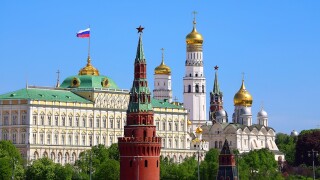

Russia

The country’s chancellor appears to have backtracked from previous pillar two scepticism; in other news, Donald Trump threatened Russia with 100% tariffs

Authorities must ensure that Russian firms do not use transfer pricing schemes to increase profits made from oil sold in different markets, advocacy organisations have argued

Russia suspended 38 tax treaties in response to the EU blacklisting the country after the 2022 invasion of Ukraine.

Russia will further its own economic isolation by suspending tax treaties with former allies, but this is part of Putin’s long-term mission.

Sponsored

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalDigitalisation is driving the auto industry through an evolutionary leap. Stephan Habisch and Andreas Göttert of Deloitte Germany look at the new digital era tax approach that may upturn existing TP practices.

-

Sponsored by Deloitte Transfer Pricing GlobalTehmina Sharma and Riddhi Shah of Deloitte India examine the industrial products and construction sector, where digitalisation is upending traditional business and supply chains.

-

Sponsored by KPMG RussiaPlace-of-supply rules state that consulting and legal services are deemed to be provided in Russia (and therefore VATable) if the purchaser carries out its activities in Russia.

Article list (load more 4 col) current tags