-

Sponsored by BurckhardtSwitzerland receives an unprecedented number of information exchange requests every year by foreign countries. Burckhardt Law’s Rolf Wüthrich explores how the private banking state is amending its exchange obligations around share rights and corporate ownership in a bid to harmonise its laws with international norms.

-

Sponsored by Deloitte SwitzerlandMost banks make it a policy not to provide tax advisory services, even though there are no regulatory prohibitions to do so in Switzerland, the UK or US. But as tax considerations become increasingly important in any investment strategy, Deloitte Switzerland’s Brandi Caruso and Karim Schubiger discuss the viability of banks providing such an explicit value-add.

-

Sponsored by Deloitte Transfer Pricing GlobalAn update to Russian transfer pricing regulations has seen an uptick in tax authority audits applying the comparable uncontrolled price (CUP) method. Deloitte’s Dmitry Kulakov, Alexey Sobchuk, Dmitriy Masharov, and Anastasia Kopysova explore the approach in three particular cases.

-

Sponsored by Deloitte Transfer Pricing GlobalSoutheast Asia is a major energy and resource destination market, but its varied geopolitical structure gives rise to a number of unique TP challenges. Deloitte’s Jee Chang See and Avik Bose discuss.

-

Sponsored by Deloitte Transfer Pricing GlobalEnergy multinationals have complex, international supply chains that contract a host of specialist companies in the process of bringing vital commodities to market, making intellectual property attribution ambiguous. In this primer, Deloitte’s Nick Gaudioso, Randy Price, Nadim Rahman and John Wells give an overview of the energy excavation and production process to understand the tax ramifications.

-

Sponsored by Deloitte Transfer Pricing GlobalTransfer pricing (TP) litigation surrounding the energy and resources (E&R) sector has increased drastically over the past two years. While determining the owner of the commodity price risk has drawn increased attention, Deloitte’s Mark Barker and Aengus Barry discuss how tax authorities predominantly employ the comparable uncontrolled price (CUP) method in any TP dispute.

-

Sponsored by Deloitte Transfer Pricing GlobalOffshore marketing hubs are becoming increasingly commonplace for Australian resource firms in Asia. Deloitte’s John Bland and Milla Ivanova discuss what factors may trigger increased regulatory scrutiny for a multinational under the Australian Taxation Office’s (ATO) risk ratings.

-

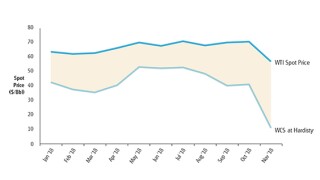

Sponsored by Deloitte Transfer Pricing GlobalVolatile oil markets in 2018 presented significant challenges to Canadian exporters, but a shortage in natural gas production globally presented a complimentary opportunity. Deloitte’s Andreas Ottosson and Markus Navikenas discuss the transfer pricing implications.

-

Sponsored by Deloitte Transfer Pricing GlobalEnergy companies using an asset-backed trading (ABT) model can hedge against volatile markets by better controlling their supply chain, but this can also trigger new transfer pricing issues. Deloitte’s Nick Pearson-Woodd and Marius Basteviken discuss.

International Tax Review is part of Legal Benchmarking Limited, 1-2 Paris Garden, London, SE1 8ND

Copyright © Legal Benchmarking Limited and its affiliated companies 2026

Accessibility | Terms of Use | Privacy Policy | Modern Slavery Statement

Cookies Settings