|

The new rules, which entered into force on January 1, are another step forward for Mexico’s TP regime |

Background

Since the implementation into Mexican legislation of the transfer pricing (TP) regime, the Mexican Income Tax Law (MITL) has established that taxpayers who undertake transactions with related parties are required for the purposes of said law, to determine their taxable income and deductions taking into account the prices that would have been used in comparable transactions with or between independent parties. In other words, related party transactions have to be carried out at arm's length.

When a related party transaction is not at arm's length, the taxpayer should adjust the price or consideration of such transaction in order to comply with the arm's-length principle. Nevertheless, the MITL does not provide any provision or guideline to implement transfer pricing adjustments.

|

|

Through these rules it is recognised that the transfer pricing adjustment can be carried out on a cashless basis |

|

|

The only provision related to TP adjustments is article 184 of the MITL, which establishes that when the tax authorities of a country with which Mexico has entered into a tax treaty for the avoidance of double taxation assess an adjustment to the prices or considerations of a taxpayer resident in such country, the Mexican related party may perform the corresponding adjustment. This is, the MITL recognises the application of adjustments provided that the primary adjustment is determined by a competent authority of a country with which Mexico has entered into a tax treaty, and provided that the Mexican tax authorities accept such adjustment.

Certainly, this should not be understood as Mexican taxpayers not being allowed to carry out a TP adjustment for Mexican tax purposes, rather it is possible to say that tax uncertainty exists when implementing such adjustments.

In order to obtain tax certainty, taxpayers may request rulings from the Mexican tax authorities that provide legal certainty for diverse tax implications, and have even entered into mutual agreement procedures (MAPs) in order to obtain a higher level of comfort from a tax perspective.

Administrative rules for TP adjustments

For several years, taxpayers have been discussing with the tax authorities the need of tax provisions or at least administrative rules or any guideline for transfer pricing adjustments. Finally, on December 23 2016, the Mexican tax authorities issued the Miscellaneous Tax Resolution (MTR) in force for tax year 2017, which among others, includes rules regarding transfer pricing adjustments.

Firstly, the abovementioned rules define transfer pricing adjustments as any change in prices, considerations or profit margins regarding transactions carried out between a taxpayer and its related parties, performed so that the taxable income or the authorised deduction of such transactions is deemed determined at arm's length. Moreover, through these rules it is recognised that the transfer pricing adjustment can be carried out on a cashless basis, this is, the adjustment could be recognised for tax purposes only.

Collateral effects of a cash or cashless adjustment on other taxes such as value added tax or general import duties are not considered, therefore, implications on other taxes should be further analysed on a case-by-case basis. Likewise, the administrative rules do not provide any guideline related to secondary adjustments that may be required to avoid double taxation derived from transactions with foreign or domestic related parties.

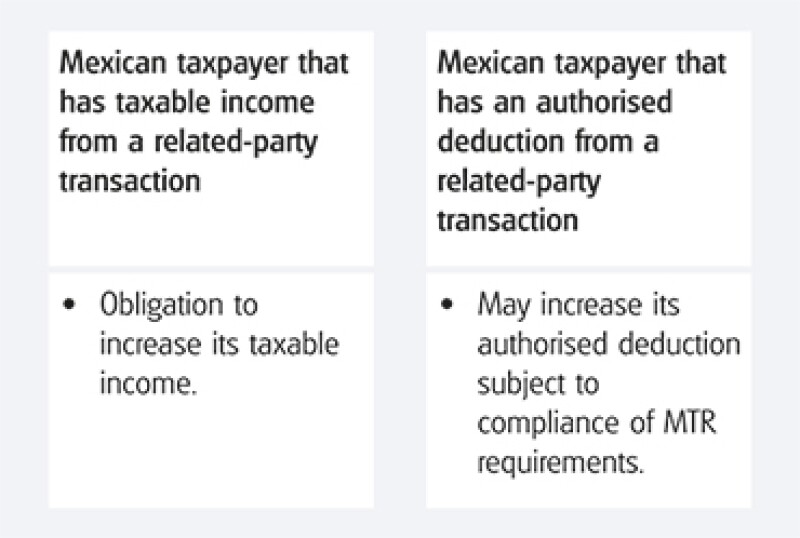

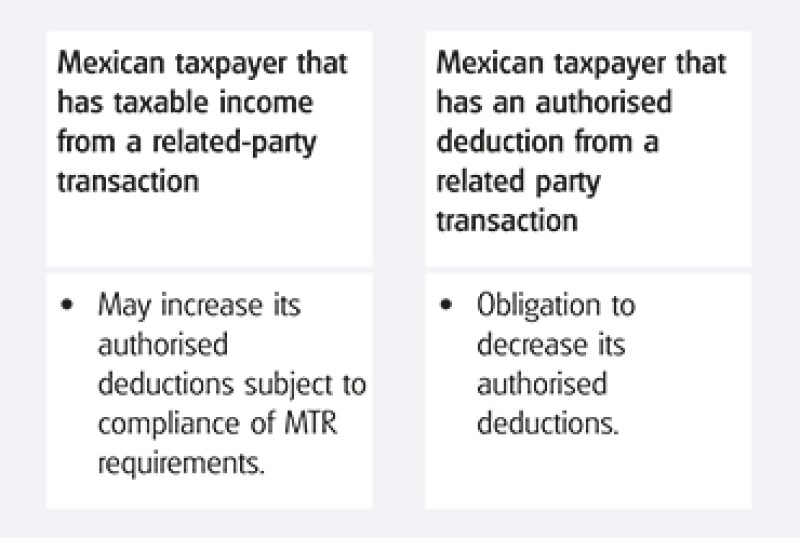

Furthermore, the rules establish the tax implications for taxpayers regarding taxable income and authorised deductions derived from a TP adjustment. The diagrams below show the tax implications for taxpayers derived from an increase or a decrease in prices, considerations or profit margins.

Diagram 1: Adjustment that increases the prices, considerations or profit margins |

|

As described in Diagram 1, if the TP adjustment increases the prices, considerations or profit margins, Mexican taxpayers that considered the original transaction as taxable income are required to increase its taxable income in an amount equal to the TP adjustment.

On the other hand, Mexican taxpayers that considered an authorised deduction from the original transaction, may increase its authorised deductions to the extent they comply with the requirements set forth in miscellaneous tax rule 3.9.1.3., which will be further explained.

As described in Diagram 2, Mexican taxpayers that considered the original transaction as taxable income may increase its authorised deductions for an amount equal to the adjustment, to the extent they comply with certain requirements. This is, the rule allows taxpayers to increase their authorised deductions rather than decreasing their taxable income.

On the other hand, Mexican taxpayers that obtained authorised deductions from the original transaction are required to decrease its authorised deductions in an amount equal to the adjustment.

Diagram 2: Adjustment that decreases the prices, considerations or profit margins |

|

The rule establishes the obligation for taxpayers to comply with certain requirements in order to be allowed to increase their authorised deductions derived from a TP adjustment. Specifically rule 3.9.1.3. sets forth the requirements that taxpayers must fulfill in order to claim a deduction derived from a transfer pricing adjustment.

In general terms, rule 3.9.1.3. includes requirements such as to submit the tax returns in a timely manner (normal or amended as the case may be) clearly showing that a TP adjustment was performed, as well as to have the documentation and information to demonstrate that the transaction was not originally carried out at arm's length, and that derived from the TP adjustment, the transaction is adjusted to comply with arm's-length principle.

Moreover, Mexican taxpayers must demonstrate that the related party with which the adjusted transaction was carried out increased its taxable income or decreased its authorised deductions, as applicable, in the same tax year when the counterparty intends to increase its authorised deductions.

In this regard, it is important to keep in mind that if a TP adjustment is performed regarding a transaction carried out with a foreign-based related party, the latter should comply with local requirements that may differ from those established in rule 3.9.1.3. For example, the foreign-based related party might recognise the adjustment in a different tax year to that of the Mexican taxpayer, which would jeopardise the fulfillment of Mexican tax requirements.

Other relevant requirement included in rule 3.9.1.3. consists in the fact that the taxpayer must demonstrate that the transfer pricing adjustment does not correspond to income subject to a preferential tax regime. This is, Mexican taxpayers are not allowed to increase their authorised deductions from a transfer pricing adjustment derived from transactions carried out with related parties that obtain income subject to a preferential tax regime, that is, income which is not taxed abroad or on which the tax is lower than 22.5%.

This rule establishes a limitation for authorised deductions beyond the tax provisions included in the MITL. This is, TP provisions established in the MITL do not establish a distinction for transactions subject to a preferential tax regime; on the contrary, the MITL establishes the obligation for taxpayers to comply with arm's-length principle for all related-party transactions, including those transactions subject to a preferential tax regime.

As regards some formalities when dealing with cashless transfer pricing adjustments, rule 3.9.1.3. states they have to be recognised through the tax reconciliation and off-balance book entries.

In connection with time frames in order to implement a TP adjustment which would represent an increase in authorised deductions, rule 3.9.1.3. establishes that in general terms such adjustment should be applied as follows:

a) On a date no later than that of the filing of the annual tax return (March 31).

b) When taxpayers elect to file the annual tax report (dictamen fiscal) or are obliged to file the tax situation informative return, on a date no later than that established for filing such documents (July 15 and June 30 respectively).

In general, the abovementioned timing rule creates asymmetry between adjustments that increase income and the limitation to increase deductions, since any adjustment related to an increase in taxable income has to be recognised even after July 15 of the following year to that of the original transaction, while adjustments related to an increase in authorised deductions have a fixed timeframe for its effect. This is, in certain cases adjustments that increase taxable income would not correspond with the adjustment as an authorised deduction.

It is important to consider that these rules define the guidelines that taxpayers should follow for purposes of carrying out a TP adjustment. This is, throughout these rules it is established that the tax authorities may exercise their audit powers on the adjustments made by taxpayers.

This also denotes an asymmetric provision since the statute of limitations in general is of five years starting the date on which the last tax return was filed, while the taxpayer has a significant shorter period of time to perform a transfer pricing adjustment to increase its deductions, that ends no later than July 15 of the following year in which the original transaction that gave rise to the adjustment occurred.

Finally, the rules establish that if a taxpayer carried out a TP adjustment that increases its authorised deductions after the dates established in rule 3.9.1.3., the adjustment may be considered as deductible provided that it is derived from a TP resolution in terms of section 34-A of the Federal Tax Code (Advanced Pricing Agreement – APA). The APA may also provide a different tax year for implementing the adjustment that increases tax deduction, than the year when the original authorised deduction was recognised. Of course this possibility could also derive on a MAP under the application of a tax treaty.

Conclusions

The issuance of the rules for the application of TP adjustments certainly represents a step forward towards a more sophisticated and complete transfer pricing system in Mexico.

Notwithstanding, the rules are limited and double taxation situations may be triggered when dealing with transactions carried out with foreign-based related parties, since such entities should have to comply with local requirements that may differ from those established by the local rules leading to a non-recognition of an adjustment in Mexico. Double taxation would also be present for TP adjustments carried out due to the timing limitation for the recognition of a TP adjustment related to a deduction in Mexico, therefore detailed analysis for implementing transfer pricing adjustments is strongly recommended.

Moreover, there are topics that are still pending clarification, for instance guidelines for secondary adjustments. Hopefully, the Mexican tax authorities will include them for analysis in the near future to improve the recently issued transfer pricing adjustment rules and therefore avoid double taxation and grant a higher level of certainty to taxpayers.

|

|

Ricardo RendónChevez, Ruiz, Zamarripa y Cía Tel: +52 (55) 5257 7019 Ricardo Rendón is a partner at Chevez, Ruiz, Zamarripa y Cía in Mexico City. He is a lawyer and a CPA. His main areas of specialisation are mergers and acquisitions, and cross-border transactions including transfer pricing. He also provides tax advice for several clients in the oil and gas industry. He teaches on the subject of taxation at the LLM business programme in law of the Panamericana University. Ricardo is a former president of the IFA Mexico branch as well as the Latin America regional committee of IFA. He is member of the practice counsel of the international tax programme at the New York University School of Law. He has published several articles on taxation in international publications. |

|

|

Yoshio UeharaChevez, Ruiz, Zamarripa y Cía. Vasco de Quiroga 2121 4º Piso, Peña Blanca Santa Fe CP 01210 México Tel: +52 (55) 5261 5678 Yoshio Uehara has been a partner at Chevez, Ruiz, Zamarripa y Cia. since October 2011. He is a certified tax specialist focused in high level transfer pricing advisory and consulting, and is frequently engaged as an advisor in mutual agreement procedures between the Mexican tax authorities and foreign tax administrations, as well as in several tax and transfer pricing controversies. He has more than 16 years of experience in diverse projects such as cross-border transactions, mergers and acquisitions which require advisory for compliance on transfer pricing for tax, banking or pension fund purposes, financial valuations of equity and intangibles, as well as anti-dumping controversies. He has represented clients of the firm within different industries such as automotive, oil and gas, financial, information technology, manufacturing, mining, and retail, among others. Yoshio obtained a master's degree in finance from the Monterrey Institute of Technology and Higher Studies in 2005 and he obtained a bachelor's degree in economics from the Autonomous Technological Institute of Mexico in 2001. |

The authors wish to thank Ignacio Mosquera, associate at Chévez, Ruiz, Zamarripa, for his collaboration in preparing this article.