lead

Direct Tax

features sponsored features special focus local insights

-

Countries worldwide have followed Mexico’s lead to tax sugar-sweetened drinks in an effort to curb obesity and unhealthy habits, but these measures are coming at a cost to manufacturers and may not be as profitable for governments as they suggest.

-

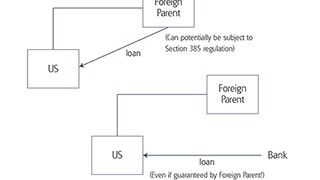

The US tax system is on the brink of change as upcoming discussions centre on tax policy (including regulations related to inversion transactions) that will ultimately reshape the US tax treatment of inter-company financing within MNEs. In the second half of 2016, a stream of new regulations and law changes, both actual and proposed, in and outside of the US, created new issues for inter-group financing by multinationals. Stuart Chessman, director at Vivendi, discusses the salient points.

-

Shiv Mahalingham of Duff & Phelps provides a roundup of the key changes to the UK transfer pricing landscape in recent months.

Sponsored Features

-

Sponsored by BDO IndiaJoin ITR for a free webinar on February 4 as senior tax practitioners from BDO India analyse a highly significant ruling by the Indian Supreme Court

-

Sponsored by DeloitteInterview with Candy Ye Tang, tax and business advisory leader, Deloitte China

-

Sponsored by DeloitteInterview with Adham Hafoudh, partner, Tax & Legal, Deloitte Czech Republic

Special Focus

-

Sponsored by EY Central AmericaAntonio Ruiz and Alejandra Arguedas of EY Central America, Panama and Dominican Republic explain how tax, geopolitical factors, and trade agreements shape foreign investment in Central America, offering guidance for companies navigating the region

-

Sponsored by DDTC ConsultingDavid Hamzah Damian of DDTC Consulting examines recent procedural changes in Indonesia’s tax disputes process and the Supreme Court’s stance on tax evidence, highlighting key implications for taxpayers facing audits, objections, and appeals

-

Sponsored by DeloitteEddie Morris, Josep Serrano Torres, and Jen Breeze of Deloitte compare transfer pricing controversies in the pharmaceutical and automotive sectors, highlighting how DEMPE functions, regulation, and intangibles drive both common themes and sector-specific challenges

Local Insights

-

Sponsored by Spanish VAT ServicesThe ruling clarifies that Spain cannot restrict VAT exemptions for general services directly necessary to independent groups’ exempt activities, says Fernando Matesanz of Spanish VAT Services

-

Sponsored by MachadoGabriel Caldiron Rezende of Machado Associados comments on the latest developments related to the beginning of the Brazilian consumption tax reform test phase and considers the next steps

-

Sponsored by KPMG SwedenNils Schmid and Isabelle Berking of KPMG Sweden analyse the possibilities for sovereign wealth funds to claim refunds of Swedish withholding tax following a recent proposal referred to the Council on Legislation