Firm

The landmark Indian Supreme Court judgment redefines GAAR, JAAR and treaty safeguards, and rejects protection for indirect transfers and tightening conditions for Mauritius‑based investors claiming DTAA relief

As tax teams face pressure from complex rules and manual processes, adopting clear ownership, clean data and adaptable technology is essential, writes Russell Gammon, chief innovation officer at Tax Systems

Partners want to join Ryan because it’s a disruptor firm, truly global and less bureaucratic, Tom Shave told ITR

The Netherlands-based bank was described as an ‘exemplar of total transparency’; in other news, Kirkland & Ellis made a senior tax hire in Dallas

Sponsored

Sponsored

-

Sponsored by MachadoGabriel Caldiron Rezende and Juliana Mari Tanaka of Machado Associados discuss the new controversies over the ICMS on interstate transactions.

-

Sponsored by KPMG ChinaThere were a number of important reforms affecting individual income tax in China at the turn of 2022. Lewis Lu of KPMG explains what they mean for taxpayers.

-

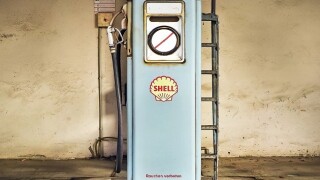

Sponsored by DLA Piper AustraliaJock McCormack of DLA Piper discusses the recent Full Federal Court decision in the Shell Energy Holdings Australia Ltd case, and summarises recent legislative reforms affecting alternative investments and patents.

Article list (load more 4 col) current tags