The landmark Indian Supreme Court judgment redefines GAAR, JAAR and treaty safeguards, rejects protections for indirect transfers and tightens conditions for Mauritius‑based investors claiming DTAA relief

The expansion introduces ‘business-level digital capabilities’ for tax professionals, the US tax agency said

As tax teams face pressure from complex rules and manual processes, adopting clear ownership, clean data and adaptable technology is essential, writes Russell Gammon, chief innovation officer at Tax Systems

Partners want to join Ryan because it’s a disruptor firm, truly global and less bureaucratic, Tom Shave told ITR

Sponsored

-

Sponsored by insightsoftwareJoin Grant Thornton and insightsoftware on April 23 for a free ITR webinar exploring how flexible tax software aligns with your existing processes, enabling smoother adoption, integration, and phased implementation across complex organisations

-

Sponsored by GNV ConsultingAhdianto Ah and Aditya Nugroho of GNV Consulting explain recent Indonesian tax reforms affecting business restructurings, treaty access, and enforcement

-

Sponsored by GNV ConsultingAhdianto Ah and Aditya Nugroho of GNV Consulting summarise an extension of the government-borne incentive, new risk-based taxpayer compliance supervision rules, and revised mutual agreement procedure guidelines

-

The ride-hailing company Uber suffered a blow in February 2021, when the UK Supreme Court ruled that its drivers are not independent contractors. Uber was left to manage increased worker rights and VAT.

-

Chinese State Tax Administration Wang Jun is set to continue to build on the STA’s achievements in tax governance and digitalisation despite the COVID-19 pandemic.

-

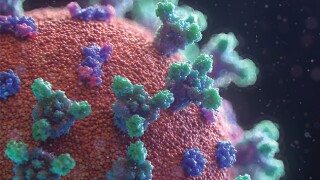

The virus that changed the world continues to create problems for taxpayers.

-

Crypto-assets from Bitcoin to non-fungible tokens (NFTs) have become the focus of a global tax crackdown over widespread concerns of tax evasion and avoidance.

-

Engie is fighting to overturn the European General Court ruling that found Luxembourg had granted the French utility company a “selective advantage”.

-

Tax fragmentation continues in the Gulf Cooperation Council (GCC) countries with varying VAT systems and corporate tax rates. Both Saudi Arabia and the United Arab Emirates have taken unilateral action, but others may follow.

-

Indonesian Minister of Finance Sri Mulyani Indrawati is chairing the G20 meetings on tax in 2022 and will be advocating for carbon taxes and other environmental tax measures based on her domestic reforms.

-

UK Prime Minister Boris Johnson may no longer be the triumphant Conservative leader he was in 2019, but he has redefined UK tax policy in response to COVID-19.

-

Nike is facing an EU state aid investigation into its transfer pricing affairs in the Netherlands. The investigation could become the next big fight in state aid.