The OECD profile signals Brazil is no longer a jurisdiction where TP can be treated as a mechanical compliance exercise, one expert suggests, though another highlights 'significant concerns'

Libya’s often-overlooked stamp duty can halt payments and freeze contracts, making this quiet tax a decisive hurdle for foreign investors to clear, writes Salaheddin El Busefi

Eugena Cerny shares hard-earned lessons from tax automation projects and explains how to navigate internal roadblocks and miscommunications

The Clifford Chance and Hyatt cases collectively confirm a fundamental principle of international tax law: permanent establishment is a concept based on physical and territorial presence

Sponsored

-

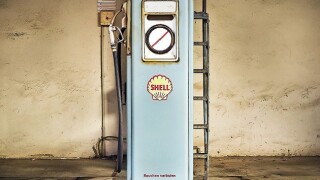

Sponsored by EY MexicoVíctor Anaya Sánchez of EY Mexico discusses how the newly introduced control system by the Mexican Tax Administration seeks to improve reporting functions related to fuel transactions.

-

Sponsored by BurckhardtRolf Wüthrich of burckhardt Ltd explains how Switzerland is improving its compliance and reporting functions to strengthen the country’s reputation as a global business centre.

-

Sponsored by Bär & KarrerDaniel U Lehmann and Anke Stumm of Bär & Karrer consider how measures put forward by the OECD’s BEPS project and the EU Anti-Tax Avoidance Directive have impacted corporate taxation in Switzerland.

-

Australian government minister Andrew Leigh reflects on the fallout of the scandal three years on and looks ahead to regulatory changes

-

The US president’s threats expose how one superpower can subjugate other countries using tariffs as an economic weapon

-

The US president has softened his stance on tariffs over Greenland; in other news, a partner from Osborne Clarke has won a High Court appeal against the Solicitors Regulation Authority

-

Emmanuel Manda tells ITR about early morning boxing, working on Zambia’s only refinery, and what makes tax cool

-

Hany Elnaggar examines how AI is reshaping tax administration across the Gulf Cooperation Council, transforming the taxpayer experience from periodic reporting to continuous compliance

-

The APA resolution signals opportunities for multinationals and will pacify investor concerns, local experts told ITR

-

Businesses that adopt a proactive strategy and work closely with their advisers will be in the greatest position to transform HMRC’s relief scheme into real support for growth

-

The ATO and other authorities have been clamping down on companies that have failed to pay their tax

-

The flagship 2025 tax legislation has sprawling implications for multinationals, including changes to GILTI and foreign-derived intangible income. Barry Herzog of HSF Kramer assesses the impact