lead

Sponsored

Sponsored by

insightsoftware

features sponsored features special focus local insights

-

Charles Yorke and David Stainer, of Allen & Overy, review the latest UK Government proposals on improving compliance by large corporate taxpayers, including a ‘voluntary’ code of practice likely to give rise to fears of ‘mission creep’.

-

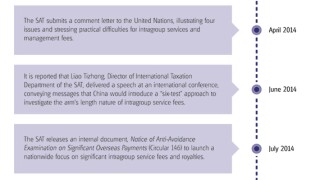

Patrick Cheung and Johnny Foun, of Deloitte China, go through the significant aspects of the BEPS action plan and local legislation to explore how these policies could affect multinationals’ outbound payments from China.

-

Deloitte’s UK transfer pricing practice recently held a seminar for its clients in the financial services sector. As part of this event, representatives from Deloitte’s financial services transfer pricing practices provided updates on key events in their respective markets. Below is a summary of each of the presentations from the London event, by Bill Yohana of Deloitte in the US.

Sponsored Features

-

Sponsored by insightsoftwareJoin Grant Thornton and insightsoftware on April 23 for a free ITR webinar exploring how flexible tax software aligns with your existing processes, enabling smoother adoption, integration, and phased implementation across complex organisations

-

Sponsored by BDO IndiaJoin ITR for a free webinar on February 4 as senior tax practitioners from BDO India analyse a highly significant ruling by the Indian Supreme Court

-

Sponsored by DeloitteInterview with Candy Ye Tang, tax and business advisory leader, Deloitte China

Special Focus

-

Sponsored by EY Central AmericaAntonio Ruiz and Alejandra Arguedas of EY Central America, Panama and Dominican Republic explain how tax, geopolitical factors, and trade agreements shape foreign investment in Central America, offering guidance for companies navigating the region

-

Sponsored by DDTC ConsultingDavid Hamzah Damian of DDTC Consulting examines recent procedural changes in Indonesia’s tax disputes process and the Supreme Court’s stance on tax evidence, highlighting key implications for taxpayers facing audits, objections, and appeals

-

Sponsored by DeloitteEddie Morris, Josep Serrano Torres, and Jen Breeze of Deloitte compare transfer pricing controversies in the pharmaceutical and automotive sectors, highlighting how DEMPE functions, regulation, and intangibles drive both common themes and sector-specific challenges

Local Insights

-

Sponsored by GNV ConsultingAhdianto Ah and Aditya Nugroho of GNV Consulting explain recent Indonesian tax reforms affecting business restructurings, treaty access, and enforcement

-

Sponsored by GNV ConsultingAhdianto Ah and Aditya Nugroho of GNV Consulting summarise an extension of the government-borne incentive, new risk-based taxpayer compliance supervision rules, and revised mutual agreement procedure guidelines

-

Sponsored by Saleh, Barsoum & Abdel Aziz – Grant Thornton EgyptRabie Morsy and Ahmed Khalifa of Saleh, Barsoum & Abdel Aziz – Grant Thornton Egypt analyse the amendments and guidance, focusing on construction, commodities, exemptions, and practical compliance implications for businesses