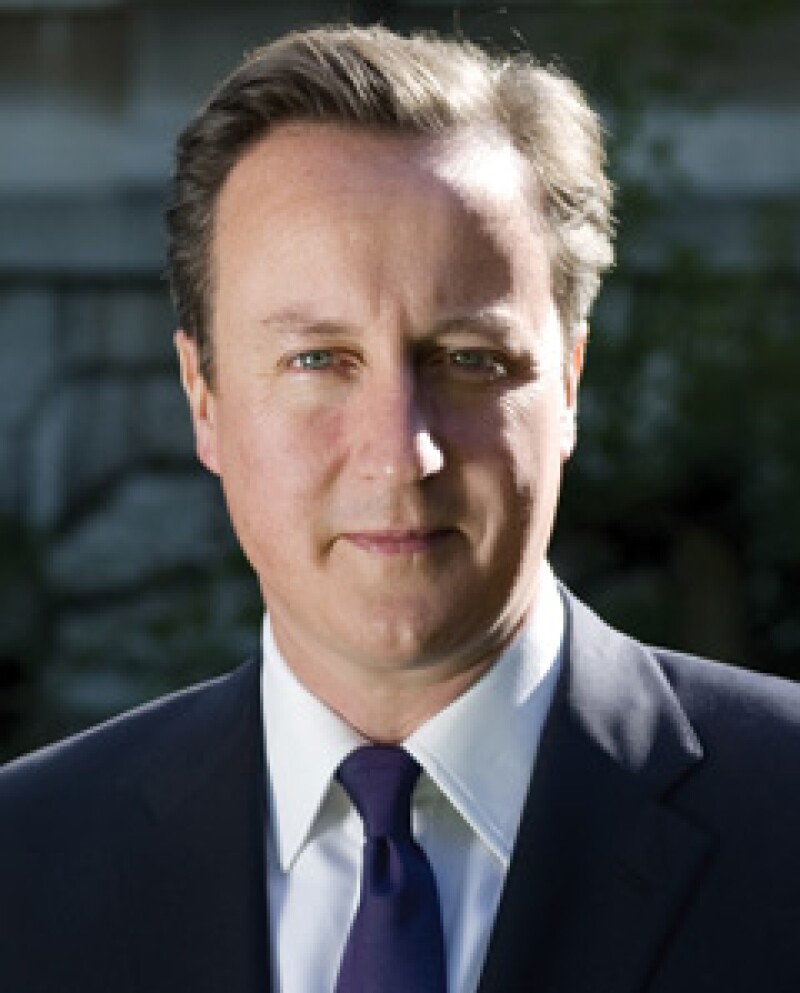

British Prime Minister David Cameron may have dropped off Forbes’ top 10 most powerful list amid flip-flops and domestic failures, but by chairing this year’s G8 and placing tax transparency at the heart of its agenda, he has been catapulted straight into third place on International Tax Review’s Global Tax 50. “We have commissioned a new international mechanism that will identify where multinational companies are earning their profits and paying their taxes so we can track and expose those who aren’t paying their fair share,” Cameron said.

Cameron, not a natural recipient of praise from anti-poverty activists given his austerity programme at home, found his words welcomed by one charity.

“David Cameron used the UK’s presidency of the G8 in 2013 to explain the global importance of financial transparency and tax payments, including their link with poor countries’ development,” says Rachel Baird of Christian Aid. “That led to both the G8 and G20 summits of 2013 producing major new commitments in relation to tax and transparency. That both the G8 and G20 included references to development in all their statements on tax, including in relation to BEPS and automatic information exchange marks a significant step forward.”

But while Cameron has been making a lot of noise about tackling aggressive tax avoidance, and has taken positive steps to crack down on global tax havens, critics have accused him of turning Britain itself into a tax haven through continual corporate tax cuts and controlled foreign company rules reform. Companies, meanwhile, have welcomed his “open for business” agenda.

Like his ideological inspiration, Margaret Thatcher, Cameron cuts a controversial figure, but like Thatcher, he remains a significant influence, if only as far as tax is concerned.

Further reading |

The tax market reacts to G8 Lough Erne Declaration: Do you agree? |

The Global Tax 50 2013 |

||

|---|---|---|

Nick Burgin |

Palaniappan Chidambaram |

|