-

Sponsored by Morais Leitão, Galvão Teles, Soares da Silva & AssociadosBudgetary changes could result in a capital gains tax rate of 53%, says Solange Dias Nóbrega of Morais Leitão, as Portugal’s policy of heavy taxation of individuals shows no sign of being reversed.

-

Sponsored by KPMG GlobalEric Janowak of KPMG discusses navigating the current trends among SWP funds and preparing for those potentially on the horizon.

-

Sponsored by MDDPMonika Dziedzic of MDDP delves into the nuances of Polish lump-sum taxation and explains how factors such as the kind of business undertaken by individuals can have a substantial impact on the applicable rates.

-

Sponsored by MDDPMarta Klepacz of MDDP explains that the application of transfer pricing changes to third-party transactions has placed a burden on taxpayers, not least because of the difficulty in identifying the suppliers in indirect transactions.

-

Sponsored by QCG Transfer Pricing PracticeMiguel Ángel García Piña of QCG Transfer Pricing Practice explains the complications for Mexican taxpayers now that business reason has been firmly embedded as a concept under recent reforms, but with uncertainties remaining.

-

Sponsored by KPMG Hong KongLewis Lu and John Timpany of KPMG China discuss the implications of a proposed refined foreign source income regime in Hong Kong for constituent entities of multinational enterprises.

-

Sponsored by KPMG ChinaLewis Lu of KPMG China looks at the Chinese government’s latest step in its Guangdong–Hong Kong–Macau Greater Bay Area strategy, a master plan for developing Guangzhou’s Nansha district.

-

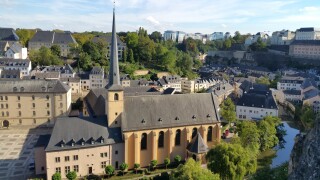

Sponsored by Deloitte LuxembourgThe differences and similarities in the implementation of the MLI in Austria, Germany, France, Luxembourg and Poland are summarised by Yves Knel and Anne-Sophie Le Bris of Deloitte Luxembourg, in association with regional experts.

-

Sponsored by PwC ChileAstrid Schudeck and Belén Guiachetti of PwC Chile consider whether Chilean VAT on digital services is more effective than Amount A in the pillar one measures.

International Tax Review is part of Legal Benchmarking Limited, 1-2 Paris Garden, London, SE1 8ND

Copyright © Legal Benchmarking Limited and its affiliated companies 2026

Accessibility | Terms of Use | Privacy Policy | Modern Slavery Statement

Cookies Settings