finally been implemented. While it has brought benefits for some, others await further clarity from the authorities on the implications. Michelle Zhou, Jason Jiang, Murray Sarelius and Sheila Zhang outline the impacts of this major tax reform and key considerations for taxpayers.

-

Taiwan refined its framework for taxing digital economy businesses in the past year, improved the tax rules for foreign enterprises operating regional logistics hubs, and updated transfer pricing (TP) provisions. Sherry Chang, Stephen Hsu, Hazel Chen, Ellen Ting, Lynn Chen and Betty Lee examine these important policy developments.

Sponsored Features

-

Sponsored by BDO IndiaJoin ITR for a free webinar on February 4 as senior tax practitioners from BDO India analyse a highly significant ruling by the Indian Supreme Court

-

Sponsored by DeloitteInterview with Candy Ye Tang, tax and business advisory leader, Deloitte China

-

Sponsored by DeloitteInterview with Adham Hafoudh, partner, Tax & Legal, Deloitte Czech Republic

Special Focus

-

Sponsored by EY Central AmericaAntonio Ruiz and Alejandra Arguedas of EY Central America, Panama and Dominican Republic explain how tax, geopolitical factors, and trade agreements shape foreign investment in Central America, offering guidance for companies navigating the region

-

Sponsored by DDTC ConsultingDavid Hamzah Damian of DDTC Consulting examines recent procedural changes in Indonesia’s tax disputes process and the Supreme Court’s stance on tax evidence, highlighting key implications for taxpayers facing audits, objections, and appeals

-

Sponsored by DeloitteEddie Morris, Josep Serrano Torres, and Jen Breeze of Deloitte compare transfer pricing controversies in the pharmaceutical and automotive sectors, highlighting how DEMPE functions, regulation, and intangibles drive both common themes and sector-specific challenges

Local Insights

-

Sponsored by Spanish VAT ServicesThe ruling clarifies that Spain cannot restrict VAT exemptions for general services directly necessary to independent groups’ exempt activities, says Fernando Matesanz of Spanish VAT Services

-

Sponsored by MachadoGabriel Caldiron Rezende of Machado Associados comments on the latest developments related to the beginning of the Brazilian consumption tax reform test phase and considers the next steps

-

Sponsored by KPMG SwedenNils Schmid and Isabelle Berking of KPMG Sweden analyse the possibilities for sovereign wealth funds to claim refunds of Swedish withholding tax following a recent proposal referred to the Council on Legislation