lead

Direct Tax

features sponsored features special focus local insights

-

User-friendly digital tax filing systems, transformative AI deployment, and the continued proliferation of DSTs will define 2026, writes Ascoria’s Neil Kelley

-

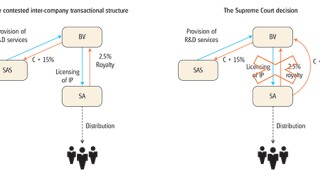

In the first of a two-part series, experts from Khaitan & Co dissect a highly anticipated Indian Supreme Court ruling that marks a decisive shift in India’s international tax jurisprudence

-

Libya’s often-overlooked stamp duty can halt payments and freeze contracts, making this quiet tax a decisive hurdle for foreign investors to clear, writes Salaheddin El Busefi

Sponsored Features

-

Sponsored by Lenz & StaehelinAfter Swiss tax reform failed to secure public support in 2017, lawmakers have revised key tenants to ensure it passes when it goes to a second referendum, this time in May 2019. Lenz & Staehelin’s Jean-Blaise Eckert and Frédéric Neukomm discuss the potential impact on corporations and shareholders.

-

Sponsored by Tax Partner AG, Taxand SwitzerlandAs Switzerland passes wide-scale tax reform, local tax authorities are increasingly focusing on intangibles and intellectual property (IP) audits as part of a two-pronged approach in tackling tax evasion. Tax Partner’s Caterina Colling-Russo and René Matteotti discuss the focus.

-

Sponsored by EY SwitzerlandAs Switzerland harmonises its corporate tax regime with international standards, the number of available tax incentives for businesses will diminish, while the effective tax rate will rise. EY Switzerland’s Kersten Honold and Kilian Bürgi discuss how cantonal ‘tax holidays’ provide an alternative to maintain rates below 10%.

Special Focus

-

Sponsored by EY Central AmericaAntonio Ruiz and Alejandra Arguedas of EY Central America, Panama and Dominican Republic explain how tax, geopolitical factors, and trade agreements shape foreign investment in Central America, offering guidance for companies navigating the region

-

Sponsored by DDTC ConsultingDavid Hamzah Damian of DDTC Consulting examines recent procedural changes in Indonesia’s tax disputes process and the Supreme Court’s stance on tax evidence, highlighting key implications for taxpayers facing audits, objections, and appeals

-

Sponsored by DeloitteEddie Morris, Josep Serrano Torres, and Jen Breeze of Deloitte compare transfer pricing controversies in the pharmaceutical and automotive sectors, highlighting how DEMPE functions, regulation, and intangibles drive both common themes and sector-specific challenges

Local Insights

-

Sponsored by Spanish VAT ServicesThe ruling clarifies that Spain cannot restrict VAT exemptions for general services directly necessary to independent groups’ exempt activities, says Fernando Matesanz of Spanish VAT Services

-

Sponsored by MachadoGabriel Caldiron Rezende of Machado Associados comments on the latest developments related to the beginning of the Brazilian consumption tax reform test phase and considers the next steps

-

Sponsored by KPMG SwedenNils Schmid and Isabelle Berking of KPMG Sweden analyse the possibilities for sovereign wealth funds to claim refunds of Swedish withholding tax following a recent proposal referred to the Council on Legislation