Malta

Malta risks ceding tax revenues to jurisdictions that adopt the global minimum tax sooner, the IMF said

US and Turkey compromise again on DST, new rules in Belarus on e-services VAT, Malta forced to charge VAT on buying and selling of securities, and more

The ‘big four’ accountancy firm extends its UK chair’s term for a further two years, while UK business leaders protest against removing a VAT break for tourists

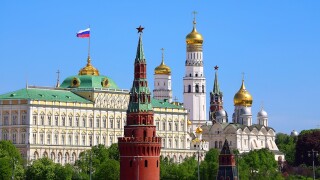

Russia will further its own economic isolation by suspending tax treaties with former allies, but this is part of Putin’s long-term mission.

Sponsored

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalPaul Riley, Samuel Gordon and Ralf Heussner preview ITR’s financial services guide, produced in collaboration with global transfer pricing (TP) experts from Deloitte.

-

Sponsored by Deloitte Transfer Pricing GlobalHead of the transfer pricing (TP) unit at the OECD, Stewart Brant, talks to Deloitte about how the OECD is responding to the challenges of taxing the digital economy, COVID-19 and developing dispute prevention and resolution mechanisms.

-

Sponsored by Deloitte Transfer Pricing GlobalStephen Weston, Silke Imig and Priscilla Ratilal interpret the potential impact of the OECD’s guidance for businesses in the financial services sector.

Article list (load more 4 col) current tags