The Internal Revenue Service’s (IRS’s) Advance Pricing and Mutual Agreement Program (the APMA Program) has continued its successes from prior years, as reported by the most recently available case completion statistics for advance pricing agreements (APAs) (2024) and mutual agreement procedure (MAP) cases (2023).

The APMA Program’s mission statement is to resolve actual or potential transfer pricing disputes and other competent authority matters in a timely, principled, and cooperative manner. Since its inception in 1991 through the end of 2024, the program has concluded 2,566 APAs, which reflects its success in helping multinationals resolve double taxation.

The IRS recognises that many transfer pricing and other treaty matters raise important and complex tax administration and compliance questions, and therefore encourages taxpayers to schedule a meeting with the respective IRS team before filing APA and MAP requests. This helps the APMA Program team provide constructive feedback on the information and analysis that should be included in the request.

Background

The IRS’s APA Revenue Procedure 2015–41 describes the IRS’s Advance Pricing Agreement Program as providing a voluntary process whereby the IRS and taxpayers may resolve transfer pricing issues and matters for which transfer pricing concepts may be relevant in a principled and cooperative manner on a prospective basis. Ancillary issues such as interest and penalties may also be resolved but only to the extent to which the APMA Program has authority under the Internal Revenue Code or under a US tax treaty to resolve the issues.

The APA process increases the efficiency of tax administration by encouraging taxpayers to come forward and present all the facts necessary for a proper evaluation of their proposed covered issues and to work towards a resolution of such issues in a spirit of openness and cooperation. The voluntary and prospective nature of the APA process lessens the burden of compliance by giving taxpayers greater certainty regarding covered issues and promotes the principled resolution of these issues by allowing for their discussion and agreement in advance, before the consequences of the resolution are fully known to taxpayers or the IRS. As such, the APA process is intended to address issues that are ongoing, have arisen, or are expected to arise based on firm commitments.

The latest statistics

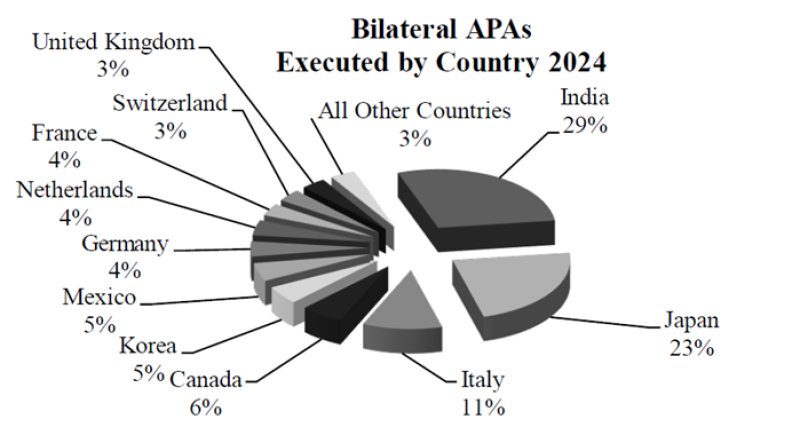

Back to the present, the APMA Program concluded 142 APAs in 2024. Of these, 119 were bilateral APAs, 13 were unilateral APAs, and 10 were multilateral APAs. The treaty partners with the highest representation of completed APAs are outlined in the chart below (see Announcement 2025-13).

In 2024, the APMA Program’s APA and MAP cases were handled by a staff of 126, comprising 76 team leaders, 35 economists, 12 managers, and three assistant directors.

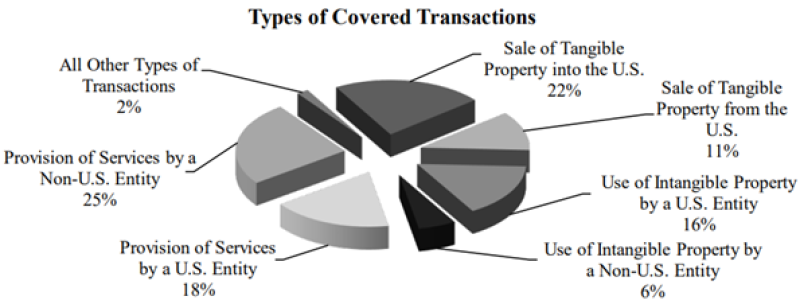

The concluded APAs covered the following types of intercompany transactions.

In addition to the above transfer pricing matters, taxpayers seeking a bilateral APA can also request that the competent authorities reach an agreement with respect to treaty-related tax matters, including the character of a payment and whether such payments are subject to withholding taxes.

MAP cases are initiated by taxpayers when a tax treaty partner issues a tax assessment following a local tax examination resulting in taxation that the taxpayer does not believe is in accordance with the applicable tax treaty. The taxpayer therefore feels its income is being taxed by more than one tax authority.

It is important to note that US transfer pricing regulations prevent a taxpayer from filing an amended return to reduce US taxable income (Internal Revenue Code Regulation 1.482-1(a)(3)), meaning that taxpayers should instead request competent authority assistance. With respect to such cases, it is very important that taxpayers and their advisers research the applicable tax treaties to make sure that their request for assistance is filed on a timely basis. Tax treaties can have different deadlines based on the date of the tax assessment or the passage of time since the end of the applicable tax year, or no specific deadline.

It is also important to note that some US tax treaties require the filing of the MAP request or filing of treaty notifications with the respective competent authorities within a certain number of years. US taxpayers should also take note that the notification deadline under the US–Mexico tax treaty is shorter than the domestic Mexican statute of limitations and are advised to file the necessary notification letters with both the US and Mexican competent authorities once a transfer pricing examination commences.

With regard to MAP cases related to transfer pricing issues, the US competent authority concluded 159 MAP cases in 2023, the most recent year for which statistics are available. Of this number, 85 cases (53%) were resolved with full double tax relief and 13 (8%) resulted in partial double tax relief. The remaining concluded cases were concluded for various reasons, including cases withdrawn by taxpayers or unilateral relief being granted through domestic remedies, or resolved with partial double taxation.

The 53% figure cited above should not be viewed as representative of MAPs in the US over time. Given the small number of cases and varying facts between years, it is not possible to make predictions, based on prior year results, about the likelihood of success of any specific MAP case.

Treaty arbitration

What happens when the competent authorities are unable to negotiate a case to eliminate double taxation or taxation not in accordance with a treaty? Several US income tax treaties provide for mandatory binding arbitration to resolve eligible cases in which the competent authorities have endeavoured but are unable to reach a complete agreement. To date, arbitration is included in the US income tax treaties with Belgium, Canada, France, Germany, Japan, Spain, and Switzerland.

If the respective competent authorities pursuing arbitration are unable to settle a case within a specified deadline, the taxpayer can require that the competent authorities enter into mandatory arbitration to resolve the matter. Such arbitration cases are decided in a manner often described as “baseball arbitration”, under which the respective competent authorities submit their final and best offers and the arbitration panel selects one of the proposals. The US rules for treaty arbitration are available here.

IRS Treaty Assistance and Interpretation Team

The IRS Treaty Assistance and Interpretation Team (TAIT) is another group within the IRS APMA Program that endeavours to resolve competent authority issues arising under all other articles of US tax treaties (see the IRS’s Advance Pricing and Mutual Agreement Program).

The TAIT group focuses on non-transfer pricing treaty issues such as withholding taxes and the character or sourcing of income. These matters sometimes arise in the normal course of tax authority income tax or transfer pricing examinations. Taxpayers can file MAP requests to resolve these issues in a manner similar to transfer pricing double taxation cases. Taxpayers may also request that the competent authorities address such issues during the bilateral APA process.

Key takeaways on US transfer pricing resolution

Several programmes exist for taxpayers to seek advance resolution of complex transfer pricing and transfer pricing-related issues that provide certainty and reduce complexity for companies, the IRS, and the tax authorities of other jurisdictions. Taxpayers are well advised to understand the nuances around these opportunities, especially with respect to sometimes varying deadlines.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (DTTL), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.

© 2025. For information, contact Deloitte Global.