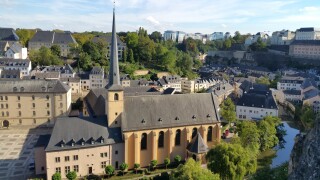

Luxembourg

Using tax to enhance its standing as a funds location is behind Luxembourg’s measures aimed at clarifying ATAD 2 and making its carried interest regime more attractive

Luxembourg’s reform agenda continues at pace in 2025, with targeted measures for start-ups and alternative investment funds

The new framework simplifies the process of relocating eligible employees to Luxembourg and offers a ‘clear and streamlined benefit’, says Alexandra Clouté of Ashurst

The Luxembourg-based TP leader tells ITR about relishing the intellectual challenge of his practice, his admiration for Stephen Hawking, and what makes tax cool

Sponsored

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalEric Centi, Julien Lamotte and Carole Hein evaluate progress on the transposition of DAC6 across EU member states amid delays caused by the coronavirus pandemic.

-

Sponsored by Deloitte Transfer Pricing GlobalRalf Heussner, Sebastian Ma’ilei and Stephen Weston explore how the coronavirus pandemic has affected businesses in the financial services sector and consider the transfer pricing (TP) changes for the ‘new normal’.

-

Sponsored by Deloitte Transfer Pricing GlobalPaul Riley, Samuel Gordon and Ralf Heussner of Deloitte preview ITR’s upcoming financial services guide, produced in collaboration with global transfer pricing (TP) experts from Deloitte.

Article list (load more 4 col) current tags