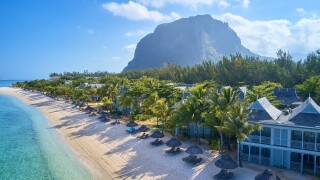

Mauritius

As we move into an era of ‘substance over form’, determining the fundamental nature of a particular instrument is key when evaluating the tax implications of selling hybrid securities

Global stakeholders will be closely watching the Supreme Court’s ruling in a case that will have substantial implications for foreign investment, says Sanjay Sanghvi of Khaitan & Co

As a new agreement between India and Mauritius may unsettle foreign investment, Sanjay Sanghvi and Avin Jain of Khaitan & Co examine the possible impact and offer potential solutions

With carbon taxes expected in the global shipping industry, onlookers say the costs of climate inaction would only be worse.

Sponsored

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalBill Yohana, Chad Lusted and Stan Hales assess how the COVID-19 economic environment has affected tax and transfer pricing (TP) considerations associated with the real estate sector.

-

Sponsored by Deloitte Transfer Pricing GlobalEric Centi, Julien Lamotte and Carole Hein evaluate progress on the transposition of DAC6 across EU member states amid delays caused by the coronavirus pandemic.

-

Sponsored by Deloitte Transfer Pricing GlobalRalf Heussner, Sebastian Ma’ilei and Stephen Weston explore how the coronavirus pandemic has affected businesses in the financial services sector and consider the transfer pricing (TP) changes for the ‘new normal’.

Article list (load more 4 col) current tags