-

Sponsored by GNV ConsultingIndonesia's Director General of Tax (DGT) issued Regulation No. PER-25/PJ/2018 (PER-25) on November 21 2018, simplifying the procedures concerning the implementation of the double taxation avoidance agreement.

-

Sponsored by EY in GreeceLaw 4548/2018 (new law) on sociétés anonymes (SAs), or corporations in Greece, entered into force on January 1 2019, replacing Law 2190/1920, which governed the operations of corporations in Greece for almost one century.

-

Sponsored by Fenech & Fenech AdvocatesUnlike many jurisdictions, Maltese employers are not obliged to provide a private workplace pension to their employees.

-

Sponsored by NeraIn our last article, we described the challenges that the digital transformation poses for transfer pricing (TP). In this article, we want to show how emerging business interdependencies can be translated into new TP models.

-

Sponsored by Bär & KarrerWithholding taxes are commonly applied in Switzerland to certain debt issues, even though many foreign jurisdictions have abolished such taxes. Bär & Karrer’s Christoph Suter and Susanne Schreiber discuss how Swiss issuers are increasingly limiting their tax exposure through foreign subsidaries and observing lender limits.

-

Sponsored by Lenz & StaehelinSwitzerland has accepted a greater number of exchange of information (EOI) requests from global actors since 2009, harmonising the otherwise private nation’s banking policies with the OECD’s more transparent standards. Lenz & Staehelin’s Jean-Blaise Eckert and Frédéric Neukomm discuss the changes.

-

Sponsored by Lenz & StaehelinAfter Swiss tax reform failed to secure public support in 2017, lawmakers have revised key tenants to ensure it passes when it goes to a second referendum, this time in May 2019. Lenz & Staehelin’s Jean-Blaise Eckert and Frédéric Neukomm discuss the potential impact on corporations and shareholders.

-

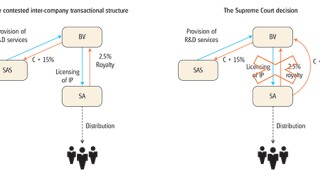

Sponsored by Tax Partner AG, Taxand SwitzerlandAs Switzerland passes wide-scale tax reform, local tax authorities are increasingly focusing on intangibles and intellectual property (IP) audits as part of a two-pronged approach in tackling tax evasion. Tax Partner’s Caterina Colling-Russo and René Matteotti discuss the focus.

-

Sponsored by EY SwitzerlandAs Switzerland harmonises its corporate tax regime with international standards, the number of available tax incentives for businesses will diminish, while the effective tax rate will rise. EY Switzerland’s Kersten Honold and Kilian Bürgi discuss how cantonal ‘tax holidays’ provide an alternative to maintain rates below 10%.

International Tax Review is part of Legal Benchmarking Limited, 1-2 Paris Garden, London, SE1 8ND

Copyright © Legal Benchmarking Limited and its affiliated companies 2026

Accessibility | Terms of Use | Privacy Policy | Modern Slavery Statement

Cookies Settings