Taxpayers should support the MAP process by sharing accurate information early on and maintaining open communication with the competent authorities, the OECD also said

The Fortune 150 energy multinational is among more than 12 companies participating in the initiative, which ‘helps tax teams put generative AI to work’

The ruling excludes vacation and business development days from service PE calculations and confirms virtual services from abroad don’t count, potentially reshaping compliance for multinationals

User-friendly digital tax filing systems, transformative AI deployment, and the continued proliferation of DSTs will define 2026, writes Ascoria’s Neil Kelley

Sponsored

-

Sponsored by Spanish VAT ServicesThe ruling clarifies that Spain cannot restrict VAT exemptions for general services directly necessary to independent groups’ exempt activities, says Fernando Matesanz of Spanish VAT Services

-

Sponsored by MachadoGabriel Caldiron Rezende of Machado Associados comments on the latest developments related to the beginning of the Brazilian consumption tax reform test phase and considers the next steps

-

Sponsored by KPMG SwedenNils Schmid and Isabelle Berking of KPMG Sweden analyse the possibilities for sovereign wealth funds to claim refunds of Swedish withholding tax following a recent proposal referred to the Council on Legislation

-

The UK tax agency has appointed six independent industry specialists to the panel

-

The two tax partners have significant experience and expertise in transactional and tax structuring matters

-

Katie Leah’s arrival marks a significant step in Skadden’s ambition to build a specialised, 10-partner London tax team by 2030, the firm’s European tax head tells ITR

-

Increasingly, clients are looking for different advisers to the established players, Ryan’s president for European and Asia Pacific operations tells ITR

-

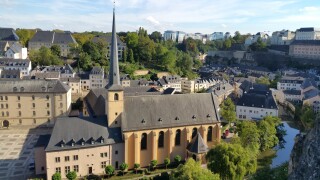

Using tax to enhance its standing as a funds location is behind Luxembourg’s measures aimed at clarifying ATAD 2 and making its carried interest regime more attractive

-

Encompassing everything from international scandals to seismic political events, it’s a privilege to cover the intriguing world of tax

-

In his newly created role, current SSA commissioner Bisignano will oversee all day-to-day IRS operations; in other news, Ryan has made its second acquisition in two weeks

-

In the age of borderless commerce, money flows faster than regulation. While digital platforms cross oceans in milliseconds, tax authorities often lag. Indonesia has decided it can wait no longer

-

The tariffs are disrupting global supply chains and creating a lot of uncertainty, tax expert Miguel Medeiros told ITR’s European Transfer Pricing Forum