|

Tim Cook was also in the Global Tax 50 2013 |

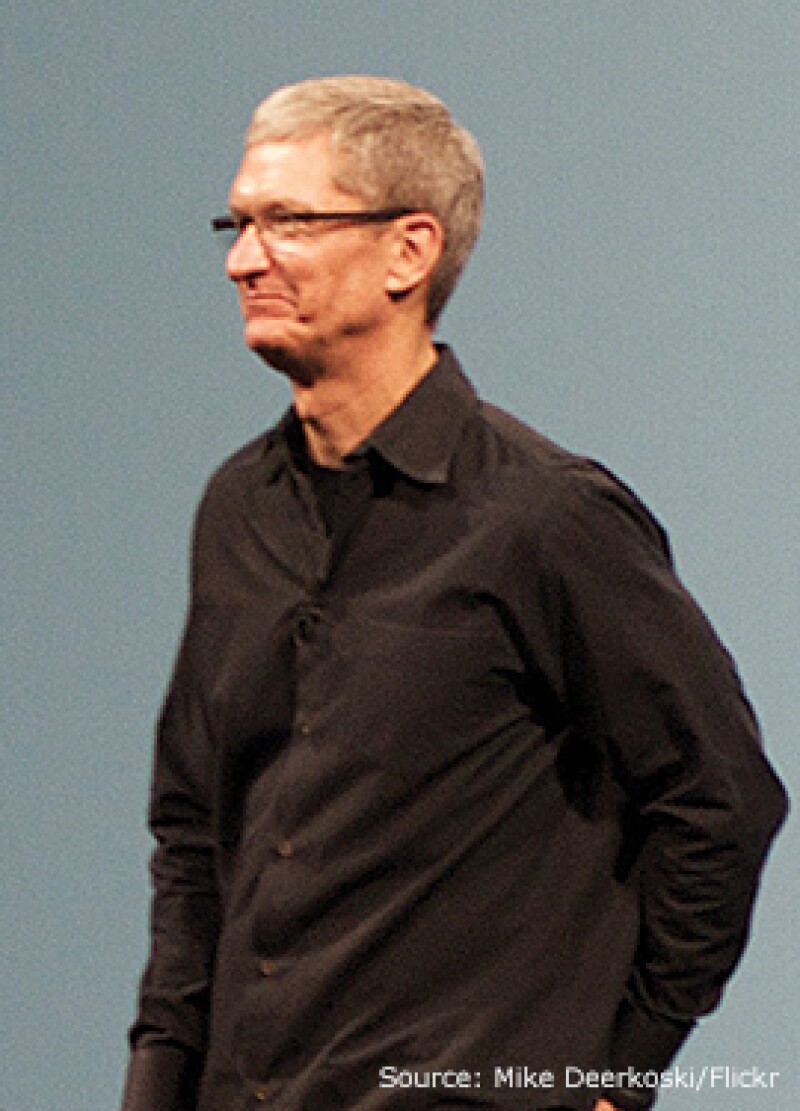

The man behind one of the world's largest technology companies has been outspoken over the past year about Apple's tax affairs, defending its tax practices at every opportunity. However, this has not stopped his company being in the centre of the biggest state aid case of 2016.

In his sixth year as CEO at Apple, he has had to deal with the European Commission's decision that Ireland had granted illegal tax benefits to Apple, which left the company with a tax bill of €13 billion ($14.5 billion). Over the past few months, Cook has dismissed criticism that Apple is not paying its fair share of taxes.

The CEO's initial reaction when confronted with the decision was to say that it was "total political crap". Later, he explained that "Apple is the biggest taxpayer in the US, and so we're not a tax dodger – we pay our share and then some".

Apple released an official statement after the decision, in which it claimed that the Commission had launched an effort to rewrite Apple's history in Europe, ignore Ireland's tax laws and upend the international tax system in the process. "The Commission's case is not about how much Apple pays in taxes, it's about which government collects the money. It will have a profound and harmful effect on investment and job creation in Europe."

Cook said he would appeal against the Commission's decision, and the Irish government decided to back the multinational and has filed its own appeal.

"It's important for everyone to understand that the allegation made in the EU is that Ireland gave us a special deal. Ireland denies that," Cook said. "The structure we have was applicable to everybody – it wasn't something that was done unique to Apple. It was their law."

The Global Tax 50 2016 |

|

|---|---|

The top 10 • Ranked in order of influence |

|

2. The International Consortium of Investigative Journalists |

|

3. Brexit |

4. Arun Jaitley |

5. Jacob Lew |

|

10. Donald Trump |

|

The remaining 40 • In alphabetic order |

|