Swiss withholding tax, levied predominantly on dividends from Swiss corporations and interest of Swiss bonds and income from Swiss Collective Investment Schemes (CIS), provide for a major part of the Swiss federal revenue (with CHF 6.6 billion ($6.7 billion) in 2015, which is roughly 10% of the annual Swiss federal revenue). Switzerland's withholding tax rate of 35%, originally designed as a mode to ensure tax compliance of Swiss residents, has become a major source of income for the federal government. Whereas Swiss residents are in general able to reclaim Swiss withholding tax levied on income from securities they hold upon declaration in their annual tax return. For foreign resident investors Swiss withholding tax often is an expense factor, as it cannot be fully recovered (depending on the relevant double tax treaty between the country of residence and Switzerland).

With worldwide investments in CIS's of roughly CHF 38 trillion, and a majority of these with investments in equity and bonds, withholding taxes suffered on the income of collective investments schemes and the possibility to reclaim have a major impact for all players involved: The investors, the CIS itself and last but not least, the federal government.

Swiss collective investment schemes

According to the definition in the Swiss Collective Investment Scheme Act (CISA) a collective investment scheme is considered where assets are raised from investors for the purpose of collective investment, and are managed for the account of such investors.

Collective investment schemes set up in Switzerland only play a side-role in the global fund market. The reason for this side-role may be manifold – Swiss Withholding Tax (WHT) being among them. For the purpose of the Swiss WHT and income tax, Swiss CIS are divided into two groups: i) Contractual Funds (FCP's), investment companies with variable capital (SICAV's) and limited liability partnerships that are treated as "transparent"; and ii) Investment Companies with Fixed Capital (SICAF's), that are treated as "opaque".

|

|

"For foreign resident investors Swiss withholding tax often is an expense factor, as it cannot be fully recovered." |

|

|

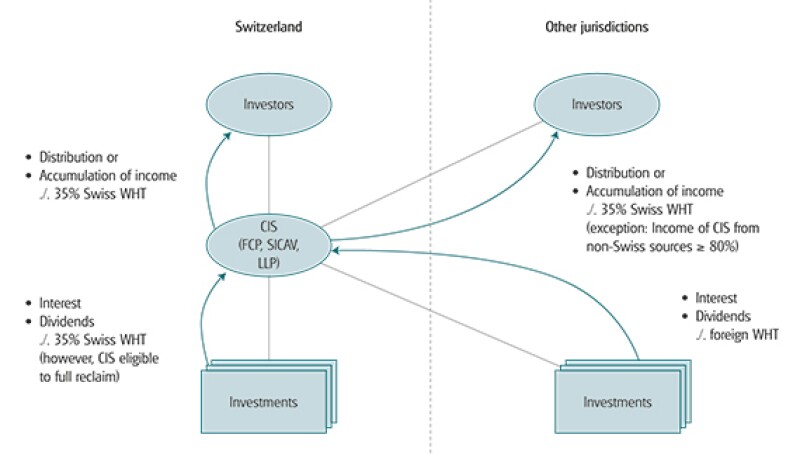

Income generated by Swiss CIS's that are treated as "transparent" is subject to Swiss WHT of 35%, irrespective of whether the income is distributed or not. With regard to shareholdings by certain Swiss tax exempt institutional investors, notification procedures rather than the deduction of the Swiss WHT may apply. In general, capital gains, and income generated by transparent CIS's through direct investment in real estate are exempt from Swiss WHT. In case of capital gains generated by the CIS, the exemption applies, provided that the capital gains are accounted for separately in the financial accounts of the Swiss CIS and – in case of distributing CIS's – if the capital gains are distributed with separate coupons. On the other hand, income including capital gains from "opaque" CIS's (SICAF's) is, in general, only subject to Swiss WHT at the time of the distribution to the investors. Notification procedures may apply in case of qualifying corporate investors.

As an exemption to the rule, or as a mode to enhance attractiveness of Swiss CIS for foreign resident investors, income and distributions from Swiss CIS that generate at least 80% of their income from foreign sources are not subject to Swiss WHT and can make use of the so-called "affidavit" procedure with regard to non-Swiss resident investors. However, a 35% EU savings tax may still apply on the interest part of the income from the CIS with regard to investors resident in an EU member state, unless information is exchanged.

A Swiss resident investor may reclaim the Swiss WHT deducted from the income received or generated by the CIS if he is the beneficial owner of the shares in the CIS, and has declared the income from the shares held in the CIS in his annual tax return. A non-Swiss resident investor can claim a reduction of the WHT under the double-tax treaty applicable between Switzerland and the state of residence and can further apply for a tax credit of the residual part of the Swiss WHT in his country of residence.

As income generated by Swiss CIS's is in general subject to Swiss WHT and in order to avoid a double taxation, the Swiss CIS is eligible to reclaim Swiss WHT suffered on the income from its Swiss investments (mainly dividends from Swiss corporations and interest from Swiss bonds), based on the Swiss WHT law. The reclaim eligibility of the CIS is independent of the country of residence of its investors and irrespective of the fact that for profit tax purposes CIS are treated as "transparent" and are not considered a "tax subject" (see Diagram 1).

Diagram 1

Foreign collective investment schemes

According to the CISA the following are considered foreign "open-ended" collective investment schemes: i) Assets that were accumulated on the basis of a fund contract or another agreement with similar effect for the purpose of collective investment and are managed by a fund management company with its registered office and main administrative office abroad; ii) Companies and schemes with their registered office and main administrative office located abroad whose purpose is collective capital investment and whose investors have a legal right with regard to the company itself, or with regard to a closely associated company, to the redemption of their units at the net asset value.

"Closed-end" foreign collective investment schemes are deemed to be companies and schemes with their registered office and main administrative office located abroad whose purpose is collective capital investment and whose investors have no legal right with regard to the company itself, or with regard to a closely connected company, to the redemption of their units at the net asset value.

For Swiss profit tax purposes foreign "open-ended" CIS's and foreign "closed-ended" limited liability partnerships with the purpose of collective capital investment are treated as "transparent", which means that the income generated by the CIS is taxed at the level of the Swiss resident investor irrespective of whether the income is distributed or accumulated by the CIS. In general, "closed-end" corporate CIS's are treated as "opaque", which means that for Swiss profit tax purposes the Swiss resident investor is taxed at the time of the distribution. For the purpose of this article, we have only considered "open-ended" CIS's.

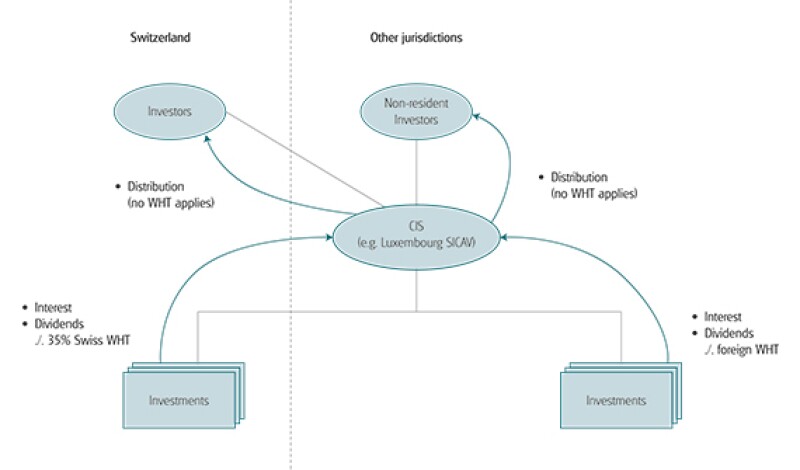

Foreign CIS are not eligible to reclaim Swiss WHT suffered on the income from its investments (mainly dividends from Swiss corporations and interest from Swiss bonds), based on the Swiss WHT law. In an international context, Swiss WHT can in general be reclaimed based on the respective treaty for the avoidance of Double Taxation Treaties (DTT) between Switzerland and the State of residence of the recipient of the income that is subject to Swiss WHT.

"Open-ended" CIS's and limited liability partnerships are in general not considered as residents according to Switzerland's DTTs. Thus, "open-ended" CIS's and limited liability partnerships can in general not apply for treaty benefits. Exceptions apply where Switzerland and the contracting state have found a bilateral agreement to extend treaty benefits to a CIS set-up in the other state (i.e. Australia, Austria, Canada, Denmark, Germany, France, Norway, Spain, Sweden, the Netherlands and the UK). However, based on the bilateral agreements treaty benefits will only be granted in respect of investors that are resident in the same state as the CIS applying for the benefit.

Thus, for CIS that cannot benefit from a tax treaty or bilateral agreement and for foreign investors resident in a jurisdiction other that the CIS, requests for reclaim of the Swiss WHT would need to be based on the DTT between Switzerland and the resident state of the investor.

With regard to Swiss investors invested in a foreign "open-ended" CIS, the request to reclaim the Swiss WHT would need to be based on the Swiss WHT law (see set-up in Diagram 2). According to the practice of the Swiss Federal Tax Authorities (FTA) the request for refund of the Swiss WHT for Swiss resident investors invested in a foreign "open-ended" CIS that has suffered Swiss WHT on its investment income, is denied. The Swiss FTA has based the denial on the argument that for Swiss WHT purposes a foreign CIS is not "transparent", due to the fact that a Swiss CIS is eligible to reclaim Swiss WHT on its own and is according to Swiss WHT law treated as an own tax subject. This practice is controversial and on the bottom-line, in cases where the foreign "open-ended" SICAV is not eligible to apply treaty benefits and the Swiss or foreign investor's reclaim request is denied on the lack of "transparency" of the CIS, the 35% Swiss WHT on the income generated by the foreign CIS would remain a final expense.

Diagram 2

There is a case pending before the Federal Supreme Court of Switzerland (the highest Swiss court) concerning a Swiss pension fund that has held 100% of the shares in an Irish Contractual Fund that has generated dividend income from Swiss corporations subject to Swiss WHT. The lower court ruled on March 26 2015 that the Swiss pensions fund is eligible to claim the refund of the Swiss WHT on the income generated by the Irish Contractual Fund, as in case of a contractual CIS the investor is the economic beneficial owner of the income generated by the CIS. Furthermore, the lower court concluded that the Swiss pension fund has been able to prove that the income from the investment by the CIS in Swiss corporations has been accounted for correctly in the financial accounts of the Swiss pension fund, and thus, the Swiss FTA has to comply with the refund request of the Swiss pension fund. As the Swiss FTA did not agree with the decision of the lower court, the case is now pending before the Federal Supreme Court of Switzerland.

The court's decision is awaited impatiently and will hopefully reinforce the lower court's decision that will abolish the Swiss FTA practice where Swiss WHT remains unrefunded in case of indirect investments through "open-ended" CIS, even though the investor is compliant and would be eligible to reclaim the Swiss WHT based on the Swiss WHT law or a DTT, if the investments would have been held directly rather than through a CIS.

Tax Partner AG – Taxand Switzerland, Alberto Lissi & Monika Gammeter Utzinger, May 2016

|

|

Alberto Lissi Tax Partner – Taxand, Zurich Tel: +41 44 215 77 06 Email: alberto.lissi@taxpartner.ch Website: www.taxpartner.ch Alberto Lissi is one of 12 partners at Tax Partner – Taxand, the Swiss leading independent firm of tax advisers. He has a Ph.D. in international taxation and about 20 years' experience of local and international tax. Alberto's activities are mainly focused on tax planning for national and international corporations and entrepreneurs. He has wide experience in M&A and reorganisations of national and international corporations. Furthermore, he also advises banks and financial institutions. Alberto is a frequent speaker and lecturer at Swiss and international tax seminars and publishes regularly on international and national tax themes. Tax Partner is one of the leading tax firms in Switzerland. With currently 38 professionals, the firm has been advising important multi-national and national corporate clients as well as individuals. Tax Partner co-founded Taxand in 2005 – the first global network of more than 2,000 tax advisers and 400 partners from independent member firms in 50 countries. |

|

|

Monika Gammeter Utzinger Tax Partner – Taxand, Zurich Tel: +41 44 215 77 29 Email: monika.gammeter@taxpartner.ch Website: www.taxpartner.ch Monika is a senior adviser at Tax Partner – Taxand, the leading independent Swiss firm of tax advisers. She has more than 20 years' experience in local and international tax law. Monika's activities are mainly focused on tax planning for national and international corporations and entrepreneurs, restructuring of national and international corporations and tax advice in the area of banking, financial services and financial products. Before joining Tax Partner AG in 2003, Monika worked for several years for the cantonal tax authorities in Zurich. Monika has studied business administration at the Zurich University of Applied Sciences and later became a Swiss Certified Tax Expert. She has published several articles in leading publications. Monika is fluent in German and English. |