Japan

Former EY and Deloitte tax specialists will staff the new operation, which provides the firm with new offices in Tokyo and Osaka

Jaap Zwaan’s arrival continues a recent streak of A&M Tax investing in the region; in other news, the US and Japan struck a deal that significantly lowered tariff rates

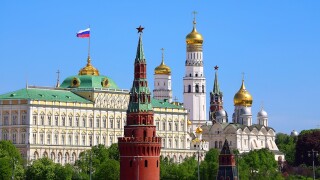

The move to a new ‘high spec’ hub is slated for 2026; in other news, India reassesses its pillar two participation following the US’s withdrawal

Jurisdictions that have ratified the global minimum tax are now in the process of making it a reality

Sponsored

Sponsored

-

Sponsored by TMF GroupITR and professional services firm TMF Group will host a webinar on March 26 on the impact of artificial intelligence on the tax industry, discussing its true definition and the steps that businesses can take to use it efficiently.

-

Sponsored by Deloitte USCompanies, tax departments and tax professionals must leverage new technologies and cultivate their capabilities for the digital future. Jen Knickerbocker, Amanda Hale and Jeff Butt of Deloitte look at the roles they will play in preparing for the digital future of tax.

-

Sponsored by Deloitte Transfer Pricing GlobalMultinationals across all sectors should be ready as fundamental changes to the international taxation system make their way into reality. Alison Lobb, Robert Stack and Paul Riley introduce this special report.

Article list (load more 4 col) current tags