Ian Halligan previously led Baker Tilly’s international tax services in the US

Exclusive ITR data emphasises that DEI does not affect in-house buying decisions – and it’s nothing to do with the US president

The firms made senior hires in Los Angeles and Cleveland respectively; in other news, South Korea reported an 11% rise in tax income, fuelled by a corporation tax boom

The ‘deeply flawed’ report is attempting to derail UN tax convention debates, the Tax Justice Network’s CEO said

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalOffshore marketing hubs are becoming increasingly commonplace for Australian resource firms in Asia. Deloitte’s John Bland and Milla Ivanova discuss what factors may trigger increased regulatory scrutiny for a multinational under the Australian Taxation Office’s (ATO) risk ratings.

-

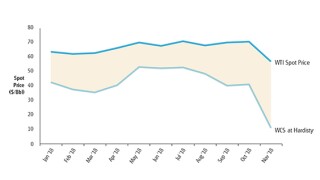

Sponsored by Deloitte Transfer Pricing GlobalVolatile oil markets in 2018 presented significant challenges to Canadian exporters, but a shortage in natural gas production globally presented a complimentary opportunity. Deloitte’s Andreas Ottosson and Markus Navikenas discuss the transfer pricing implications.

-

Sponsored by Deloitte Transfer Pricing GlobalEnergy companies using an asset-backed trading (ABT) model can hedge against volatile markets by better controlling their supply chain, but this can also trigger new transfer pricing issues. Deloitte’s Nick Pearson-Woodd and Marius Basteviken discuss.

-

Salim Rahim, a TP specialist, had been a partner at Baker McKenzie since 2010

-

While the manual should be consulted for any questions around MAPs, the OECD’s Sriram Govind also emphasised that the guidance is ‘not a political commitment’

-

The landmark Indian Supreme Court judgment redefines GAAR, JAAR and treaty safeguards, rejects protections for indirect transfers and tightens conditions for Mauritius‑based investors claiming DTAA relief

-

The expansion introduces ‘business-level digital capabilities’ for tax professionals, the US tax agency said

-

As tax teams face pressure from complex rules and manual processes, adopting clear ownership, clean data and adaptable technology is essential, writes Russell Gammon, chief innovation officer at Tax Systems

-

Partners want to join Ryan because it’s a disruptor firm, truly global and less bureaucratic, Tom Shave told ITR

-

If Trump continues to poke the world’s ‘middle powers’ with a stick, he shouldn’t be surprised when they retaliate

-

The Netherlands-based bank was described as an ‘exemplar of total transparency’; in other news, Kirkland & Ellis made a senior tax hire in Dallas

-

Zion Adeoye, a tax specialist, had been suspended from the African law firm since October over misconduct allegations