Compliance and cooperation are key factors in reducing the risk of becoming involved in a dispute with the Italian tax authority in a global environment where MNEs are facing increasing levels of transparency and disclosure.

Background

The Italian APA programme was introduced in 2003 to provide much needed tax certainty, both for MNEs operating in Italy and to Italian headquartered multinationals.

The OECD defines an APA as an arrangement that determines, in advance of controlled transactions, an appropriate set of criteria (e.g. method, comparables, appropriate adjustments, critical assumptions on future events, etc.) to determine the transfer pricing (TP) for those transactions over a fixed period.

The Italian APA programme was introduced by Article 8 of Law Decree No. 269 of September 30 2003, and was converted into Law No. 326 of November 24 2003 (Law 326). The procedure was reformed in 2015.

Legislative Decree No. 147/2015 introduced, in Presidential Decree No. 600/1973, a provision regulating the reformed international ruling procedure (Article 31-ter). The new provision was enacted by the Regulation of the Director of the Revenue Agency No. 42295/2016, dated March 21 2016.

The APA programme started with a unilateral-only APA valid for two years. Sixteen years later, the programme has been expanded to bilateral and multilateral APAs and the term of these extend to five years. This has attracted considerable popularity among investors and entrepreneurs who have lodged a considerable number of applications.

MNEs with international activities wishing to reach a prior agreement with the Italian tax authority, may request for an APA to:

Define the most appropriate TP methods and criteria applicable to the transactions carried out with related parties;

Determine the entry or exit value of assets when the entity transfers its residence in or out of Italy;

In case a non-resident company starts a new business in Italy, verify through prior assessment whether the conditions for a permanent establishment (PE) to exist in Italy are met, before the business starts;

Define the tax law provisions, including double tax treaty provisions applicable to cross-border items, among which the tax treatment of income (such as dividends, interests, royalties or other income items) paid to/received from non-resident companies; and

Determine the attribution of profits to a PE in Italy of a non-resident company or to a PE in another state of a resident company, according to the international standard recommended.

According to the law, the negotiation of the agreement "must be completed" within 180 days. However, this time limit is non-mandatory and, in practice, the whole process will normally take up to two years in complex cases and even longer where two or more tax authorities are involved.

In the case of a unilateral APA, the agreement remains in force for five years including the year in which it is signed and for the following four years.

One advantage of the 2015 reform is the possibility of applying the agreement retroactively (so-called 'roll back'), up to the fiscal year in which the application of the APA was filed. This is possible if the same factual and legal circumstances on which tax ruling is based also occurred in the interim period, i.e. from the year in which the APA was filed to the year in which the agreement is reached with the Italian tax authority. This means that only a limited 'roll-back' mechanism is available in Italy for unilateral APAs.

With reference to bilateral or multilateral APAs, Italy applies the agreements from the first year covered by the request and the following four years thereafter, provided the request is submitted before the end of the fiscal year that is to be covered by the APA.

In principle, Italy does not allow for the roll-back of multilateral, bilateral or unilateral APAs for those fiscal years preceding the fiscal year in which the APA request was submitted, even though such years are still open (under the Italian domestic statute of limitation) at the moment an APA is entered into. Therefore, Italy does not fully meet the BEPS Action 14 minimum standard concerning the prevention of disputes, albeit it has an established APA programme. Formally, Italy does not enable taxpayers to request roll-backs of APAs even though other strategies can be explored.

Compliance is the key

Italy is a TP jurisdiction reported as experiencing a proliferation of audit activity since the introduction of the TP documentation rules, dated September 29 2010.

The increased number of TP enquiries is also driven by the pressure of the Italian governments from the fallout of the global financial crisis, which resulted in a high debt-to-GDP ratio, to generate recovery through increased revenues from taxation.

There is no doubt that MNEs are becoming more aware of tax controversy risk in Italy and that at least some of them are becoming more conservative, largely for reasons of reputation and brand. Even though tax planning is still an important part of any tax function, understanding pre-controversy risk management is critical to its success. In Italy, as in many other territories, juridical mechanisms such as litigation are not an optimal way to resolve TP disputes. Entering into tax litigation proceedings in Italy is an expensive and long process with an uncertain outcome.

Nevertheless, compliance and cooperation are key to reducing the risk of becoming involved in a dispute with the Italian tax authority. It is part of the entrepreneurial strategy of the multinational having a business model disclosed in advance using the APA programme to prevent the most frequent challenges arising from the Italian tax authority in recent years, such as TP adjustments, hidden PEs, non-deductible management service fees, etc.

Trends in unilateral APAs vs bilateral/multilateral APAs

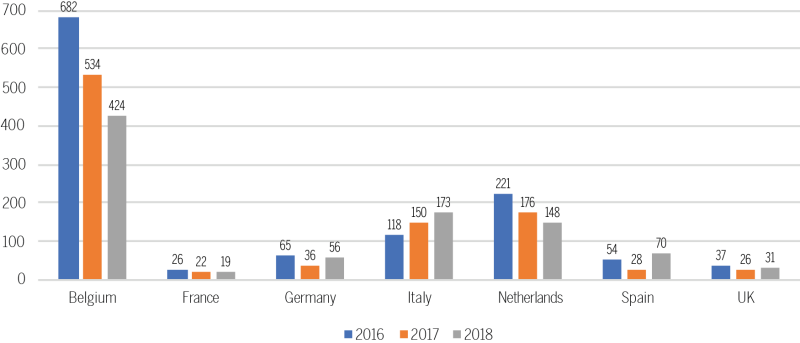

In 2018, the total number of APA requests in Italy registered an increase of more than 15% compared to 2017. A total of 173 APAs were filed in 2018, making Italy the second country in the European Union (the first being Belgium) with the highest number of APAs filed during that year.

Figure 1 shows that most of the larger EU countries experienced a declining trend of APA filings in the past three years. On the contrary, Italy registered a steady growth in the same period.

Figure 1 – Three-year trend of APA filings

One trend that is becoming distinguishable is the increased proportion of bilateral/multilateral APA applications. This is mainly due to the increased risks for foreign parent companies not being able to gain fully the benefits of the unilateral APA resolution of their Italian subsidiaries in their tax jurisdiction, leading to overall double taxation in some cases.

However, the increased interaction between the Italian tax authority and several competent authorities as a result of BEPS meetings have helped foster a new and enhanced relationship between them, giving tax authority representatives the opportunity to meet and resolve bilateral APA cases.

On top of this, the increasing use of technology (such as video conferencing, etc.) has helped remove some of the administrative barriers historically faced during the bilateral APA process.

Given the above, bilateral APAs are an attractive option in Italy. However, the analysis of when and where a bilateral APA is appropriate requires a detailed case-by-case analysis.

Companies need to create a strategic focus, examining jurisdictions, transactions, penalty protection regimes, etc. before proceeding with a bilateral APA. For instance, in the UK, HM Revenue and Customs (HMRC) looks for cases where the TP issues are complex, the transactions are of a high value, and situations where there is a high likelihood of double taxation.

Although there is an increasing proportion of bilateral/multilateral APA applications, unilateral APAs are still the most common type of APAs filed in Italy. In addition, unilateral APAs may be quicker and a cheaper way to agree the details with just one tax authority rather than with two or more.

What are the key benefits of an APA in Italy?

The success of the APA programme in Italy is due to the following advantages for MNEs:

For most MNEs, obtaining certainty regarding TP is the most important benefit sought via the APA. Knowing the tax impact is important, but companies also benefit from the ability to make operational decisions without concerns about subsequent TP adjustments.

TP examinations are time consuming and expensive. During an examination, the Italian tax authority requests extensive information about the Italian taxpayer and the related parties involved in the transactions. This requires the taxpayer to spend a significant amount of time and money providing the relevant information. On the contrary, the APA programme is generally expected to take less time (or less day-to-day management time) to complete than a TP examination. After the taxpayer and Italian tax authority negotiate an APA, the taxpayer is only required to demonstrate on an annual basis compliance with the APA, eliminating the need to update annually the comparable company information used in preparing the TP documentation.

Substantial reduction of compliance costs over the term of the APA. In addition, the Italian APA programme does not require any access fees to be paid.

Bilateral and multilateral APAs substantially reduce the possibility of juridical or economic double or non-taxation where all the relevant countries participate. By contrast, unilateral APAs do not provide certainty in the reduction of double taxation because other tax administrations may consider that the methodology adopted does not give a result consistent with the arm's-length principle. On the other hand, there are cases where unilateral APAs in Italy may be advisable or even the only possibility when many countries are involved or when the tax authorities of the other countries involved do not see the need for entering into an APA. The same may be true for small MNEs and in cases where only a small amount of tax is at stake or where the issues are not difficult, and the main goal is to secure the TP position of the taxpayer in Italy.

In some cases, the Italian tax officers in the assessment field might not have specialist knowledge of the specific industry/sector or on complex TP aspects. On the contrary, the Italian APA team has developed expertise in TP with respect to legal and economic issues, as well as how a treaty partner will approach an issue, with a focus on efficient and creative ways to resolve a TP case. In addition, the Italian APA team has shown greater openness in improving the tax authority-taxpayer relationship, while the local tax departments, which are under pressure to reach monetary targets, are less flexible.

In a global environment characterised by increasing levels of disclosure and information sharing between tax authorities, the number of disputes is likely to increase as taxpayers are not necessarily aware of all the information that tax authorities exchange between countries.

In this new era, any solution that prevents those disputes should be a part of the tax strategy for MNEs and for this reason the APA programme in Italy represents a strategic opportunity.

Davide Bergami |

|

|---|---|

|

Partner, TP and OME – Tax and law market leader Studio Legale Tributario EYTel: +39 335 1229309 Davide Bergami is a member of the leadership team of Studio Legale Tributario EY and a partner in-charge of the TP and operating model effectiveness (OME) team in the Mediterranean. Davide has more than 20 years of experience in TP focusing on APAs, MAPs and controversy cases. Davide experienced a one-year secondment in Amsterdam. He also took international executive training courses at the Kellogg School of Management (2011), INSEAD (2014) and London Business School (2016). Over the past 20 years, Davide has been lecturing in various master and specialised seminars at institutions including: Bocconi University, Guardia di Finanza, Higher School of Economics and Finance Ezio Vanoni, and Università Cattolica del Sacro Cuore. He has also authored several publications in leading international taxation journals. Moreover, Davide has been the energy market segment leader for the Mediterranean. |

Antonio Zegovin |

|

|---|---|

|

Senior manager, TP and OME Studio Legale Tributario EYTel: +44 (0) 207 760 9252 Antonio Zegovin is a senior manager in the TP and OME team in the UK. He has acquired significant experience in the field of international taxation, working on transaction, structuring and controversy projects. He also has extensive experience in advance pricing agreements, mutual agreement procedures and settlement negotiations. His clients include leading Italian and UK multinationals. Antonio began his career as a TP professional in 2010. He worked at Studio Legale Tributario EY's Milan office from 2016 to 2018 and moved to Ernst & Young in the UK in 2019. He holds a degree in business administration and a master of science degree in business administration and law (Bocconi University, Milan). |