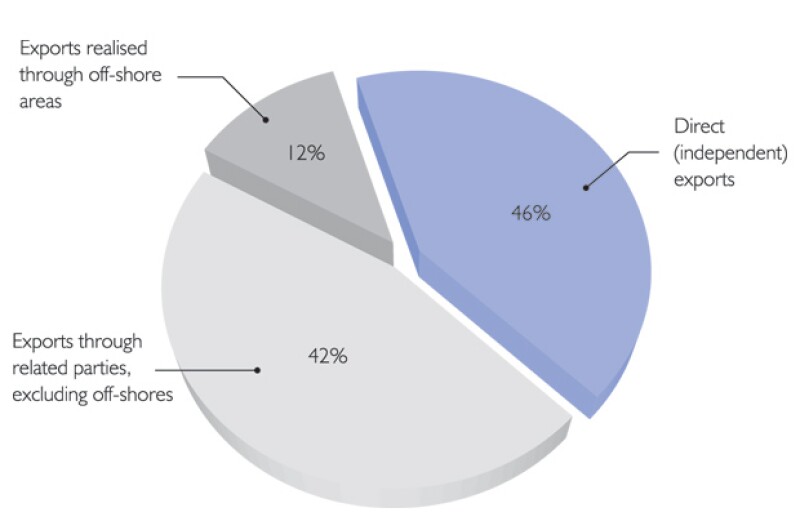

The historic transfer pricing situation in the Ukraine allowed businesses to successfully transfer profits outside of Ukraine and accumulate them in low-tax jurisdictions, resulting in a decrease in revenues to the state budget and capital draining from the country. The tax office has assessed an impressive 42% of all exports from Ukraine being conducted through related parties and 12% of exports realised through off-shore areas in 2012, jointly amounting to more than $35 billion.

Diagram 1: Total exports from Ukraine in January-November 2012 |

|

Source: Ukraine’s Tax Office’s website |

The situation is about to change soon. Transfer pricing, as a legal concept, is relatively new to Ukrainian business. It was introduced by Article 39 of the Tax Code of Ukraine starting from January 1 2013. Though, it has been gaining importance rapidly. The Ukrainian Tax Ministry has recently been reorganised causing broad discussions among both the government authorities and businesses. In early 2013, the Centre for Commodities Markets Monitoring has started its work. Furthermore, a special unit of the Tax Office for transfer pricing control has been created (Transfer Pricing Audit Group). These institutions were established to employ customs and trade specialists who will define the acceptable price ranges for various industries and, in perspective, perform tax audits of prices applied in controlled transactions.

Although relatively new, the concept of transfer pricing has been gaining importance rapidly. |

The situation will change even more with the enactment of the new transfer pricing law, promising big amendments to the country's entire taxation structure. The transfer pricing law, now pending approval from the Parliament, is about to replace Article 39 and give Ukraine OECD-based transfer pricing rules with burdensome compliance requirements and severe penalties.

The Ukrainian Tax Minister, Oleksandr Klymenko, lobbying for enactment of the transfer pricing law, has pointed out in the course of numerous interviews that this would mean "doing business in a civilised way" and the establishment of a new "tax culture" in Ukraine. This sounds promising and optimistic, yet the business seems to be having second thoughts – and not without reason.

Based on the Tax Office's statistics, the industries generating the majority of Ukrainian exports are most likely going to be subject to transfer pricing control (see Table 1).

Table 1 |

||

Commodity |

Share of total export conducted through related parties in 2012 |

Value, US dollars |

Black metals |

75% |

$11 billion |

Grains |

82% |

$6.034 billion |

Animal and vegetable oils |

85% |

$3.527 billion |

Source: Ukraine’s Tax Office’s website |

||

However, other businesses are also at risk, even where they are operating within national groups, even if not doing business with foreign related parties. The official forecast of the additional tax revenue that could be generated due to transfer pricing audits amounts to $61 million in 2013 and $184 million in 2014.

But while the transfer pricing law still has not been enacted, is there anything to worry about?

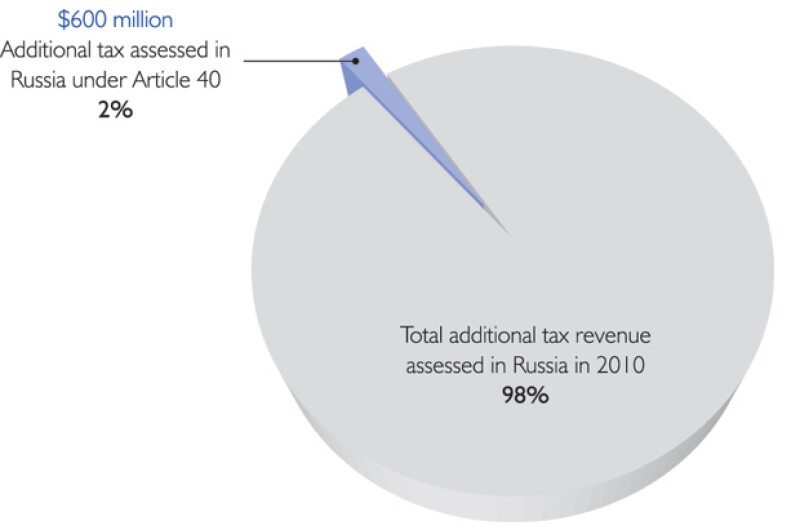

What the Ukrainian businesses often fail to recognise is that legislation is mostly put in place to create a legal framework which can help the company justify its actions in ambiguous cases, should it face an inquiry from the tax authorities, and to give a sound basis for managing future risks. However, the absence of a relevant law, such as a specific transfer pricing regulations, by no means implies that no risks exist. Article 39 defines the scope of transactions subject to price control, such as transactions between related parties, barter transactions and transactions with non-residents. Under those provisions, trading any goods in Ukraine below their customs value is not acceptable for tax purposes. Article 39 consists of only 1,183 words and may seem rather perfunctory and formal. In Russia, the comparable Article 40 was the only legislative source for transfer pricing audits up until 2012. However, just in 2010, $600 million worth of additional taxes have been collected under Article 40 (although still constituting only a minor share of the additional tax assessed in 2010 – see Diagram 2).

Diagram 2 |

|

Source: Federal Tax Office of Russian Federation |

Alone, the existence of Article 39 of the Tax Code, however imperfect, should be a clear sign to business that government intends to strengthen price controls. Assessing additional tax and imposing fines for non-compliance with the new transfer pricing legislation is an efficient instrument for bolstering the state budget, which becomes even more attractive given the substantial deficit the Ukrainian budget has been featuring in 2013 ($555,8 million in the first year quarter).

The new transfer pricing law: Who is at risk?

Even though the draft law has not yet gone through the necessary approval procedure in Parliament, heavy lobbying from government officials gives us serious reason to believe it is going to be adopted in 2013, with an effective date of January 1 2014. Moreover, it is likely to happen unexpectedly with no transition period. This would immediately expose many businesses in and outside Ukraine to unexpected and unknown risks. To know whether your business is going to be affected, you should pose the following questions:

1) Does the Ukrainian entity of my multinational group conduct any transactions with its local or foreign related parties?

2) Does it conduct any transactions with (independent) third parties registered in low-tax jurisdictions?

Under the new transfer pricing law, any jurisdiction where the tax rate is lower than in Ukraine by more than 5% is a low-tax jurisdiction. Given the Ukrainian CIT rate of 19%, such countries include Ireland, Cyprus, Liechtenstein, Qatar, Bulgaria, Albania, Macedonia, Paraguay and the Swiss canton Zug. The list of the relevant jurisdictions and their tax rates is reapproved yearly by the Cabinet of Ministers of Ukraine.

Transactions generating turnover of no less than UAH50 million ($6.1 million) during a calendar year will be subject to these regulations. Thus, if the annual volume of transactions with related parties exceeds UAH50 million and the answer to any of the above questions is positive, your business could have exposure.

If the annual transaction volume between related parties exceeds UAH50 million, the business could have transfer pricing risks. |

To enhance compliance, large taxpayers will be obliged to notify the tax authorities on their controlled transactions and to submit the supporting transfer pricing documentation annually. Regular taxpayers will be required to notify the tax authorities on any controlled transactions they have been party to and to submit transfer pricing documentation to the tax authorities upon their request within 60 days.

As stated in the draft law, a fine for non-compliance could amount to 5% of the transactions' value, for example, UAH 2.5 million for a UAH50 million deal.

What you can do to protect your business

It is crucial to understand that measures to mitigate these transfer pricing risks have to be taken today. First, all types of controlled transactions in which an entity engages or plans to undertake in the future have to be clearly identified. A functional analysis has to be carried out for each transaction type to define the functions, risks and assets of each party. This analysis has to be sufficiently detailed as to ascertain that the role of each party in the transaction is correctly estimated.

Depending on the transaction type, an appropriate transfer pricing method and profit level indicator (PLI) is chosen. The draft law allows five methods and seven profit level indicators. Companies may use whatever method they find to be most appropriate. However, a detailed explanation has to be provided in the final documentation in case the comparable uncontrolled price (CUP) method has been rejected.

Afterwards, a benchmarking study has to be conducted to define the average market profitability level that would be reached by independent parties in comparable transactions. As has already been mentioned, controlled transactions in Ukraine are evaluated on an individual basis. This implies that a precisely targeted search has to be carried out to find comparable transactions realised by comparable companies. Adjustments can be required for companies engaging in similar activities but featuring a different asset structure, for example owning valuable intangibles.

The draft law does not imply that it is forbidden to use data obtained from foreign companies' financial statements prepared under IFRS. However, financial results can differ because of divergences between the Ukrainian accounting standards and IFRS, and such differences will also have to be eliminated. It is further reasonable to consider that any foreign data should be used only where it is not possible to obtain relevant data from Ukrainian companies. Even though this rule is not explicitly outlined in the draft law, it is dictated by common sense. Moreover, such a rule was imposed by the Russian transfer pricing law, which to a great extent, has served as a prototype for the Ukrainian draft law. Also, all companies analysed as comparables have to be independent.

Finally, a transfer pricing policy has to be developed to support each controlled transaction covering the detailed description of the transaction and the related parties, the results of functional analysis, the choice of transfer pricing method, the selection of data used in the benchmarking study and the reasoning underlying these. This policy will serve as a basis for preparing transfer pricing documentation to present to the tax authorities upon their request or, in the case of a legal action, to be presented to the court.

Why the company's global group TP documentation cannot be used and simply translated into Ukrainian?

Many of the Ukrainian entities subject to TP control form part of multinational enterprises that have already prepared global or at least pan-European transfer pricing documentation and wish to use it as templates for their Ukrainian transactions. Unfortunately, in the majority of cases, this foreign documentation will have to undergo substantial adjustment and enhancement before it can be used in Ukraine. The Ukrainian law imposes numerous specific regulations that can be grouped as follows:

Functional analysis prescriptions

The draft law offers a lengthy list of functions, risks, assets, market characteristics and trading conditions that have to be analysed thoroughly for each controlled transaction, including special attention to describing the Ukrainian participant of the transaction.

Choice of transfer pricing method and PLI

The draft law prescribes which transfer pricing methods should be chosen for various types of transactions. Any deviation from these prescriptions should be sufficiently reasoned and documented. The CUP method is given preference and should be used whenever it could apply.

It could be necessary to use a different profit level indicator than the one used in the global documentation, in accordance with the Ukrainian law that outlines seven specific PLIs.

Data selection and conduct of benchmarking studies

Data should be obtained from the pre-approved sources defined in the draft law, such as government statistics and specialised databases. Therefore, global or European benchmarks are likely to be not applicable.

Language requirements

To provide the transfer pricing package documentation to the Ukrainian tax authorities, the package will have to be prepared separately in the Ukrainian language for each controlled transaction.

Individual approach

All transactions must be dealt with on an individual basis. This means that even businesses that are generally profitable will be subject to additional tax assessments (and possibly fines) if the businesses conduct any single transaction for which the price is not found to be at arm's-length.

Even though there is no certainty as to whether the transfer pricing draft law will be enacted before the end of 2013, Ukrainian businesses will have to face new realities and struggle through the end requirements to ensure compliance with the transfer pricing regulations, whichever form they may take.

Biography |

||

|

|

Konstantin Karpushin KPMG Tel: +7 (495) 937 44 77 (ext 13888) Email: kkarpushin@kpmg.ru Konstantin Karpushin is head of Transfer Pricing group of KPMG in Ukraine. Konstantin has more than seven years experience in transfer pricing gained during his assignments in Moscow and Helsinki. He developed and implemented a new approach of database searches for comparable companies which significantly reduced time spent on benchmark studies and increased quality. In 2012 he designed and conducted eight world-unique workshops "Benchmarking study in 60 Minutes" in Moscow, St. Petersburg and Yekaterinburg which were highly valued by more than 800 attendees. |

Biography |

||

|

|

Anna Korobova KPMG Tel: +380 (44) 490 55 07 Email: akorobova@kpmg.ru Anna Korobova is a leading expert of the transfer pricing and international corporate tax group of KPMG in Ukraine. Anna has more than five years of experience working with KPMG, including dedicated transfer pricing experience in Moscow office. Anna has been working on significant projects drafting transfer pricing policies and documentation to support clients' transfer pricing position before the tax authorities. In addition, Anna drafted advance pricing agreements for the benefit of large industrial group. |

Biography |

||

|

|

Oleksandra Tovkun KPMG Tel: +380 (44) 490 55 07 Email: otovkun@kpmg.ua Oleksandra Tovkun works in the transfer pricing group at KPMG-Ukraine. She holds a Bachelor Honors degree from Kyiv National Economic University and a Master of Science degree in economics from Trier University, Germany. She has previously worked in Germany in the FMCG sector, where she was responsible for facilitating international sales, including transfer pricing issues under the provision of OECD transfer pricing rules. Besides, her professional interests include international taxation and international economic relations as well as public finance. |