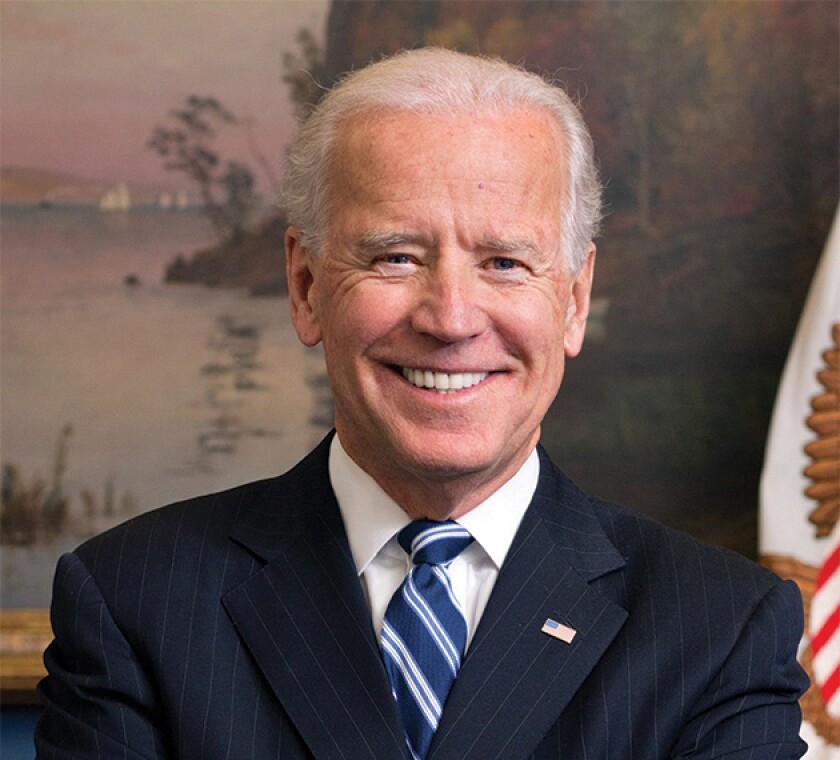

US President Joe Biden called for a higher tax on stock buybacks to reduce corporate share repurchases during his state of the union address on Tuesday, February 7.

Congress passed a 1% tax on stock buybacks as part of the Inflation Reduction Act, which was approved in August 2022. The tax came into effect on January 1. But the president is concerned that the 1% rate is too low and called for an increase to 4% in his annual address.

Many US companies, including Apple, Chevron, ExxonMobil and Meta, have used their profits for stock buybacks. Apple’s amounted to $20 billion last quarter and nearly $90 billion in 2022, while Meta ploughed more than $40 billion into share repurchases.

Biden singled out Chevron and ExxonMobil in particular due to the cost-of-living crisis. Chevron authorised $75 billion in stock buybacks in 2022, while ExxonMobil spent $30 billion on dividends and buybacks last year.

Despite the 1% tax, ExxonMobil is committed to $25 billion in stock buybacks over the next two years. Many Democrats consider this an improper use of corporate profits at a time when high inflation is hitting energy bills across the US.

The 1% buyback rate has not proved to be a disincentive, so the Biden administration might seek to raise this in 2023. However, the proposal will come up against fierce opposition in Congress.

France and Germany seek US assurances over EV tax credits

The US has agreed to address French and German concerns that the Inflation Reduction Act might be harmful to domestic production, according to an FT report on Tuesday, February 7.

France and Germany are in talks with the US over its tax credits for electric vehicle (EV) production, but the negotiations have not produced a compromise so far.

The IRA included a $370 billion support programme for green technology developments. But a growing list of governments view this as a threat to EV production in their own countries.

French Finance Minister Bruno Le Maire and German Finance Minister Robert Habeck flew to Washington DC to present a united front on the tax credit issue. The European Commission is concerned that the US tax credits may be a starting shot in a subsidy race.

This could mean greater trade tensions between the EU and the US over EV production at a time when governments should be taking measures to tackle climate change.

The UK’s transfer pricing yield falls by 30% in 2022

HM Revenue and Customs took a 31% hit on its transfer pricing yield last year – from £2.16 billion ($2.61 billion) to £1.48 billion – according to a report published on Tuesday, February 7.

The revenues in the 2021-22 tax year stem from enquiries, advance pricing agreements (APAs), advance thin capitalisation agreements (ATCAs), and mutual agreement procedure (MAP) cases.

These results are a mixed picture for HMRC, with the number of resolved MAP cases more than doubling last year (62 to 131) and total ATCAs falling sharply from 23 to 7. Meanwhile, the number of enquiries settled rose from 124 to 175 but the number of APAs secured dropped from 24 to 20.

Similarly, the resolution time for cases varied – enquiries and MAPs were resolved faster than in the previous tax year, but APAs and ATCAs took longer. The wait time for ATCAs was particularly long, increasing from 28.1 months to 44 months (nearly four years) on average.

HMRC also announced it is carrying out 100 investigations into multinational companies with arrangements to divert profits. The UK revenue service estimated the total tax at stake to be £2.4 billion as of the end of March 2022.

Puerto Rico tax reform

Puerto Rico Governor Pedro Pierluisi announced a sweeping proposal to reform the US territory’s tax code on Monday, February 6.

Pierluisi set out proposals to cut Puerto Rico’s corporate tax rate from 37.5% to 33% for large businesses and to 17% for smaller companies. The proposal would also cut the top rate of income tax from 33% to 30%.

“My vision for the Puerto Rico of the future is that we will be a jurisdiction with low taxes that are easy to comply with,” said Pierluisi.

These changes to the tax code may be worth $545.5 million to taxpayers. The Puerto Rican administration has set out to make the territory more attractive than other offshore jurisdictions.

Meanwhile, Puerto Rico is still going to offer non-resident companies significant tax benefits on their investments – including a maximum corporate rate of 4%. The tax reform would simplify and reduce the domestic tax burden.

Puerto Rico has long positioned itself as an offshore low-tax jurisdiction for US multinational companies to operate through. These companies include household names like Coca-Cola and Microsoft.

Next week in ITR

ITR will continue to follow the OECD work on the digital economy. The OECD will be holding its annual two-day tax conference on February 15 and February 16, with topics including the two-pillar solution to the digital economy. ITR will be reporting on any announcements.

Don’t miss out on the key developments next week. Sign up for a free trial to ITR.