A two tiered approach is not new in Europe. In 2006 the council of the European Union outlined an approach to transfer pricing documentation to be taken by member states. The methodology relied on two elements: a master file that would have general information about the transfer pricing policy and a specific local file that would focus on the individual countries in which the MNE operates.

We have carried out a survey amongst Grant Thornton International member firms throughout Europe to look at their experience of the EU master file/local file approach in practice and whether further standardisation of reporting or documentation templates could be helpful in those jurisdictions.

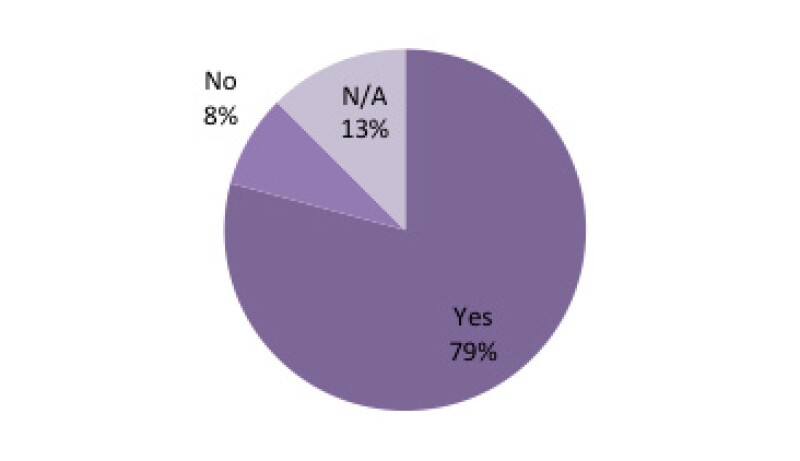

Can you use EU TP documentation in your country - Master file and local file concepts as detailed in the EU JTPF/003/2004/EN?

A summary of the responses to this question is shown as a chart below:

Is EU TPD acceptable in your country?

In most countries (79%) the master file/local file approach is acceptable. For those territories who gave a negative answer, for example Poland, documentation is only accepted in the format prescribed by their country's tax authority.

In our experience documentation in Poland is often prepared contemporaneously because, when documentation is requested by the tax authority it is required to be presented within seven days. It was also noted that not all countries within the EU have transfer pricing rules in place, so for some territories the approach would not be applicable.

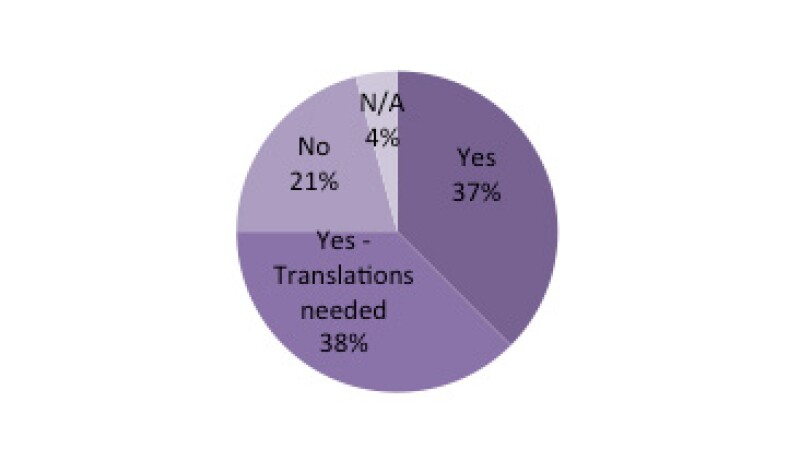

In which language should documentation be filed? Can the master file be kept in a different language?

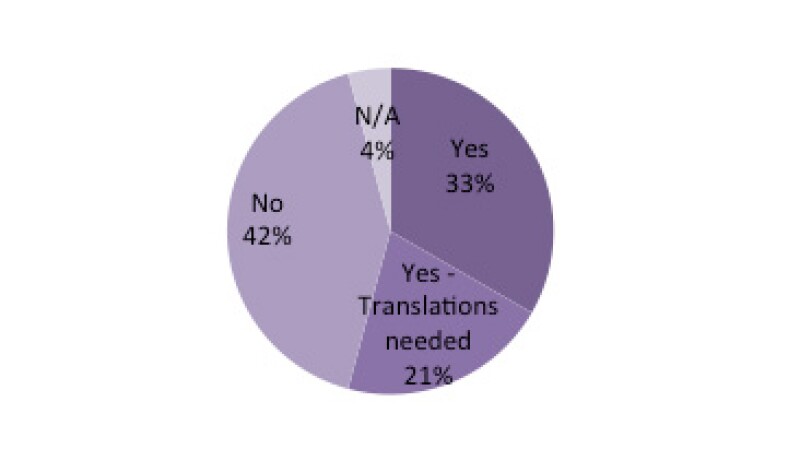

The discussion draft of Chapter V also poses a question about the language that documentation should be prepared in. A summary of the responses to this question is shown graphically below, split between master file and local file.

Masterfile- can file be kept in other languages (such as English)?

Local file - can file be kept in other languages (such as English)?

As shown above there is a difference between master file and local file - often the local file will need to be in the local language or, if not, it will require translation. Furthermore some territories, especially Nordic territories, will allow transfer pricing documentation to be held in a number of languages including English. When gathering comments from industry for submission to the OECD on their discussion draft there was an opposing view from in-house tax teams as to whether translating documents, in particular centrally held master files, was an onerous exercise or not.

In our experience an MNE’s head of tax, whether in the UK or elsewhere, often needs to be able to review documentation, both the master file and the local file. Hence business preference is to be able to prepare and maintain documentation in a common language, which is then available for translation if and when required.

From your experience would standardised reporting/documentation templates be helpful for compliance purposes in your country?

The general view from Grant Thornton International member firms, in EU countries, was that in theory this would be helpful, but in practice every country has different rules about what the required documentation should contain. The danger of a coordinated approach is that it can become a collective wish list rather than a list of essential information that can be considered best practice.

A standardised approach could be useful for collecting general information about an MNE's group and its transfer pricing policy to provide a clear overall picture of how transfer prices have been determined and why they have been considered to be arm's-length. This is essentially the contents of a master file and so it is perhaps easier to have a coordinated approach to a master file than to local country files.

Countries that do not have legally prescribed transfer pricing compliance obligations, such as Bulgaria, thought that if this is introduced in those territories, standardised reporting and documentation templates would be helpful.

Do you think the master file/country file system will be easily adopted in your country? How do you think your clients feel?

Grant Thornton International member firms support a standardised streamlined approach to transfer pricing documentation, as this will be beneficial in the long run for both tax authorities and taxpayers. Adopting a standardised approach should, in theory, give taxpayers assurance that they are complying with all the necessary obligations. The new system, however, may add more complexity, and if introduced in its current form, is likely to increase the administrative burden for taxpayers, at least in the interim. Clients are concerned about the impact on them, because many do not have enough resources dedicated to transfer pricing "housekeeping".

There have certainly been a lot of concerns raised by the OECD's proposals, as evidenced by the large number of comments received by the OECD on the discussion draft. As we found in this survey, the coordinated approach, introduced by the EU, has been met with mixed success. Although many businesses have adopted elements of the master file/country file approach many have not adopted it in its entirety (leaving out elements such as APAs and rulings).

Given the EU approach involves a limited number of countries, within a close geographic area, it is difficult to see how successfully and quickly a global approach can be implemented. The OECD has a tall order to be able to issue the new chapter V within the BEPS action plan 13 timetable of September 2014.

Wendy Nicholls, head of transfer pricing at Grant Thornton UK said: "There is appetite for more standardisation of documentation rules globally to reduce the burden on taxpayers and we support the master file/country file approach. However, there are some challenges, and even the EU has failed to gain widespread use of the concept. The main difficulties are local rules mandating extra local documentation and /or local language requirements. Therefore we believe that the master file/country file approach should only be mandated as and when countries and tax authorities agree to forego their own additional rules. Sadly this is not likely to be any time soon."

Nicholls will be attending the public consultation with the OECD on transfer pricing documentation in May 2014.

With thanks to the member firms of Grant Thornton International who took part in this survey. By Lorna Smith (lorna.smith@uk.gt.com) Oriana Panidha (oriana.panidha@uk.gt.com) and Zakariya Modan (zakariya.modan@uk.gt.com) and of Grant Thornton UK LLP.