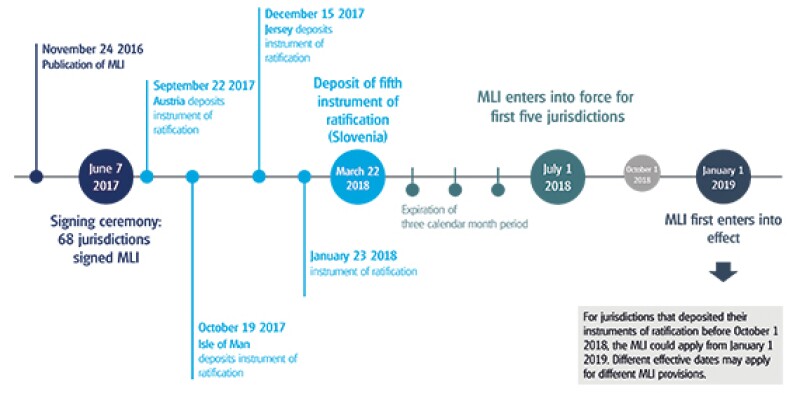

On July 1 2018, the Multilateral Convention to Implement Tax Treaty-Related Measures to Prevent Base Erosion and Profit Shifting (MLI) entered into force for the first five jurisdictions to deposit their instruments of ratification with the OECD. The MLI essentially allows the tax treaty-related measures of the OECD/G20 BEPS project to be introduced into the existing tax treaties of the signatories to the convention in a consistent and efficient manner, eliminating the need to renegotiate every bilateral tax agreement separately.

The MLI positions adopted by each participating jurisdiction will coexist with existing tax treaties. For practical purposes, that means that, from now on, when considering the relevant treaty provisions between two jurisdictions, two instruments will need to be consulted: the applicable bilateral tax treaty and the MLI. For the sake of convenience, some jurisdictions have announced their intention to publish consolidated versions of their existing tax treaties incorporating their MLI positions, so that only one document would need to be considered.

A tax treaty will be supplemented or modified by the MLI only if it is a 'covered tax agreement' (CTA), which means that both contracting states to an existing treaty have indicated that they wish to modify that treaty using the MLI. The articles within the MLI introduce treaty changes with respect to the following topics: hybrid mismatches (BEPS Action 2), prevention of tax treaty abuse (BEPS Action 6), permanent establishments (BEPS Action 7) and dispute resolution (BEPS Action 14). The MLI provides flexibility, since certain articles are optional, so that a jurisdiction can modify its tax treaties based on its policy preferences. However, some elements of the MLI are OECD/G20-agreed 'minimum standards' (including the provisions on the prevention of treaty abuse and dispute resolution) which must be adopted by jurisdictions participating in the BEPS initiative. This article describes the anti-treaty abuse requirements.

Entry into force

The MLI entered into force for the first jurisdictions on July 1 2018, the first day of the month following a three calendar-month period after five jurisdictions formally ratified the MLI and deposited their instruments of ratification with the OECD. For each jurisdiction that subsequently ratifies the MLI, the MLI will enter into force for that jurisdiction following a period of three months after the date of ratification, on the first day of the subsequent calendar month. The effective date, however, will be later.

For most jurisdictions, the MLI is expected to have effect for withholding tax purposes at the start of the first calendar year after the MLI enters into force. For other tax purposes, the MLI generally will have effect from the first taxable period beginning on or after a period of six calendar months has elapsed from the date the MLI enters into force. A shorter-entry-into effect period may apply for withholding tax and other tax purposes if both jurisdictions agree. A CTA will be modified by the MLI provisions only when the MLI has entered into effect for both parties to that agreement, which will occur on the later of the effective dates for the two jurisdictions.

As at October 1 2018, only 15 jurisdictions had deposited their instruments of ratification, so that, in many jurisdictions, the MLI may not apply until 2020, at the earliest.

Figure 1

Treaty abuse

The MLI requirements in respect of the prevention of treaty abuse are twofold:

The preamble to CTAs must be modified to clarify that their purpose is to eliminate double taxation without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance. The preamble, therefore, sets out the context for a tax treaty and should be taken into account when interpreting and applying the provisions of the relevant treaty, although it seems unlikely that the preamble effectively could override a treaty provision that clearly differs in scope; and

All tax treaties covered by the MLI must include an anti-abuse rule to prevent treaty benefits from being granted in unintended circumstances. This follows the BEPS Action 6 final report on 'Preventing the Granting of Treaty Benefits in Inappropriate Circumstances,' under which jurisdictions must implement one of the following approaches: (1) a PPT; (2) a PPT and either a simplified or a detailed limitation-on-benefits (LOB) provision; or (3) a detailed LOB provision supplemented by an anti-conduit rule.

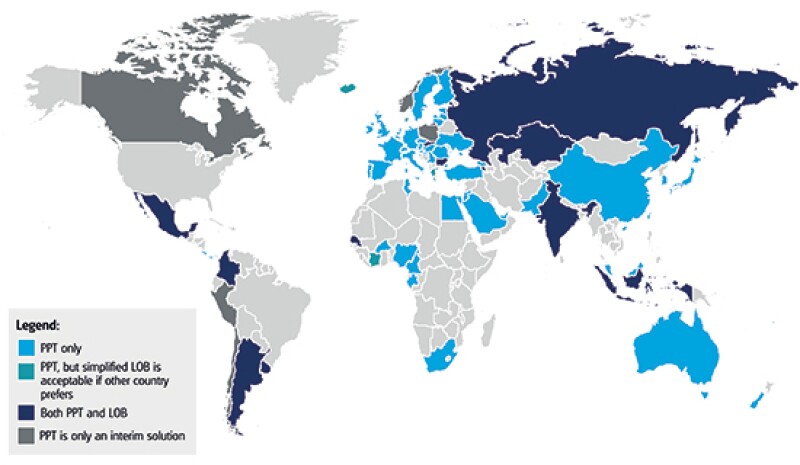

The amendments made by the MLI will affect only existing tax treaties that are identified as CTAs by both treaty partner jurisdictions. However, since the amended preamble and the PPT have been included in the 2017 update of the OECD model tax treaty, the changes also will affect future tax treaties that are based on the OECD model (see Figure 2).

Thus far, the majority of signatories to the MLI have opted for a PPT only. The PPT will apply to deny treaty benefits if, having regard to all relevant facts and circumstances, it is reasonable to conclude that obtaining the treaty benefit was one of the principal purposes of an arrangement or transaction that directly or indirectly resulted in that benefit. As an exception to this rule, if granting the benefit would be in accordance with the object and purpose of the relevant provisions (objective test), the treaty benefit will not be denied.

The term 'benefit' in the context of the PPT is likely to be broadly interpreted, so that it could, for example, consist of a tax reduction, exemption, deferral or refund that is obtained through the application of the relevant tax treaty. The MLI's use of the phrases 'that resulted directly or indirectly in that benefit' and 'any arrangement or transaction' (emphasis added) also appear to widen rather than narrow the potential application of the PPT.

Figure 2

To determine whether obtaining a treaty benefit was one of the principal purposes of an arrangement or transaction, an objective analysis should be conducted of the aims and objectives of all persons involved, considering all relevant circumstances. In this regard, it is not necessary to find conclusive proof regarding the intent of a person, but it must be reasonable to conclude that one of the principal purposes of an arrangement or transaction was to obtain a treaty benefit. If an arrangement was undertaken as part of a core commercial activity, and the form of the arrangement was not driven by tax considerations or by obtaining a reduction in tax, it is unlikely that its principal purpose was obtaining a tax benefit. In contrast, if an arrangement or transaction can only be reasonably explained by a tax benefit, it seems likely that one of the principal purposes was obtaining the tax benefit. In addition, obtaining a treaty benefit only has to be one of the principal purposes – it need not be the sole or dominant purpose of an arrangement or transaction.

Persons to whom a treaty benefit could be denied as a result of the application of the PPT still may be able to obtain the treaty benefit if they can establish that obtaining that benefit would be in line with the object and purpose of the relevant provision, given the applicable facts and circumstances. The object and purpose of a specific treaty provision should, in principle, be derived from the text of the provision. Some treaty articles, such as the dividend article, may contain fixed thresholds (e.g. a 10%-or-greater shareholding) that have to be met to obtain benefits, and in these circumstances it may be easier to determine the object and purpose of a specific article and whether the facts and circumstances are in line with that object and purpose. In other circumstances, this may be more difficult, although some guidance is provided by the examples in the OECD BEPS Action 6 final report.

Examples

The final report on Action 6 provides examples of arrangements and transactions that either do, or do not, potentially trigger the application of the PPT. However, most of the examples are relatively straightforward, making it difficult to assess how the PPT might apply to more complex arrangements and fact patterns that do not neatly follow the OECD examples.

The examples range from the insertion of an arrangement or entity to benefit from a lower withholding tax rate, which is regarded as a conduit arrangement and, therefore, may trigger the application of the PPT, to examples covering the location of a new business that must be analysed based on the relevant facts. One example of the latter describes a situation in which a manufacturing company based in one jurisdiction would like to expand its business to another jurisdiction. The company considers locations in three different countries for the establishment of a new manufacturing plant. All three countries provide similar economic and political environments; however, only one has a tax treaty with the country in which the existing manufacturing company is located. Considering these facts, the decision is made to establish the plant in the country with the tax treaty. In this example, the investment decision is made in light of the benefits provided by the tax treaty, but the report on Action 6 concludes that it cannot reasonably be considered that obtaining the treaty benefits is one of the principal purposes of building the plant. In addition, the report refers to the general objective of tax treaties being to encourage cross-border investments, and the investment decision being in accordance with the object and purpose of the convention. This example reinforces the need to undertake an objective analysis of the aims of an arrangement and to consider both the business and the tax reasons for the arrangement. In this example, it seems reasonably clear that there are strong business reasons for the arrangement.

Another example refers to a company that is considering establishing a regional services company that could provide group services to foreign subsidiaries. After reviewing the possible locations, the company decides to establish the regional services company in a country that has a number of attractive features, including the availability of skilled staff and a stable business environment, as well as a comprehensive tax treaty network. The chosen country has concluded tax treaties with all the countries in which the relevant foreign subsidiaries are located, and the treaties all provide low withholding tax rates. Again, the conclusion in the Action 6 report is that this should not necessarily lead to the application of the PPT to deny treaty benefits. The report states that merely reviewing the effects of tax treaties would not enable a conclusion to be drawn on the purpose of the arrangement. Consideration also should be given to the business activities of the new regional centre and the exercise of substantive economic functions using assets and assuming risks. This example appears to indicate that it is important not only to consider all the factors involved in the decision underlying an arrangement or transaction, but that the actual activities and assets subsequently undertaken may influence the weight given to the likely business-versus-tax factors. In more basic terms, having real business or substance in the selected jurisdiction should help a taxpayer to pass the PPT.

In essence, the PPT shifts the burden of proof regarding treaty abuse: in the pre-MLI era, the tax authorities had a heavier burden of proof to establish that a certain arrangement was abusive in nature, while the burden of proof under the PPT shifts to the taxpayer to establish that a certain arrangement is not abusive.

Impact on companies

It will be important for multinational companies to assess the potential impact of the treaty changes resulting from the MLI on their business activities. Many existing bilateral tax treaties, particularly in OECD member countries, already may include anti-abuse provisions, but not all do. Even if there are anti-abuse provisions, the scope may be narrower than the PPT and an anti-abuse provision may not have been included in all articles within a tax treaty. Another consideration is that some countries have domestic anti-abuse rules that target artificial structures or those that lack substance, and these may prevent access to tax treaties even before consideration can be given to the application of a PPT. Even so, there are likely to be countries where the introduction of a PPT could have a substantial impact.

To summarise, where an arrangement or transaction potentially qualifies for a treaty benefit, such as a reduced rate of withholding tax, a number of practical points must be considered before assessing the principal purpose from a treaty perspective. For instance:

Does the relevant jurisdiction have domestic anti-abuse legislation that would preclude access to the treaty?

Does the tax treaty between the jurisdictions in which the parties to the transaction or arrangement are resident already include anti-abuse provisions?

Is the relevant tax treaty a CTA for purposes of the MLI, and if so, what options have the two jurisdictions adopted (e.g. a PPT or a simplified LOB and PPT, etc.) and how does this change the previous treaty position?

Have the two jurisdictions ratified the MLI and deposited their instruments of ratification with the OECD? If so, have they agreed on a shortened entry-into-effect period, or do the standard periods apply?

Where, as a result of the application of the MLI, a new anti-abuse provision that involves a PPT will be introduced into the relevant treaty, the following may be useful in identifying the principal purpose of an arrangement or transaction and supporting that the PPT should not be applied to deny treaty benefits:

Identifying and quantifying the treaty benefit from the arrangement or transaction, compared to a situation that would not be purely tax driven;

Identifying and quantifying the business (i.e. non-tax) reason for undertaking the transaction and the choice of location of the entity/entities;

Critically evaluating the evidence to assess the weight of the business versus tax-related purposes and considering this in light of any other realistic alternatives identified; and

Determining whether, even if obtaining a treaty benefit was a principal purpose for the arrangement or transaction, granting the treaty benefit in the relevant circumstances would be in accordance with the object and purpose of the relevant provision of the treaty. In other words, as noted earlier, the taxpayer should show that there is substance or economic activity in the selected jurisdiction.

Outlook

The MLI constitutes a major development in international taxation, as it allows jurisdictions to quickly update their tax treaties to implement treaty-related BEPS provisions and potentially to challenge arrangements and transactions they previously may have been unable to address. Of the two anti-treaty abuse elements covered in this article – the change to the preamble and the introduction of some kind of PPT and/or LOB provision – the latter seems the more likely to have a direct impact on taxpayers and their transactions or arrangements. The extent of any impact is likely to be dependent on a number of factors, including the taxpayer's facts, the two treaty partner countries involved, whether the relevant tax treaty or domestic law already has anti-abuse provisions and how the respective tax administrations use a PPT to tackle transactions that they regard as abusive. However, in any situation where the taxpayer wishes to apply the benefits of a relevant tax treaty, it will be important to consider the application of the MLI and whether it changes the previous treaty position.

Jasper Korving and Loes van Hulten,Deloitte Netherlands