Sponsored

-

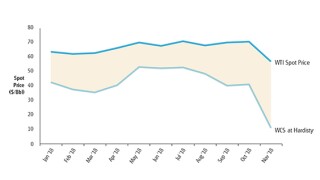

Sponsored by Deloitte Transfer Pricing GlobalVolatile oil markets in 2018 presented significant challenges to Canadian exporters, but a shortage in natural gas production globally presented a complimentary opportunity. Deloitte’s Andreas Ottosson and Markus Navikenas discuss the transfer pricing implications.

-

Sponsored by Deloitte Transfer Pricing GlobalEnergy companies using an asset-backed trading (ABT) model can hedge against volatile markets by better controlling their supply chain, but this can also trigger new transfer pricing issues. Deloitte’s Nick Pearson-Woodd and Marius Basteviken discuss.

-

Sponsored by Deloitte Transfer Pricing GlobalThe OECD has issued new guidance on applying the profit-split method (PSM) in the energy and resources (E&R) sector. But will this see an uptick in its use? Deloitte’s Mark Barker and Aengus Barry discuss.

-

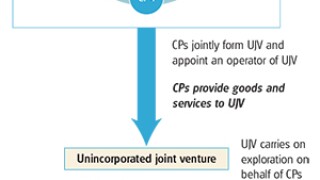

Sponsored by Deloitte Transfer Pricing GlobalIndia’s rapid growth and energy consumption has seen the government simplify public-private investment partnerships in the upstream oil and gas (O&G) sector. Deloitte’s Bhavik Timbadia and Ankit Goel discuss the transfer pricing (TP) implications.

-

Sponsored by Deloitte Transfer Pricing GlobalAs resource-rich Middle Eastern governments suffer a decline in oil revenues, many governments are reforming transfer pricing (TP) regulations to limit capital flight. Deloitte’s Shiv Mahalingham, Alena Kovalova and Claire Boushell discuss the regional regulatory trends.

-

Sponsored by Deloitte Transfer Pricing GlobalPublic and political pressure has seen tax authorities play closer attention to transfer pricing. Deloitte’s Tony Anderson, Alex Evans, Mariusz Kazuch, Rafal Sadowski and Lian Tang He explore changes in Canada, China and Poland.