The landmark Indian Supreme Court judgment redefines GAAR, JAAR and treaty safeguards, rejects protections for indirect transfers and tightens conditions for Mauritius‑based investors claiming DTAA relief

The expansion introduces ‘business-level digital capabilities’ for tax professionals, the US tax agency said

As tax teams face pressure from complex rules and manual processes, adopting clear ownership, clean data and adaptable technology is essential, writes Russell Gammon, chief innovation officer at Tax Systems

Partners want to join Ryan because it’s a disruptor firm, truly global and less bureaucratic, Tom Shave told ITR

Sponsored

-

Sponsored by insightsoftwareJoin Grant Thornton and insightsoftware on April 23 for a free ITR webinar exploring how flexible tax software aligns with your existing processes, enabling smoother adoption, integration, and phased implementation across complex organisations

-

Sponsored by GNV ConsultingAhdianto Ah and Aditya Nugroho of GNV Consulting explain recent Indonesian tax reforms affecting business restructurings, treaty access, and enforcement

-

Sponsored by GNV ConsultingAhdianto Ah and Aditya Nugroho of GNV Consulting summarise an extension of the government-borne incentive, new risk-based taxpayer compliance supervision rules, and revised mutual agreement procedure guidelines

-

The Malawian government has targeted US gemstone miner Columbia Gem House, while Amgen has successfully consolidated two separate tax disputes with the Internal Revenue Service.

-

ITR's latest quarterly PDF is now live, leading on the rise of tax technology.

-

ITR is delighted to reveal all the shortlisted firms, teams, and practitioners for the 2022 Americas Tax Awards – winners to be announced on September 22

-

‘Care’ is the operative word as HMRC seeks to clamp down on transfer pricing breaches next year.

-

Tax directors tell ITR that the CRA’s clampdown on unpaid taxes on insurance premiums is causing uncertainty for businesses as they try to stay compliant.

-

HMRC has informed tax directors that it will impose automated assessments on online sellers with inaccurate VAT returns, in a bid to fight fraud.

-

UK businesses need to reset after the Upper Tribunal ruled against BlackRock over interest deductions it claimed on $4 billion in inter-company loans, say sources.

-

Hong Kong SAR’s incoming regime for foreign income exemptions could remove it from an EU tax watchlist but hand Singapore top spot in APAC.

-

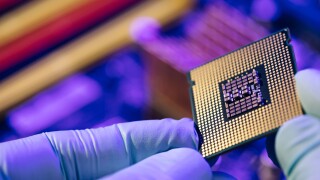

Congress passed legislation with $52 billion in tax credits and other incentives on July 28 to boost production at US semiconductor companies.