The landmark Indian Supreme Court judgment redefines GAAR, JAAR and treaty safeguards, rejects protections for indirect transfers and tightens conditions for Mauritius‑based investors claiming DTAA relief

The expansion introduces ‘business-level digital capabilities’ for tax professionals, the US tax agency said

As tax teams face pressure from complex rules and manual processes, adopting clear ownership, clean data and adaptable technology is essential, writes Russell Gammon, chief innovation officer at Tax Systems

Partners want to join Ryan because it’s a disruptor firm, truly global and less bureaucratic, Tom Shave told ITR

Sponsored

-

Sponsored by insightsoftwareJoin Grant Thornton and insightsoftware on April 23 for a free ITR webinar exploring how flexible tax software aligns with your existing processes, enabling smoother adoption, integration, and phased implementation across complex organisations

-

Sponsored by GNV ConsultingAhdianto Ah and Aditya Nugroho of GNV Consulting explain recent Indonesian tax reforms affecting business restructurings, treaty access, and enforcement

-

Sponsored by GNV ConsultingAhdianto Ah and Aditya Nugroho of GNV Consulting summarise an extension of the government-borne incentive, new risk-based taxpayer compliance supervision rules, and revised mutual agreement procedure guidelines

-

The COVID-19 pandemic led to a surge in transactions involving intangible assets. Tax professionals are invited to anonymously share how they managed the transfer pricing (TP) implications and what they would have done differently.

-

Tax directors and advisors do not expect VAT regimes in Kuwait and Qatar to be introduced before 2024 as concerns over rising inflation and high oil prices bolster tax revenues.

-

The UK finally completed Making Tax Digital (MTD) for VAT, but the problem of low-quality data has not been solved. Instead, HM Revenue and Customs (HMRC) has left the problem to taxpayers.

-

Canadian Finance Minister Chrystia Freeland’s budget does not change corporate tax rates, but it headlines parts of the OECD’s digital tax agenda and Canada’s incoming domestic minimum top-up tax.

-

This week the Securities and Exchange Commission (SEC) ruled in favour of Amazon shareholders having a vote on whether the company will sign up to the Global Reporting Initiative (GRI).

-

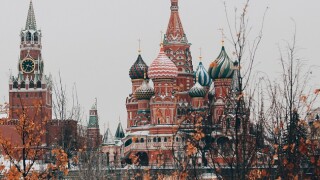

Businesses could face drastic transfer pricing (TP) consequences as Putin’s government aims to seize intellectual property (IP) from companies leaving the Russian market.

-

The South Korean Financial Services Commission’s KRW 15.4 billion ($12.6 million) fine to global pharmaceutical company Celltrion is a warning to others to comply with accounting standards and transfer pricing rules.

-

The Asia-Pacific awards research cycle has now begun – don’t miss out on this opportunity to get recognised.

-

French President Emmanuel Macron has pledged to abolish the contribution on added value (CVAE) in his second term to build on his tax reform efforts. However, the presidential election looks like it will be a close call.