Firm

The Netherlands-based bank was described as an ‘exemplar of total transparency’; in other news, Kirkland & Ellis made a senior tax hire in Dallas

The deal establishes Ryan’s property tax presence in Scotland and expands its ability to serve clients with complex commercial property portfolios across the UK, the firm said

The Fortune 150 energy multinational is among more than 12 companies participating in the initiative, which ‘helps tax teams put generative AI to work’

The ruling excludes vacation and business development days from service PE calculations and confirms virtual services from abroad don’t count, potentially reshaping compliance for multinationals

Sponsored

Sponsored

-

Sponsored by KPMG ChinaThere were a number of important reforms affecting individual income tax in China at the turn of 2022. Lewis Lu of KPMG explains what they mean for taxpayers.

-

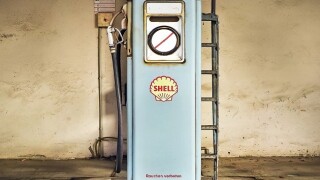

Sponsored by DLA Piper AustraliaJock McCormack of DLA Piper discusses the recent Full Federal Court decision in the Shell Energy Holdings Australia Ltd case, and summarises recent legislative reforms affecting alternative investments and patents.

-

Sponsored by NeraYves Hervé and Jens Rubart of NERA Economic Consulting explain why a Federal Fiscal Court decision regarding intercompany financing will have significant implications for taxpayers in Germany.

Article list (load more 4 col) current tags