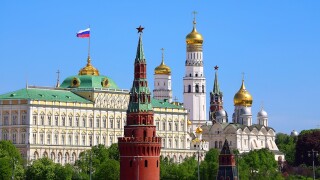

Russia

The country’s chancellor appears to have backtracked from previous pillar two scepticism; in other news, Donald Trump threatened Russia with 100% tariffs

Authorities must ensure that Russian firms do not use transfer pricing schemes to increase profits made from oil sold in different markets, advocacy organisations have argued

Russia suspended 38 tax treaties in response to the EU blacklisting the country after the 2022 invasion of Ukraine.

Russia will further its own economic isolation by suspending tax treaties with former allies, but this is part of Putin’s long-term mission.

Sponsored

Sponsored

-

Sponsored by Deloitte USIn a wide-ranging interview, ITR speaks to Terri LaRae, partner and leader of the global operations transformation tax team at Deloitte, about the factors driving tax transformation and how tax departments can get the best out of it.

-

Sponsored by KPMG RussiaRussia signed the Multilateral Convention to Implement Tax Related Measures to Prevent BEPS (multilateral instrument, or MLI) on June 7 2017.

-

Sponsored by Deloitte Transfer Pricing GlobalAn update to Russian transfer pricing regulations has seen an uptick in tax authority audits applying the comparable uncontrolled price (CUP) method. Deloitte’s Dmitry Kulakov, Alexey Sobchuk, Dmitriy Masharov, and Anastasia Kopysova explore the approach in three particular cases.

Article list (load more 4 col) current tags