lead

Direct Tax

features sponsored features special focus local insights

-

In July 2016, China’s State Administration of Taxation (SAT) released Announcement 42, outlining the updated Chinese requirements for contemporaneous documentation. In October, it released Announcement 64, containing revisions to the guidance on the administration of advance pricing arrangements. Chi Cheng, Xiaoyue Wang, Simon Liu, Kelly Liao and Mimi Wang explore the implications.

-

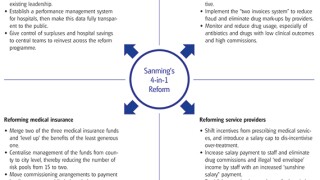

China has been rolling out various measures to reform its healthcare system. Among these changes, the “two invoices system” has attracted much attention and is likely to affect the way pharmaceutical companies are structured and how they sell their drugs. Grace Xie, Henry Ngai and Thomas Li provide an overview of what is happening in China and how it will impact the pharmaceutical sector.

-

China’s progress in rolling out the 2015 BEPS recommendations, key cross-border tax enforcement trends in 2016, and the development of China’s external tax policy are the focus of this chapter by Khoonming Ho, Chris Xing, Lilly Li and Conrad Turley.

Sponsored Features

-

Sponsored by BDO IndiaJoin ITR for a free webinar on February 4 as senior tax practitioners from BDO India analyse a highly significant ruling by the Indian Supreme Court

-

Sponsored by DeloitteInterview with Candy Ye Tang, tax and business advisory leader, Deloitte China

-

Sponsored by DeloitteInterview with Adham Hafoudh, partner, Tax & Legal, Deloitte Czech Republic

Special Focus

-

Sponsored by EY Central AmericaAntonio Ruiz and Alejandra Arguedas of EY Central America, Panama and Dominican Republic explain how tax, geopolitical factors, and trade agreements shape foreign investment in Central America, offering guidance for companies navigating the region

-

Sponsored by DDTC ConsultingDavid Hamzah Damian of DDTC Consulting examines recent procedural changes in Indonesia’s tax disputes process and the Supreme Court’s stance on tax evidence, highlighting key implications for taxpayers facing audits, objections, and appeals

-

Sponsored by DeloitteEddie Morris, Josep Serrano Torres, and Jen Breeze of Deloitte compare transfer pricing controversies in the pharmaceutical and automotive sectors, highlighting how DEMPE functions, regulation, and intangibles drive both common themes and sector-specific challenges

Local Insights

-

Sponsored by Spanish VAT ServicesThe ruling clarifies that Spain cannot restrict VAT exemptions for general services directly necessary to independent groups’ exempt activities, says Fernando Matesanz of Spanish VAT Services

-

Sponsored by MachadoGabriel Caldiron Rezende of Machado Associados comments on the latest developments related to the beginning of the Brazilian consumption tax reform test phase and considers the next steps

-

Sponsored by KPMG SwedenNils Schmid and Isabelle Berking of KPMG Sweden analyse the possibilities for sovereign wealth funds to claim refunds of Swedish withholding tax following a recent proposal referred to the Council on Legislation