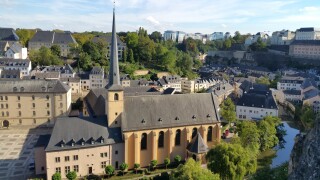

Luxembourg

Using tax to enhance its standing as a funds location is behind Luxembourg’s measures aimed at clarifying ATAD 2 and making its carried interest regime more attractive

Luxembourg’s reform agenda continues at pace in 2025, with targeted measures for start-ups and alternative investment funds

The new framework simplifies the process of relocating eligible employees to Luxembourg and offers a ‘clear and streamlined benefit’, says Alexandra Clouté of Ashurst

The Luxembourg-based TP leader tells ITR about relishing the intellectual challenge of his practice, his admiration for Stephen Hawking, and what makes tax cool

Sponsored

Sponsored

-

Sponsored by Deloitte LuxembourgMélanie Delvaux and Jean-Michel Henry of Deloitte Luxembourg give an update on the EU’s proposal for a directive to prevent shell companies being used to evade or avoid tax, and how the regulations could affect companies.

-

Sponsored by Deloitte LuxembourgSergio Ruiz de Gracia and Thierry Bovier of Deloitte Luxembourg explain why change is no longer an option but a must when it comes to a data management strategy.

-

Sponsored by Arendt & MedernachAlain Goebel, Danny Beeton and Benjamin Tempelaere of Arendt & Medernach explain the use of bilateral/multilateral APAs and MAPs and consider how they can be used by taxpayers during times of uncertainty.

Article list (load more 4 col) current tags