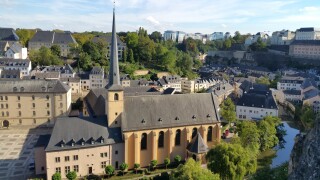

Luxembourg

Using tax to enhance its standing as a funds location is behind Luxembourg’s measures aimed at clarifying ATAD 2 and making its carried interest regime more attractive

Luxembourg’s reform agenda continues at pace in 2025, with targeted measures for start-ups and alternative investment funds

The new framework simplifies the process of relocating eligible employees to Luxembourg and offers a ‘clear and streamlined benefit’, says Alexandra Clouté of Ashurst

The Luxembourg-based TP leader tells ITR about relishing the intellectual challenge of his practice, his admiration for Stephen Hawking, and what makes tax cool

Sponsored

Sponsored

-

Sponsored by Deloitte LuxembourgJulien Lamotte of Deloitte Luxembourg explains how the new regime positions the country as a leading destination for alternative investment funds while providing tax-efficient treatment

-

Sponsored by Deloitte LuxembourgEdouard Authamayou of Deloitte Luxembourg explains an Administrative Tribunal ruling that clarifies the distinction between modification requests and formal tax claims, highlighting procedural requirements for taxpayers submitting claims to the grand duchy’s tax authorities

-

Sponsored by Deloitte LuxembourgEdouard Authamayou of Deloitte Luxembourg examines an Administrative Court ruling confirming that tax authorities have full discretion under Section 100a of the General Tax Law to review assessments, with procedural deadlines of critical importance

Article list (load more 4 col) current tags