The availability of advanced data management solutions means organisations can collect, store, manage, and analyse more tax-related data more quickly than ever. Access to accurate tax data has a ripple effect across organisations, increasing expectations for speed to insight and transparency. Consequently, tax leaders globally are refining practices, strategies, and technologies to ensure their departments and the broader finance function and enterprise have real-time, transaction-level access to tax data.

Meeting these goals can require significant amounts of time and money, meaning that tax leaders must assemble the right capabilities – in terms of technology platforms and employee expertise – for the right reasons to generate the most value for their organisation and clients. This article outlines Deloitte’s approach to designing a tax data management system that can achieve these goals.

Multiple factors are raising the data management stakes

Deloitte has assisted organisations of all sizes in designing and implementing tax data management systems. The first step is to develop a common understanding of the drivers behind tax data changes. This is followed by identifying and anticipating technological and organisational barriers to adopting changes, and agreeing on a long-term approach to maintain and expand tax data management capabilities as regulatory and business dynamics warrant.

First things first. A handful of factors are driving the growth and importance of managing tax data.

1 Ongoing technology and digital transformation

Digital solutions – including sophisticated ERP systems, advanced data management tools, and cloud-based applications – play a crucial role in shaping the tax data landscape. These technologies improve data accuracy, enable real-time reporting, enhance compliance efficiency, and facilitate better planning.

2 Regulatory changes and tax authority demands

Global tax changes and shifting regulatory requirements, such as the global minimum tax under OECD pillar two and e-invoicing, add complexity to tax data management. Tax functions need to adapt to these changes and ensure they capture the necessary data elements to remain compliant. Similarly, tax authorities are increasingly demanding more transparency, moving towards digital tax administration. This includes requiring more data, more frequently. This trend, in turn, drives organisations to invest in more-robust tax data management systems.

3 Expanding global economic opportunities

Most organisations’ strategic goals include growing revenue in addition to enhancing profitability. Doing both could include expanding into new markets or jurisdictions, particularly now that many of the supply chain issues seen earlier in the decade are being resolved. Geographic expansion, however, adds to the complexity of tax data management because it means understanding and complying with a wider variety of direct and indirect tax regimes and statutory requirements.

4 Evolving business models

Changes in business dynamics and models can create new tax data requirements. Beyond expanding their reach to new markets (and tax jurisdictions), organisations adding products and services can face different regulations associated with these new offerings. Changes in business models can also have tax implications. An enterprise that previously licensed services, for example, might shift to a subscription service model; that may require capturing data minute by minute and then aggregating that data while tagging for geo-sourcing to recognise revenue in the proper jurisdictions.

5 Broader adoption of remote work practices

The COVID pandemic and the resulting shift towards remote work means that employees are living and working in different places. That could have tax implications for them and the organisation, and also highlights the value of digitalised, automated systems, and processes to ensure the tax function continues to provide the best possible service to the organisation.

These trends are prominent factors driving the need for better data management, although there will be others in the future.

Managing tax data effectively poses ongoing challenges for tax functions

These dynamic trends generate complications and opportunities for tax leaders. The one constant is added pressure on tax departments to keep pace by adopting a data management strategy that will support the organisation, ensure compliance today and tomorrow, and position the function for efficient and effective results in support of the organisation’s goals. In Deloitte’s experience, tax leaders should keep in mind three challenges when investing in data management systems and capabilities.

1 Anticipate how to handle the growth and integration of data volume

Future-proofing data management capacity and capabilities is crucial. Many of Deloitte’s clients now augment traditional data warehouses and databases with data lakes that can handle all types of data (including unstructured and semi-structured data such as images, video, and audio). Given the volume of data generated, these play an increasingly important role in tax departments. Gartner, the US technological research and consulting firm, calculated that 57% of data and analytics leaders are investing in data warehouses, 46% are using data hubs, and 39% are now using data lakes.

Whatever the mechanism, investing in scalable, high-performing data management solutions is critical for effective integration. Deloitte’s research showed that integrating tax-related data was a top priority for more than a third of respondents to a recent survey of tax leaders and the No. 1 priority for 10% of respondents (see Figure 1). The forthcoming integration of generative AI tools into an organisation’s infrastructure will likely build upon the return on investment of these data approaches – further leveraging that investment to support business growth.

Figure 1: Greatest challenges for the tax department over the next three to five years

Source: Deloitte Tax Transformation Trends 2023

2 Build in flexibility to respond quickly to regulatory changes

Staying current with revisions to tax laws and regulations requires constant vigilance. OECD pillar two will potentially create the need to identify and capture new data elements for calculating the global minimum tax or for e-invoicing as adopted by jurisdictions affected. This presents a novel challenge for the tax function and its capability and capacity to manage tax-relevant data working with business and information technology.

3 Place a premium on real-time reporting

An overriding goal of modern data technologies is to enable real-time reporting and access to tax data. Tax reporting is driven by transactional data, which means that it needs to be tightly integrated with the organisation’s digital architecture, including ERP solutions farther up the chain. Critical processes designed and built for the business should have tax data requirements embedded in them. This facilitates efficient monitoring and reporting, and ensures that stakeholders have access to accurate and up-to-date direct and indirect tax information.

By anticipating and addressing these challenges, leaders can identify the best tax data automation tools for the organisation and generate real-time insights and reporting that builds trust among all stakeholders, from executives to regulatory authorities and investors. The bottom line for the organisation: enhanced reputation and credibility.

The tax data management trifecta: strategic investment, training, and maintenance

Implementing advanced data management systems helps the tax department and the organisation to become more tax sensitive and responsive, but reaping these benefits requires ongoing commitment. That is why Deloitte encourages tax organisation leaders to view data management strategy as targeting three distinct but related goals:

Investing in innovative solutions;

Recruiting and training data-savvy personnel; and

Maintaining robust, current capabilities.

1 Invest in the right tools and technology

With a wide variety of data management solutions (and providers) to choose from, it pays to know the ultimate goals of the tax organisation when selecting them. Data automation and management tools should streamline operations, promote transparency, and unlock innovation and the potential of tax data. Deloitte’s Intela platform, for example, was specifically designed with these goals in mind and empowers tax professionals to make data-driven decisions, optimise tax strategies, and help to ensure compliance. The same goals can be achieved through the use of many different technologies, some of which your organisation may license enterprise wide or through specific tax-customised solutions.

2 Build data skills into talent management and development

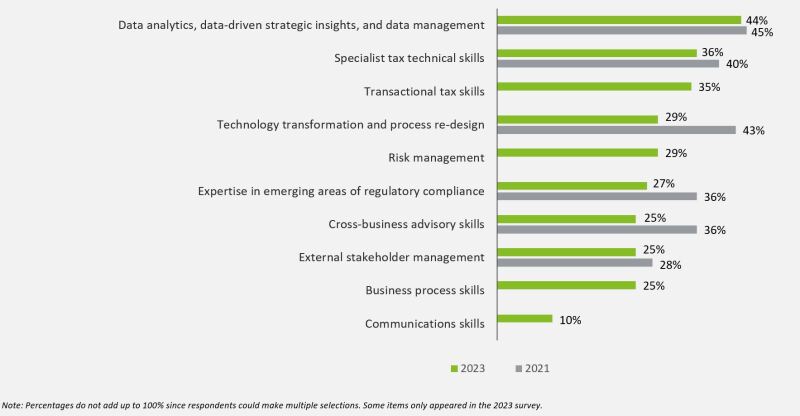

Organisations must train tax professionals both on the new tax laws and regulations to ensure compliance and the data management strategies used to achieve compliance. A tax function can extract the most benefits from their investment in tax data management platforms – and digital transformation generally – by incorporating robust, ongoing training, as well as updating talent acquisition and development strategies to elevate data management and technology skills. Deloitte’s survey of tax leaders revealed that many tax departments are prioritising data management, with 44% naming data analytics, data-driven strategic insights, and data management as their greatest need for skills over the next three to five years (Figure 2).

Figure 2: Greatest need for skills in tax departments

Source: Deloitte Tax Transformation Trends 2023

3 Commit to maintaining a robust tax data management governance structure

A data management strategy and governance structure help to maintain a consistent data architecture and reinforce the value of technology in analysing and reporting. In many cases, this is, or can be, done in conjunction with the enterprise’s IT function and data governance programmes. Keeping data and technology moving forward as they are never-ending is critical to achieving full value on investments.

An effective tax data management strategy should be grounded in a deep understanding of the business context in which tax data management exists, both globally and across the enterprise, and the goals of regulatory authorities and client organisations. This ensures that data management investments address specific needs and equips finance and tax executives with unprecedented insight into the company’s global tax positions, risks, and opportunities. Using the invest–train–maintain approach outlined here, organisations can achieve real-time reporting, improved tax transparency, higher confidence in the data, efficient compliance, and, ultimately, better tax and finance reporting.