|

Dawn of the robots is a new entry this year |

Robots are taking human jobs. Technology is evolving our workforce. Likewise, robotic software that replicates a human's actions to execute repetitive tasks is starting to emerge and, for example, will start to replace an accountant's process work. Accounting firms are not only employing these bots to manage their digital data dirty work, but are advising their clients to do so too.

For financial institutions, robotic process automation (RPA) in tax compliance has been the clearest glimpse into a future where machines automatically file taxes with tax administrations.

A PwC report predicts that there is a 32.2% risk of financial and insurance jobs in the UK being automated by the early 2030s.

The speed at which automation and the business cases for replacing human jobs are developing, and the growing number of discussions about taxing robots, has earned this development its place in this year's Global Tax 50.

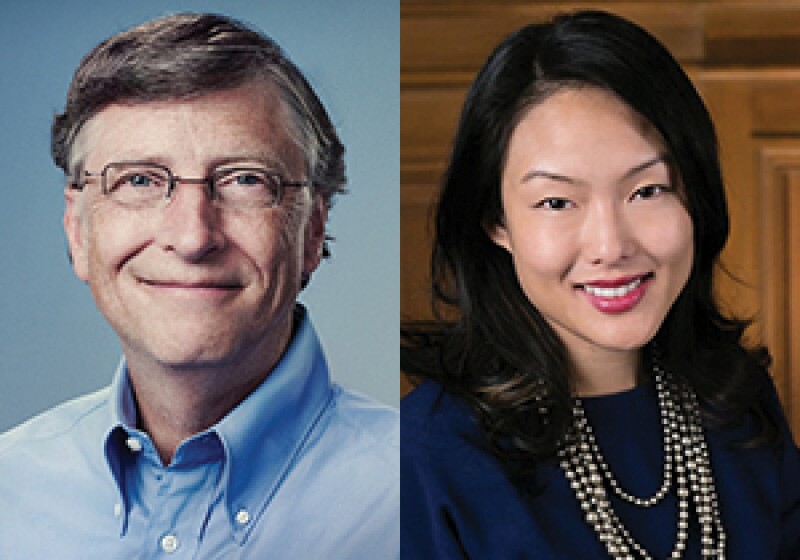

However, Bill Gates, American philanthropist and co-founder of Microsoft, has emphasised the importance of being able to manage the displacement of tax revenue that will be created from replacing humans with robots – if individuals are not employed and paying labour taxes as well as spending their hard-earned cash on goods and services that include an indirect tax, then who will fill this gap?

Essentially, a robot tax charged on the company 'employing' the robots could act as security for the displaced human worker. This is something the South Korean government is considering by reducing the amount of tax relief businesses get from corporation tax for automation equipment, dubbed a 'robot tax'. Similarly, in the UK, opposition Labour Party leader Jeremy Corbyn wants to create a fund to retrain staff who lose their jobs because of new technology. On the other hand, the European Parliament rejected a call from European lawmakers for EU-wide legislation to regulate the rise of robots in February 2017. No further official legislative efforts have been made in the EU as yet.

Nevertheless, Gates believes a robot tax is the future. "Certainly there will be taxes that relate to automation," Gates said in an interview with Quartz where he first brought up the idea for the levy. "Right now, the human worker who does, say, $50,000 worth of work in a factory, that income is taxed and you get income tax, social security tax, all those things. If a robot comes in to do the same thing, you'd think that we'd tax the robot at a similar level."

Gates has been a strong voice on the issue on the global economic stage, recently presenting a report at the G20 summit in Cannes, France, to encourage innovation and development aid. Among a tobacco tax, a financial transaction tax, and an aviation and bunker fuel tax, Gates stressed that investment in innovative forms of revenue would help curb the uncertainty of the current economic environment and the developing risk to global prosperity.

Listening to Gates is Jane Kim, an American civil-rights attorney who has been working with public policymakers to draft a robot tax in Silicon Valley.

However, tech leaders and international organisations are calling the tax an "innovation penalty", claiming that automation softwares are productivity tools and taxing the use of robots will undermine technological innovation and competition.

The government should embrace innovation, not tax it – right? So how do you solve the societal challenge that automation will eventually create?

Gates, like Corbyn, believes a tax on the use of robots could help to retrain the displaced workers in other roles. He also says the speed of automation could be temporarily slowed down to examine the impact of the changes.

Meanwhile, after months of research and discussions with technology leaders in Silicon Valley, Kim launched the Jobs of the Future Fund to build support among individuals and organisations to "learn about and discuss the final language for an upcoming ballot measure". The campaign has recently hosted the first public forum to begin the conversation about how we prepare for a future in which automation displaces millions of workers.

"It was a great discussion that showed the diverse coalition of individuals and organisations that are focused on making sure this transition actually benefits workers and helps us create more economic opportunity, and we're looking forward to many more in upcoming months," Julie Edwards, spokesperson for Kim, told ITR.

The question now is what defines what a robot is and what constitutes job displacement. For the Jobs of the Future Fund, this will be at the core of upcoming discussions with individuals and organisations ranging from organised labour and community groups to workforce development organisers and business leaders.

Focusing on industry-specific solutions will be important to finding an answer. "Given how widespread a problem this will be, it is likely we will need multiple solutions – some industry-specific, some community-specific, some focused on retraining displaced workers, some focused on educating young workers towards jobs that cannot be automated and some focused on elevating currently low-waged work that cannot be automated. The important point is that we want to make sure that we're working towards a future where more Californians can have meaningful, middle-class jobs," Edwards said.

Although no one is clear on what needs to be done, the key challenge is to find a way to tackle future imbalances in the economy from the displacement of human workers by machines. And this extends to the whole digitalisation of the economy. In April 2018, the OECD will present a report to the G20 with concrete proposals to solve upcoming issues in digital advancements, Pascal Saint-Amans, director at the centre for tax policy and administration at the OECD, told ITR.

There are a lot concerns when it comes to the rise of technology, but it is expected – perhaps most reassuringly – that automation will change the role of the tax professional rather than eradicate it. Machines could simply save time on the number crunching front and leave the judgment tasks to humans. This might actually lead to more jobs, believes Michelle Lee, US tax robotics process automation leader at PwC.

"If history tells us anything, there were speculations of job losses when spreadsheets and computers were introduced into the tax compliance process, but instead we saw significant growth of jobs in tax departments," she says. "It's certain that how we perform the work and the skillsets will change, but this will create new opportunities."

Perhaps there is a future where human job displacement by robots is a cause for celebration rather than worry. Whatever the scenario, only with the help of forward-thinkers such as Gates and Kim can we reach a solution.

The Global Tax 50 2017 |

|

|---|---|

The top 10 • Ranked in order of influence |

|

6. Arun Jaitley |

|

The remaining 40 • In alphabetic order |

|

| The Estonian presidency of the Council of the European Union |

|

| International Consortium of Investigative Journalists (ICIJ) |

|

| United Nations Committee of Experts on International Cooperation in Tax Matters |

|