|

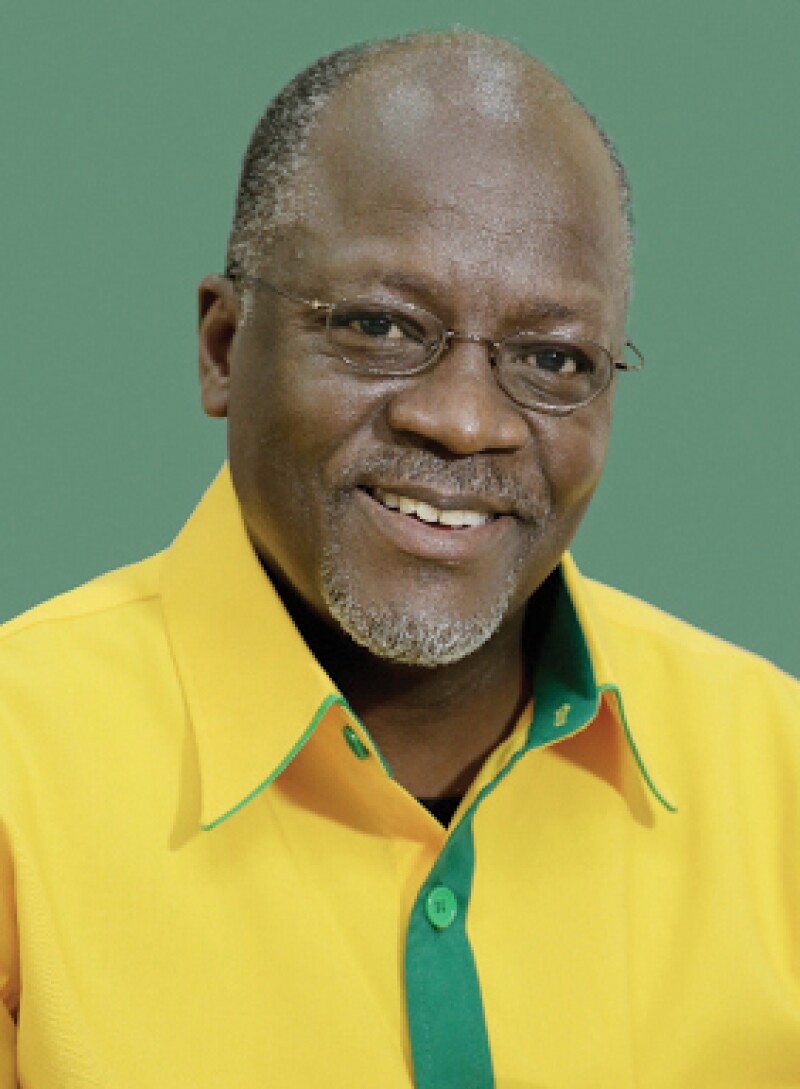

John Pombe Joseph Magufuli is a new entry this year |

John Pombe Joseph Magufuli, sometimes described as Tanzania's bulldozer president, has taken aim at international natural resource companies.

Just ask Barrick Gold. The Canadian miner's subsidiary, Acacia Mining, was served a bill in back taxes of some $190 billion in July. In a show of good faith, the parties agreed on a $300 million payment in October, and a restructuring of the distribution of future mining income.

Magufuli's recent overhaul of the country's natural resource royalties and taxation regimes remain controversial. Regardless of the outcome, master reformist or foe to mining companies, Magufuli's radical action scares investors, which may end up harming the country's chances of being perceived as a good place for foreign investment.

Magufuli took over the presidency in 2015 with a campaign promise to clean up corruption, but has on occasion been rapped over muzzling the free press.

However, Magufuli's rhetoric is soft. While Philippines President Rodrigo Duterte threatened miners on environmental grounds saying "I'll tax you to death", Magufuli recommends alleged tax evaders seek "the forgiveness of angels".

Speaking at an FT summit in London in October, Aliko Dangote, a Nigerian businessman with investments in Tanzania, reportedly criticised Magufuli as nationalist in his thinking.

"They've scared quite a lot of investors, and scaring investors is not a good thing to do," said Dangote. "Once an investor complains the rest will run away, they don't even want to hear the details."

Undoubtedly, the news of the legislative overhaul had London investors gripping their desks and looking for Swahili translators.

The action almost certainly set a precedent for other African countries as tax authorities from Namibia and Zambia to Ghana are all taking a closer look at trade outflows.

Empowered by international initiatives that highlight tax and transfer pricing loopholes allowing for corporate profits to move at low or zero-tax rates, many African countries are now tightening the net.

Some African countries have replaced donor funding with sovereign bonds and debt that is hard to keep up with, especially during a commodity downturn. Domestic revenue mobilisation from tax has become a key target for many governments, including Tanzania's.

Tanzania's tax-to-GDP ratio has risen from 8% in 2000 to 11.9% in 2016, which is still well below the average, even for low-income countries. However, what this signifies is serious room for growth. The IMF has proposed broadening the tax base with VAT and corporate income tax, property tax and by adjusting specific excise rates.

The scope for tax reform in Tanzania is big but the country will most probably benefit the most from tax simplification and clear guidelines for business.

But Magufuli does not appear to be one for slow policy change. Instead, he has gripped the mining industry by the collar. The outcome of this radical move has yet to prove successful and might determine the remainder of his term.

The Global Tax 50 2017 |

|

|---|---|

The top 10 • Ranked in order of influence |

|

6. Arun Jaitley |

|

The remaining 40 • In alphabetic order |

|

| The Estonian presidency of the Council of the European Union |

|

| International Consortium of Investigative Journalists (ICIJ) |

|

| United Nations Committee of Experts on International Cooperation in Tax Matters |

|