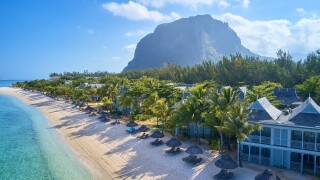

Mauritius

As we move into an era of ‘substance over form’, determining the fundamental nature of a particular instrument is key when evaluating the tax implications of selling hybrid securities

Global stakeholders will be closely watching the Supreme Court’s ruling in a case that will have substantial implications for foreign investment, says Sanjay Sanghvi of Khaitan & Co

As a new agreement between India and Mauritius may unsettle foreign investment, Sanjay Sanghvi and Avin Jain of Khaitan & Co examine the possible impact and offer potential solutions

With carbon taxes expected in the global shipping industry, onlookers say the costs of climate inaction would only be worse.

Sponsored

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalStephen Weston, Silke Imig and Priscilla Ratilal interpret the potential impact of the OECD’s guidance for businesses in the financial services sector.

-

Sponsored by Deloitte Transfer Pricing GlobalMatej Cresnik, Oliver Busch and Jeremy Brown explain how captive insurance companies of non-insurance groups have come under increased scrutiny from the judiciary and tax authorities.

-

Sponsored by Deloitte Transfer Pricing GlobalStan Hales and Ralf Heussner consider the key challenges that the interbank offered rates (IBORs) reform faces from a transfer pricing (TP) perspective.

Article list (load more 4 col) current tags