In a post-BEPS environment, new opportunities and challenges are developing as a result of fast-evolving and disruptive business models and shifting approaches to enforcement. The intensity of transfer pricing (TP) disputes continues to escalate on the back of TP reforms, public scrutiny of multinational enterprises (MNEs), and access to larger and more complex resources. Developments in technology and increasing collaboration between revenue authorities to enforce this increasingly fiscal and political matter have also ramped up the pressure.

Effective TP audit management is now more relevant than ever in view of increasingly coordinated multilateral approaches to compliance and enforcement. This is confirmed through the G20 and OECD's base erosion and profit shifting (BEPS) project. BEPS promises to bolster collaboration and transparency initiatives – note the country-by-country reporting – for information sharing between tax authorities. This is likely to prompt further increases in audit activity as authorities continue to target their fair share of MNE profits.

In a post-BEPS world, equilibrium seems to remain out of reach: companies are experiencing more intrusive audit approaches, while tax authorities often consider certain tax planning behaviours by companies to be too aggressive.

Efforts to bring certainty earlier in the process, such as rulings on tax arrangements, advance pricing agreements (APAs) and cooperative compliance, are appreciated. Nevertheless, there is more work to be done in South America. In this important period of transformation in tax systems worldwide, the dialogue for tax confidence should continue to be a priority.

How are businesses in the region responding to this and how do you evaluate, defend or align your model with new value creation in a sustainable manner? A look at some of the most important recent developments in the region should provide some valuable insights.

Argentina

On December 27 2018, the Argentine government enacted the Regulatory Decree (the Decree), to the reformed Income Tax Law (ITL), which became effective on January 1 2018.

International intermediaries

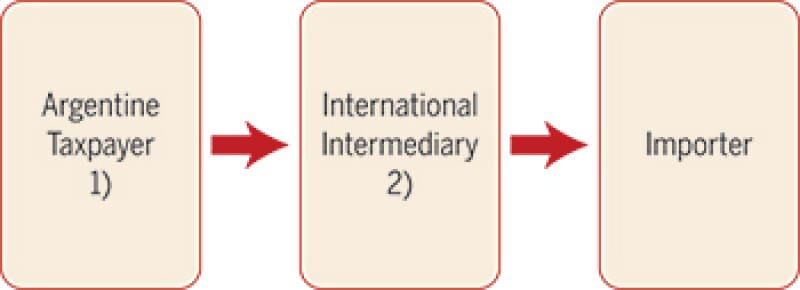

The Decree introduces guidance on the information that taxpayers must provide to the tax authorities in relation to goods imported or exported involving Argentine taxpayers and international intermediaries. The information requirements apply to two different scenarios (Table 1).

Based on Table 1, the provision will apply when the intermediary is considered a related party of the taxpayer; or the foreign counterparty in the transaction is considered a related party of the taxpayer. Therefore, taxpayers that carry out those transactions will have to demonstrate that the remuneration obtained from the foreign intermediary is consistent with the functions and risks involved in the transactions.

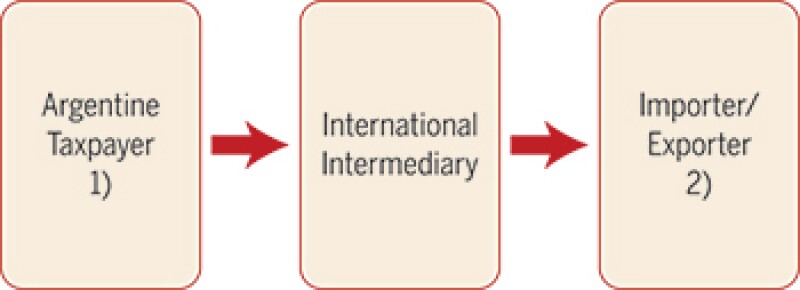

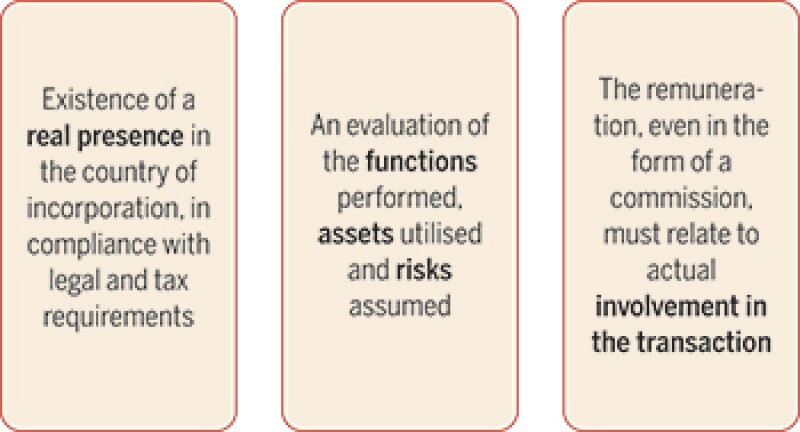

The Decree establishes a functional analysis of foreign intermediaries (Table 2).

In addition, when the intermediary is a related party, the Argentine taxpayer must keep information on the purchase and sale price and expenses related to the transaction.

If the international intermediary's remuneration is higher than the one obtained by third parties, the excess of the remuneration will be considered as income from an Argentine source attributable to the local taxpayer. Even worse, if the actual transaction differed significantly from the described functions or agreements in force, or if a transaction was exclusively arranged for a tax purpose, the Argentine tax authority (Administración Federal de Ingresos Públicos – AFIP) may re-characterise the transaction and disregard the existence of the intermediary in the operation.

More than ever, this provision is one area of potential conflict between Argentine taxpayers and the tax administration.

Finally, according to the Decree, when a taxpayer can prove with strong evidence that conditions 1 & 2 of Table 1 are not met, they do not need to provide such information and documentation of the intermediary.

Table 1: Intermediary tax disclosure

I) The Argentine taxpayer and international intermediary are considered related parties

II) The Argentine taxpayer and importer/exporter are considered related parties

Table 2: International intermediary: functional analysis

Valuing commodities exports

The Decree includes a definition for quoted prices for commodities transactions. Quoted prices are: "physical products that own or adopt public prices and well-known knowledge negotiated in transparent markets, stock exchanges or similar, national or international (including also the available prices or indexes recognised and published by statistical or public or private pricing agencies, among others), when these prices are usually used as market benchmarks by independent parties."

According to the Decree, taxpayers must document the price-setting mechanism and in addition to complying with the substance test mentioned above, must register, with the local tax authority, the written agreements related to such export transactions. The registration is done electronically via the AFIP's webpage.

The information to be disclosed includes: the date of the agreement; the name/address/tax ID of the exporter; information of the foreign importer; the existence of a relationship between the exporter, importer or the intermediary; the type of shipment, product, quality, transportation, etc.; price and sales 'conditions, including the price-setting methodology; prices and condition of sale considered as reference of transparent markets, stock exchanges or similar, or indexes or reports from specialised publications; adjustments performed to the quote price; the official price, where available; the agreed period of the shipment of the goods; the country destination of the goods.

The new tax rule establishes that for those transactions that do not fulfil the registration requirements and for those contracts whose data do not keep consistency with the operation or do not have the corresponding documentary support, the price of the goods exported at the time of shipment must be considered for tax purposes.

It is important to mention that the AFIP will publish prices or indexes for some goods that taxpayers may use as a minimum value for the export transactions.

Overall, from a business perspective, taxpayers in Argentina who have this type of transaction must remember that failure to comply with such reporting will lead to the determination of the taxable income by reference to the quoted price as at the shipment date.

Economic relationship

The Decree includes the list of criteria for categorising two entities as related parties. These criteria include shareholding but also economic and functional influence. It is particularly important to mention that these assumptions can be challenged by taxpayers because the Income Tax Law does not state that they are not refutable.

Non-cooperative and low-tax jurisdictions

Countries considered non-cooperative for tax purposes are defined as those jurisdictions that do not have a tax information exchange agreement or a tax treaty signed with Argentina. They also include countries where, despite having this kind of agreement, the exchange of information has failed. Low-tax jurisdictions are those countries or tax regimes that are determined as having a maximum corporate income tax rate lower than 60% of the Argentine corporate income tax rate (25%). To determine whether a jurisdiction is a low- or no-tax jurisdiction, the Decree clarifies that the total tax rate will be considered, regardless of the government level that imposed the tax.

Preferential tax regimes are those that diverge from the general corporate tax system and result in a lower effective tax rate. Prior versions of the Decree contained a list of jurisdictions considered as non-cooperating for tax transparency purposes, but the list has been removed from the final Decree.

Companies that have transactions with parties located in a 'non-cooperating' or low- or no-tax jurisdictions may need to analyse the consequences of those transactions from an Argentine TP standpoint, and consider the special deductibility rules and exclusions from capital gains exemptions, among others.

Transfer pricing compliance threshold

The Decree establishes changes to TP documentation requirements in accordance with OECD BEPS Action 13, including the materiality threshold for inter-company transactions. The Decree also defines the information to be included in the master file, local file and country-by-country reports. In practice, the threshold for applicability in a master file and local file has been established for taxpayers for which inter-company transactions do not exceed ARS3 million ($54,000), in total amount of transactions, or ARS300,000, for each individual transaction.

On a separate note, taxpayers expect that the AFIP will issue supplementary guidelines providing greater detail about the master file and local file and the due dates.

Comparability analyses

The Decree introduces guidance regarding comparability analyses. The proposed scheme on related parties' transactions must be carried out individually, operation by operation. Nevertheless, a global approach could be used when different transactions are closely related.

In light of this issue, and the additional scrutiny this is likely to bring, successful defence of these structures will turn on two key points. The first, is that although the arm's-length principle is of a transactional nature, multiple controlled transactions by a taxpayer must be regularly analysed on an aggregate basis in order to enhance the reliability of the arm's-length test or for practical reasons. Second, an aggregation may even be warranted for transactions carried out by a separate group of companies when those transactions are closely linked to each other. A business perspective must be applied for the purpose of determining whether an aggregation should be made.

The Decree also establishes that inter-company transactions must be analysed using segmented financial information. In addition, for analyses of the related transactions, tested party information must come from the current tax year, while for comparable companies it is possible to use more than one year, depending on the business conditions.

It is also important to evidence those business strategies – penetration, permanence and market expansion – and include the evidence as an acceptance comparability reason as long as the taxpayer documents it when the decision is taken.

Transfer pricing methods

Taxpayers are allowed to use other methods for specific transactions. This is the case when dealing with the transfer of valuable and unique intangibles, financial assets, or investment assets that do not have comparables and where the TP methods included in the Decree are not applicable.

When applying the residual profit split, a taxpayer must notify the AFIP prior to the application of this method.

Lastly, changes in the TP method from one year to the next must be duly substantiated, with the reasons documented.

Interquartile range

Historically, the TP adjustment was made to the median +/- 5%. According to the Decree, the interquartile range was kept as the arm's-length range when there were two or more comparables. However, the adjustment is now made to the median.

Interest deductibility limitations

Primarily, Law No. 27,430 established a rule capping the deduction on interest expense with local and foreign related parties to 30% of the taxpayer's taxable income before interest, foreign exchange losses and depreciation (EBITDA). In addition, it is not only interest expenses that must be considered for the ratio calculation, but also the foreign exchange losses produced by the financial inter-company debts. The Decree also clarifies that the limit does not apply to interest subject to withholding tax, even when the provisions of a tax treaty (for example, reduced rates or exemptions) apply.

Steering in the right direction

Even if the amendments introduced by the tax reform and regulated by the Decree can be viewed as an important stage in aligning Argentine TP rules with the transparency and substance concepts in the taxation of international transactions, some local measures will require further clarification by the AFIP.

Multinational entities conducting business or planning to invest in Argentina should carefully analyse these rules and be aware of the impact of these changes.

While the Decree provides extensive guidance, businesses expect that the AFIP would issue supplementary guidelines providing more detail and clarity relating to TP compliance in Argentina. This would help them evaluate potential effects on their existing operations and on how their business in Argentina is organised.

Peru

In 2018, Peruvian TP rules regarding cross-border commodity transactions were modified in line with the objective of the tax authorities to monitor transactions involving commodities. Until then, it had not been possible to audit those types of transactions through an efficient mechanism. These amendments entered in force on January 1 2019 and are an extension of the application of the comparable uncontrolled price method (CUP method) to analyse certain commodities and are based on the 'sixth transfer pricing method'.

The main amendments introduced by the new Decrees impact the good involved, as goods included within their scope include commodities such as copper, gold, silver, zinc and fishmeal for exports; and corn, soybean and wheat for imports.

The arm's-length price must be determined by using the date of the agreed quoted price, as long as this value is equivalent to a quoted price agreed by independent parties over similar conditions and the taxpayer fulfils the corresponding communication to the National Superintendency of Tax Administration (SUNAT).

Notwithstanding the above, taxpayers are allowed to apply adjustments to the price in order to reflect the characteristics of a transaction, and to the extent that such adjustments are dully supported and reliably documented through specialised technical documentation, such as reports from independent experts, databases or specialised journals or reports. The rules also state that any foundation of a general nature has no value to support these types of adjustments.

In communicating with SUNAT, a written statement (commonly known as the 'communication') must be filed within 15 working days prior to the date of shipment or disembarkation. The communication qualifies as an affidavit and the taxpayer must include the agreement and or details of such an agreement where the terms of import or export operation are clearly detailed.

Likewise, where a taxpayer does not file the communication, or files it incompletely, extemporaneously or not according to the agreement between the parties, the market value will be deemed the average of the quotation price on the day of the shipment or disembarkation. Corresponding penalties will then apply.

To the extent that SUNAT has not yet issued specific guidance about the format or template of the affidavit and the procedure to submit it, taxpayers must file the communication by using a XLS format to the e-mail address: precioscommodities@sunat.gob.pe.

Where taxpayers select a different TP method instead of the CUP method, the selection must be supported by a specific technical report accompanied by documentation explaining the economic, financial and technical reasons. This technical report must be filed for each one of the shipments and should be attached to the aforementioned communication. In case a taxpayer does not present the technical report or its supporting documentation, the SUNAT can apply the most appropriate valuation method according to its own analysis instead of the taxpayer's selected method. Failure to include this technical report in the Communication to SUNAT may mean the Communication is deemed incomplete.

As the above shows, transfer pricing is unquestionably an increasingly popular business topic in Peru which requires significant attention from nearly every business. The issuance of guidelines that provide details regarding the form and conditions for filing the communication is still pending. We expect that such a resolution will provide more detail regarding the documentation that may support the affidavits for these kinds of operations and clarify the doubts that have arisen from these amendments.

Uruguay

The Uruguayan tax authority (Dirección General Impositiva – DGI) continues to focus on TP issues when performing tax examinations. Outside of loss-making products or lines of business, significant management services and the characterisation of Uruguayan entities for TP purposes, the DGI has recently been focusing on closed entities, in the context of business restructurings, and merger transactions performed on a global scale and their valuation for tax local purposes.

Between October 2018 and January 2019, Uruguay issued Decree No. 353/018 and the DGI published a series of guidelines to complement the TP rules set forth in the Tax Transparency Act (No. 19.484), which was published in January 2017.

Consequently, in March and April 2019, the following first filing took place. This included country-by-country (CbC) notifications referring to the fiscal years 2017-2018 or 2018-2019 (for future filings, the CbC notification must be filed before the taxpayer's year-end). For 2017, CbC notifications were filed when the ultimate parent company of the MNE group was an Uruguay-based entity and when the ultimate parent company of the MNE, or the surrogate entity, was located in a country that does not have a competent authority agreement with the Uruguayan tax authorities. For future filings, the due date will be 12 months immediately after the MNE's year-end.

There have been no rulings or statements from the DGI in relation to the filing of a master file report. However, it is important to mention that the master file requirement is noted in the Tax Transparency Act and in its related regulations.

Ecuador

In the past three years, Ecuador's tax authority (Internal Revenue Service, or IRS) has intensified its actions with respect to transfer pricing examinations. Most of the examinations have targeted multinational companies operating in the oil, pharmaceutical and goods (bananas, shrimp, flowers and cocoa) export industries, but commodity importers of steel, wheat, soybeans and corn have also been included.

One of the main practices challenged by the IRS is the application of the CUP method in transactions involving commodity imports. The IRS seeks to apply the CUP method using information that, in some cases, is not publicly available and that is restricted to the tax and customs authorities.

Commodity import negotiations are not performed at trader or broker level, where profits arise on negotiations performed in public stock exchanges for such commodities. Taxpayers domiciled in Ecuador typically import commodities as a means of obtaining raw materials to ensure inventories for the production of goods for the Ecuadorian domestic market. Consequently, import prices are, preferably, analysed using methods that examine the profitability of operations.

Since the additional assessments imposed by the IRS are the result of a change of method by taxpayers, in requiring them to apply CUP, taxpayers have decided to resort to the prior assessment consultation (CVP).

The CVP is a process similar to an APA that allows a consultation with respect to the pricing methodology used in inter-company transactions. The CVP provides a threshold of security when applying a TP method and the selection of comparable companies or transactions. The term of a CVP ruling is four years. Taxpayers efforts are now focused on objectively demonstrating that the CUP method is not applicable for many of their import transactions because economic realities vary and the information that the Ecuadorian tax authority seeks to use does not correspond to normal situations in public and transparent markets.

Consequently, companies should allocate time to plan their transactions and prices at the beginning of each fiscal period. In the case of complex transactions that may have a significant impact on the taxpayer's financial statements, it is vital that a CVP process be initiated to ensure a timely agreement with the tax authorities on an appropriate methodology. The IRS has made a channel available to taxpayers to review and discuss methodologies, even when the result concludes that application of the CUP method is appropriate.

Venezuela

Over recent years, it has been commonplace for taxpayers that receive of an objection writ from the Venezuelan tax authority (SENIAT) challenging their transfer prices, to file a notice of disclaimer refuting the terms of the challenge. Once the SENIAT responds to such a disclaimer and makes the resolution of the indictment (usually within a two-year term) in general, the taxpayer must make the payment of the adjustment determined by the SENIAT. Common practice over these recent years has also seen companies take the defence process to the next stage via an administrative appeal.

Although fines for non-compliance with formal TP reporting obligations are considered low, the review of formal obligations typically represents the first step before formally opening an examination.

In this sense, TP specialists are actively participating in tax audits of foreign-based companies. In tax reviews conducted during the past year, it is evident that the underlying purpose of recent examinations extends beyond the traditional, more-limited review conducted and that they have routinely included a review of formal TP obligations.

Colombia

In mid-2019, there was a noticeable increase in the Colombian tax authority's (DIAN) focus on the provisions set forth in Article 90 of the Finance Law. This states that when the price agreed between the parties (not necessarily related parties) in purchases and other payments differs notoriously from the market price of the goods or services on the date of their purchase or provision, the DIAN's officer in charge of the audit is allowed to reject the prices for tax purposes and to indicate a price for such goods or services, according to their nature, characteristics, conditions and/or status.

For this purpose, the case officer may use statistical data generated by the DIAN, the National Department of Statistics, the Central Bank of Colombia or other related public entities. This has the practical effect of overriding the pricing and transfer pricing analysis prepared by the taxpayer in the examination.

It is understood that the prices of goods sold and/or of the services rendered between parties 'differ notoriously from the average' when there is a discrepancy of more than 15% compared to the market prices of the goods and services with the same characteristics and quality at the date of the transaction.

Despite the fact that in Colombia a TP framework for local parties does not exist (except for those agreed with related parties located in free trade zones within Colombia), the aforementioned provision generates the basis to define the elements that must be used or considered to determine if a local inter-company transaction complies with the arm's-length principle. Under this understanding, the TP technique takes on a greater relevance, not only in terms of documentation, because it will be the main tool through which the taxpayer will have to carry out efficient tax planning.

In order to match the DIAN's level of scrutiny, companies should more effectively manage their TP risk profiles. Based on the above, Colombian entities have to understand whether their existing business model justifies the current inter-company pricing or TP policy and what its potential impact in an examination may be, given the existence of such far-reaching provisions.

The time for action is now

Unquestionably, the Latin American tax world will continue to see a lot of change in the next year – and for years after that.

Past tax deals are becoming a future risk for companies. There is no doubt that tax controversy is increasing both across borders and within countries. In this post-BEPS environment, MNEs will need a global documentation strategy, along with underlying systems and processes, to allow them to deliver consistent and robust TP documentation across all their affiliates and in line with statutory deadlines.

The cost of non-compliance is too great to leave TP to chance. With this in mind, MNEs should be aware of key audit areas across their operating jurisdictions and preventively develop strong TP policies and procedures. Perhaps it will become increasingly necessary to make better use of APAs in order to gain certainty and avoid disputes.

This evolving South American landscape presents an even greater challenge to company executives who need to keep their fingers on the pulse of change and constantly adapt their TP strategies.

Taking into account that a new and more challenging world of controversy lies ahead, we should focus not only on resolution, but also on the prevention of disputes. The time for discussion is over; the time for action is now.

Silvana Blanco |

|

|---|---|

|

Transfer pricing partner, Argentina Deloitte Tel: +(54) 11 4320 4046 Silvana Blanco is a partner in Deloitte Argentina's TP team. She has been working at the transfer pricing department since its inception. From the beginning of the application of TP standards in Argentina, Silvana has participated actively with the tax administration officers. She has more than 21 years of experience in the application of tax, economic and financial criteria in transfer pricing, valuation analysis of intangibles, planning, business model optimisation, structuring and economic consulting. Silvana has a large experience in fields such as the coordination of multi-country TP assignments for multinational groups, the optimisation of tax burden, and information requests posed by tax authorities in key industries such as the automotive industry, the oil seeds industry and the pharmaceutical industry. She has actively participated as a speaker in seminars and conferences at the Bolsa de Cereales de Buenos Aires, Consejo Profesional de Ciencias Económicas de la Capital Federal, Bolsa de Comercio de Rosario and Asociación Argentina de Estudios Fiscales, among others. She has written many articles in newspapers and local tax specialised publications such as Ámbito Financiero, colección Errepar, Buenos Aires Herald, World Trade Executive, etc. She is the co-writer of 'Manual de Precios de Transferencia en Argentina' (La Ley 2007). Silvana graduated as a certified public accountant from Salvador University and holds a master's degree in strategic business administration and marketing from the Universidad de Ciencias Empresariales y Sociales (UCES). She is a member of the International Fiscal Association (AAEF) and part of the Transfer Pricing Commission. |

Horacio Dinice |

|

|---|---|

|

International tax and transfer pricing partner, Argentina Deloitte Tel: +54 11 4321-3002 Horacio Dinice is a tax partner in Deloitte Argentina. He has engaged mainly in international tax consulting and TP Matters. His experience covers a wide range of industries but it has been centred on the pharmaceutical sector for many years. Horacio's professional experience includes being in charge of the TP practice in Buenos Aires and LATCO and being one of the partners responsible for international tax. He has advised multinational corporations on tax implications of cross-border acquisitions/transactions and the establishment of foreign operations in countries of the Latin American region (Argentina, Bolivia, Paraguay and Uruguay). He is the lead partner on more than 100 documentation studies per year and specialises in cross-border structuring for Argentinean and Latin American companies. He has advised on various mergers and acquisitions in Argentina, developed linked regional cross-border tax planning and TP solutions and participated in several regional and global TP projects. Horacio has been a professor of tax at the University of Buenos Aires (1986-1992) & CEMA (2006-2015) and is a frequent speaker at conferences focusing on tax and TP issues. He is a member of the AAEF (IFA member) and participant of the Transfer Pricing Commission. He is also a certified public accountant. |

Gloria Guevara |

|

|---|---|

|

Transfer pricing partner, Peru Deloitte Gloria Guevara is the partner responsible for the Deloitte Perú transfer pricing practice. Gloria has more than 16 years of experience with Deloitte, during which she has advised multinational companies and key local groups operating in diverse industries such as: mining; oil and gas; energy; manufacturing; pharmaceuticals; consumer business and telecom, media; and technology (TMT), among others. Gloria has extensive experience advising clients on strategic planning design and TP policies. She has actively participated in high level complexity TP issues (valuation of intangibles, valuation of mining properties, and residual profit split application), as well as diverse audit defences regarding this field. She advised one of Deloitte's main clients in the telecoms industry in the negotiation of an advance pricing agreement (APA) with the National Tax Administration. Gloria is also the TMT industry leader at Deloitte Perú. In this role, she is responsible for coordinating and promoting all the services that the firm can offer to existing and potential TMT clients throughout the different business lines. Her responsibilities also extend to the coordination with the TMT regional and global leaders in order to better serve Deloitte's global TMT clients. |

Alejandra Barrancos |

|

|---|---|

|

Transfer pricing senior manager, Uruguay Deloitte Tel: +598 2916 0756 Alejandra Barrancos is a senior manager in the transfer pricing practice of Deloitte Uruguay. She has worked in different areas of Deloitte's tax department since 1997 and spent a few months at Deloitte Argentina TP practice. She accumulated significant experience in various advisory services to foreign companies, such as tax compliance, local and international tax planning, M&A and transfer pricing. Her experience in TP projects includes planning projects, documentation projects, either locally prepared or as part of a global documentation project, and tax and TP controversy. She has participated in several TP courses in Uruguay and abroad. Alejandra has participated as a speaker in seminars and conferences at Deloitte and 'Jornadas Tributarias', among others. She is a professor of international tax for the post-graduate degree course in taxation in the Catholic University of Uruguay and a former assistant professor of taxes in Universidad ORT Uruguay. She is also a former assistant professor of tax legislation at the Faculty of Economics and Administration at the Universidad de la República. Alejandra is a member of the Uruguayan Institute for Tax Research and a certified public accountant. |

Joseph Soto |

|

|---|---|

|

Tax and transfer pricing partner, Ecuador Deloitte Tel: + 593 (4) 3700-100 Ext.: 1111 Joseph Soto is an international tax partner in the Guayaquil office of Deloitte Ecuador. He has more than 24 years of experience in tax consulting and transfer pricing for local and multinational corporations. He is the TP leader for Ecuador office. Joseph has a portfolio of clients that includes multinational and local business groups, to which he provides advisory services, tax planning, due diligence services and tax advice on mergers and acquisitions. Clients are active in manufacturing, distribution, commercial activities, telecommunications, services, shipping, airlines and other areas. He is a graduate of the University of Guayaquil and holds an executive master's degree in business administration. He is also a member of the Ecuadorian Institute of Tax Law and the Deloitte Tax Practice Commission. Joseph has taught taxation subjects in Ecuadorian universities and has participated as a speaker in business development seminars and in tax matters and TP programs. He regularly contributes articles to various publications specialising in tax and TP. |

Iliana Salcedo |

|

|---|---|

|

Transfer pricing partner, Venezuela Deloitte Tel: +58 (212) 206 8778 Iliana Salcedo is a public accountant with a master's in tax management. She has more than 20 years of experience providing tax technical advisory in TP matters. She is part of Deloitte's Andean region TP practices. Iliana has wide experience in the preparation and review of TP documentation in different industry sectors, including: automotive; pharmaceutical; basic materials; mining; chemicals; and services, among others. She has been actively involved in the development of projects for documenting and designing TP policies, strategies and structures for multinational groups. Iliana is also experienced in defence preparation in transfer pricing audits in Venezuela. She is a speaker in different TP regime-related conferences across the Andean region. |

Bruno Urrieta Farías |

|

|---|---|

|

Partner, Colombia Deloitte Tel: + 57 (1) 4262303 Bruno Urrieta is a partner in the Bogotá office and responsible of the Colombian transfer pricing practice. For more than 17 years he has assisted multinational and national groups with operations in different industries, including: mining; manufacturing; media and entertainment; automotive; real estate; hospitality; telecommunications; and retail, among others. He advises on the design, implementation and/or defence of their TP policies. Before joining Deloitte Colombia, Bruno was part of the Mexican TP practice in the Mexico City office, where he participated in different projects for some of the largest Mexican multinational and national groups and subsidiaries of US and Canadian companies. The projects included: the application of economic and financial criteria in transfer pricing; the design of inter-company policies and methodologies; valuation of intangible property; business model optimisation; tax controversy situations; negotiation of advance pricing agreements; and documentation projects to comply with local regulations. Additionally, Bruno has a broad experience coordinating regional TP documentation and planning projects for multinational groups that have operations in Latin and North America. Bruno is a member of Deloitte's technology, media and entertainment and telecommunications (TMT) tax practice, and has worked closely in compliance and planning projects with some of the major players in the Mexican and Latin American advertising, media and entertainment markets. He holds a master's degree in strategic business consulting from the Universidad Panamericana and a BA (honours) in economics from the Universidad Nacional Autónoma de México (UNAM). |