Ian Halligan previously led Baker Tilly’s international tax services in the US

Exclusive ITR data emphasises that DEI does not affect in-house buying decisions – and it’s nothing to do with the US president

The firms made senior hires in Los Angeles and Cleveland respectively; in other news, South Korea reported an 11% rise in tax income, fuelled by a corporation tax boom

The ‘deeply flawed’ report is attempting to derail UN tax convention debates, the Tax Justice Network’s CEO said

Sponsored

-

Sponsored by Lenz & StaehelinAfter Swiss tax reform failed to secure public support in 2017, lawmakers have revised key tenants to ensure it passes when it goes to a second referendum, this time in May 2019. Lenz & Staehelin’s Jean-Blaise Eckert and Frédéric Neukomm discuss the potential impact on corporations and shareholders.

-

Sponsored by Tax Partner AG, Taxand SwitzerlandAs Switzerland passes wide-scale tax reform, local tax authorities are increasingly focusing on intangibles and intellectual property (IP) audits as part of a two-pronged approach in tackling tax evasion. Tax Partner’s Caterina Colling-Russo and René Matteotti discuss the focus.

-

Sponsored by EY SwitzerlandAs Switzerland harmonises its corporate tax regime with international standards, the number of available tax incentives for businesses will diminish, while the effective tax rate will rise. EY Switzerland’s Kersten Honold and Kilian Bürgi discuss how cantonal ‘tax holidays’ provide an alternative to maintain rates below 10%.

-

Salim Rahim, a TP specialist, had been a partner at Baker McKenzie since 2010

-

While the manual should be consulted for any questions around MAPs, the OECD’s Sriram Govind also emphasised that the guidance is ‘not a political commitment’

-

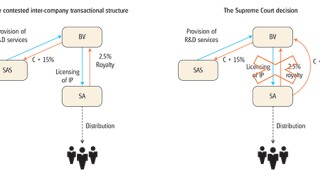

The landmark Indian Supreme Court judgment redefines GAAR, JAAR and treaty safeguards, rejects protections for indirect transfers and tightens conditions for Mauritius‑based investors claiming DTAA relief

-

The expansion introduces ‘business-level digital capabilities’ for tax professionals, the US tax agency said

-

As tax teams face pressure from complex rules and manual processes, adopting clear ownership, clean data and adaptable technology is essential, writes Russell Gammon, chief innovation officer at Tax Systems

-

Partners want to join Ryan because it’s a disruptor firm, truly global and less bureaucratic, Tom Shave told ITR

-

If Trump continues to poke the world’s ‘middle powers’ with a stick, he shouldn’t be surprised when they retaliate

-

The Netherlands-based bank was described as an ‘exemplar of total transparency’; in other news, Kirkland & Ellis made a senior tax hire in Dallas

-

Zion Adeoye, a tax specialist, had been suspended from the African law firm since October over misconduct allegations