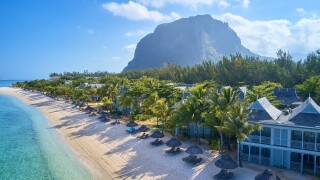

Mauritius

As we move into an era of ‘substance over form’, determining the fundamental nature of a particular instrument is key when evaluating the tax implications of selling hybrid securities

Global stakeholders will be closely watching the Supreme Court’s ruling in a case that will have substantial implications for foreign investment, says Sanjay Sanghvi of Khaitan & Co

As a new agreement between India and Mauritius may unsettle foreign investment, Sanjay Sanghvi and Avin Jain of Khaitan & Co examine the possible impact and offer potential solutions

With carbon taxes expected in the global shipping industry, onlookers say the costs of climate inaction would only be worse.

Sponsored

Sponsored

-

Sponsored by TMF GroupITR and TMF Group will host a live webinar on Thursday, September 24 to discuss how to overcome the complex regulations of operating in a shared service centre environment.

-

Sponsored by Deloitte Transfer Pricing GlobalPaul Riley, Samuel Gordon and Ralf Heussner preview ITR’s financial services guide, produced in collaboration with global transfer pricing (TP) experts from Deloitte.

-

Sponsored by Deloitte Transfer Pricing GlobalHead of the transfer pricing (TP) unit at the OECD, Stewart Brant, talks to Deloitte about how the OECD is responding to the challenges of taxing the digital economy, COVID-19 and developing dispute prevention and resolution mechanisms.

Article list (load more 4 col) current tags