lead

Direct Tax

features sponsored features special focus local insights

-

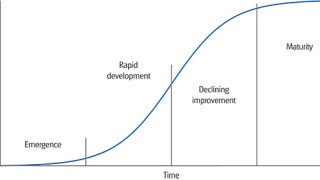

The evolving nature of technology means that markets change over the useful life of a technology. Michael Bowes and Jay Das address the importance of adapting to new performance characteristics and predicting how and when an upper limit of a given technology is reached.

-

Shannon Blankenship, Frank Polance, Keith Reams and James Ryan explore the evolution of the consumer products industry and the transfer pricing challenges it creates.

-

Life sciences companies, long at the vanguard of international tax planning, are facing particular challenges because of the important role the exploitation of intellectual property (IP) plays in the industry. Aydin Hayri, Keith Reams and Susan Eisenhauer discuss the complex web of tax and transfer pricing regulations that multinational companies have to navigate.

Sponsored Features

-

Sponsored by insightsoftwareJoin Grant Thornton and insightsoftware on April 23 for a free ITR webinar exploring how flexible tax software aligns with your existing processes, enabling smoother adoption, integration, and phased implementation across complex organisations

-

Sponsored by BDO IndiaJoin ITR for a free webinar on February 4 as senior tax practitioners from BDO India analyse a highly significant ruling by the Indian Supreme Court

-

Sponsored by DeloitteInterview with Candy Ye Tang, tax and business advisory leader, Deloitte China

Special Focus

-

Sponsored by EY Central AmericaAntonio Ruiz and Alejandra Arguedas of EY Central America, Panama and Dominican Republic explain how tax, geopolitical factors, and trade agreements shape foreign investment in Central America, offering guidance for companies navigating the region

-

Sponsored by DDTC ConsultingDavid Hamzah Damian of DDTC Consulting examines recent procedural changes in Indonesia’s tax disputes process and the Supreme Court’s stance on tax evidence, highlighting key implications for taxpayers facing audits, objections, and appeals

-

Sponsored by DeloitteEddie Morris, Josep Serrano Torres, and Jen Breeze of Deloitte compare transfer pricing controversies in the pharmaceutical and automotive sectors, highlighting how DEMPE functions, regulation, and intangibles drive both common themes and sector-specific challenges

Local Insights

-

Sponsored by Crowe Valente/Valente Associati GEB PartnersFederico Vincenti and Carola Valente Della Rovere of Valente Associati GEB Partners/Crowe Valente examine the challenges and methodologies involved in determining arm’s-length prices for transactions involving intangible assets, addressing how to ensure compliance and mitigate tax risks

-

Sponsored by VdAThe regime has modernised the taxation of employee equity, but several lingering shortcomings leave room for enhancement, say João Riscado Rapoula, Miguel Gonzalez Amado, and Ana Francisca Ribeiro of VdA

-

Sponsored by PwC ChileSandra Benedetto and Paula Campusano of PwC Chile analyse recent Chilean Internal Revenue Service rulings that adopt a new methodology compared with the criteria set in previous administrative instructions