There is increasing momentum building for multinationals to transition their enterprise resource planning (ERP) systems to SAP Business Suite 4 SAP HANA (S/4 HANA). The new suite presents a significant opportunity for multinationals to increase efficiencies and achieve a broad range of commercial benefits.

Tax also has a role to play in the shift to S/4 HANA. This article provides a brief introduction and outlines what the opportunity could mean for the tax function. In addition, we provide some suggestions as to how the tax function may engage with the broader organisation to ensure that tax does not miss out on the opportunities that exist.

S/4 HANA in a nutshell

S/4 HANA is software company SAP's latest technology and it goes beyond automating business processes. Often reference is made to the 'intelligent enterprise' whereby the latest SAP technologies can turn insight into action in real time with a completely new user experience. SAP's S/4 HANA uses in-memory computing to process data in an unprecedented manner. SAP launched S/4 HANA in 2015 and had planned to stop supporting predecessor SAP ERP Central Component (SAP ECC) on December 31 2025. On February 4 2020, SAP announced a maintenance commitment for SAP S/4 HANA until the end of 2040. At the same time, SAP will provide mainstream maintenance for SAP Business Suite 7 core applications until the end of 2027. This offboarding phase will be followed by optional extended maintenance until end of 2030.

Why is S/4 HANA better than old SAP?

Traditional ERP systems are optimised for transaction processing with data stored in many different tables. S/4 HANA uses its Universal Journal to store all financial transaction details in one table. Data is available and accessible with near-zero latency. The new system brings a simplified data model that allows users to record once, use multiple times and create a single source of reliable data. Analytics and insights that were historically unfeasible, or very time consuming, can now be processed quickly.

With the SAP Global Tax Management Suite, SAP has released a number of new tax solutions that deal with critical challenges that clients have to cope with, matters such as real time tax reporting, ensuring accurate indirect tax determination, advanced tax reporting and increased control over their business processes for tax that are now possible with S/4 HANA.

S/4 HANA comes with a completely new user interface. Data is much more accessible and can be processed in a very intuitive manner. Tax digital boardrooms, for example, provide key stakeholders immediate insight into the relevant tax data.

Put simply, S/4 HANA allows multinationals to transform their core systems and streamlining processes, and simplify their data model and underlying architecture. It represents an opportunity to fix legacy issues such as manual accounting and finance processes, inter-company and reconciliation problems or data integrity and control issues.

Tax as a part of the S/4 HANA transformation journey

Changes to the global tax legislative landscape, and companies becoming more digital, mean that tax compliance and reporting are becoming more immediate, digitalised and data intensive.

Areas driving significant change include:

Globalisation and complexity – there continues to be increasing cross-border trade, greater competition, growth in new delivery models through reduced barriers to entry and increasingly complex pricing models in many areas.

Increasing amount of regulation and tax requirements – the global tax regulatory landscape is constantly changing, making it increasingly challenging to stay up-to-date with all the relevant tax laws in each country. At the same time, tax authorities are changing how they engage with taxpayers in areas such as real-time data sharing requests and electronic invoicing. As a result, there is an increasing need for risk and control frameworks to allow taxpayers to manage the increasing demands that the global tax transparency agenda is placing on them.

People and operating models – technology is playing an increasingly important role within tax departments and this is changing the skillsets required within the tax function. Operating models are changing quickly and there is pressure for tax functions to partner more with the business to understand and add value as the business itself changes.

Data and technology – ERP systems are expanding and taking on more functions through organic growth or acquisition of best-of-breed software. The volume of data is increasing dramatically and there is cost pressure on the tax function to leverage technology to deliver more with less.

To keep pace with these changing demands, tax functions in multinationals require more 'right-first-time' transaction data to be captured and to have access to more streamlined calculations. This means that multinationals must look at how they can better leverage their ERP systems to help them meet all of the demands from the changing tax and business environment.

Tax departments must look to their ERP systems such as S/4 HANA to ensure that value can be delivered in areas such as:

Providing 'right-first-time' data and reporting;

Creating an unified approach to the tax calculation;

Ensuring relevant change management and operating model discussions;

Understanding the opportunities of automation through the ERP system and how this will support the digitisation of tax and real-time tax reporting.

The tax authorities are transforming their processes by moving to e-filing, e-audits and e-assessments, and S/4 HANA provides an opportunity for multinationals to accelerate their readiness for these future challenges and opportunities.

There are many opportunities for the tax function in S/4 HANA implementation. Table 1 provides a summary of the key areas we see where tax has a role to play.

Insights into VAT and S/4 HANA

VAT is a good example where S/4 HANA stands out in how the capabilities can be leveraged when compared to the previous versions of SAP.

VAT is a transaction-based tax and thus requires single transaction-based data to achieve compliant reporting. With the new model, SAP promises a new data driven user experience with one single source of truth. Early involvement in the process of selecting S/4 HANA solutions provides the tax function with the opportunity to establish end-to-end (E2E) processes, which enable both process standardisation and speed. Ultimately, the tax function is given the opportunity to structure and implement their own business operation workflow using the full capability of robotics and machine learning within S/4 HANA. This allows them to finally become the owner of the tax data, which they are responsible for towards the tax authorities.

VAT authorities around the globe are front-runners when it comes to standard audit files for tax (SAF-T), real time reporting and e-filing requirements. There are already a number of countries that require VAT reporting to partially be in a specific electronic format enabling tax authorities to run their analytics software and spot inconsistencies within very short timeframes. As taxpayers are asked to provide information to tax authorities within increasingly short timeframes, S/4 HANA provides a scalable solution to allow taxpayers to provide robust responses. In particular, S/4 HANA can provide powerful analytics capabilities and with S/4 HANA, the tax function can manage the degree of detail and frequency of the analytics capabilities on a country-by-country basis.

Opportunities of being part of the S/4 HANA transformation journey

Tax processes and accessing data from ERP systems are often quite bespoke. Engaging tax in the S/4 HANA migration will enable compatibility between the customised features and short-term fix solutions that are built into the current ERP system and the processes that support tax workstreams. Thus, by maintaining these features, the tax department will continue to operate effectively.

Many tax functions within multinationals have started to invest significant resources and time in efforts to 'go digital'. Ensuring they are part of the initial design phase of transitioning to S/4 HANA will optimise and boost the efforts they have already made on their 'digital' agenda.

When the tax functions participate in the planning phase of the S/4 HANA transition, tax data can be aligned with the system of record for tax compliance and audit requirements.

Finally, it will be easier for tax departments to comply with the increasing real time tax reporting requirements imposed on multinationals in many countries if the tax functions participate and benefit from the improvement opportunities that are available from embedding tax requirements into S/4 HANA.

Table 1: Tax and legal integration considerations

Direct tax |

Indirect tax |

Operational transfer pricing |

Customs and global trade |

Legal |

Data sensitisation for tax provision and compliance |

Indirect tax determination automation, i.e. VAT/GST calculation (tax engine or SAP solution/add-on) |

Intercompany transactions |

Intrastat |

Cloud contracting |

Legal entity reporting |

Real-time reporting, i.e. SAF-T, e-invoicing, etc. |

Allocations |

License control |

|

Chart of accounts |

Indirect tax compliance and reporting |

Country-by-country reporting |

SPL and embargo |

|

Local/regional tax reporting requirements |

Statistical reporting, i.e. Intrastat, ESL |

Functional profit and loss |

Product classification with commodity code/tariff numbers |

|

Fixed asset set-up and reporting |

Data and analytics to support compliance and reporting |

Cost-plus/Resale-minus calculations |

Direct interface to the content provider for the update of SPL lists and tariffs |

|

Property tax |

Other local taxes |

TP adjustments |

||

Income tax reporting |

||||

Withholding tax |

Top recommendations to include tax into the S/4 HANA transformation

Have a vision for the tax upgrade

S/4 HANA may be the best opportunity to address key tax challenges from the start. Consider the SAP upgrade timetable and key milestones related to tax from the beginning of the project, and make it a part of the overall S/4 HANA vision statement. Assess the impact of getting key tax requirements addressed within (or outside) the S/4 HANA implementation – are these related to cost saving, process efficiencies, improved insight or compliance? Explore ways of performing tasks, such as bolt-ons/add-ons to SAP and other tax technologies and software.

Set up a dedicated tax workstream

Combine internal (backfill) and external resourcing and align tax deliverables with other project deliverables to really integrate tax into the project. This is a life event for tax, a once in a lifetime opportunity to ensure the right foundations are laid across data, processes and systems, thereby future-proofing the tax function to keep pace with the rapidly changing digital world we now live in. Also, don't forget that tax spans the project as a horizontal and vertical factor, and is involved in other areas, including supply chain and finance design.

Start preparing your road to S/4 HANA

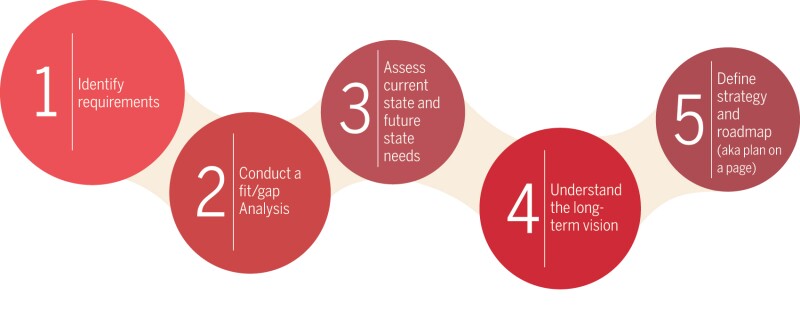

Diagram 1: Five simple steps to implement S/4 HANA

There are five simple steps outlined in Diagram 1 that can be taken to embed tax into the beginning of the S/4 HANA implementation programme. S/4 HANA is typically an enabler to support a broader business transformation (either around finance, business model, etc). Articulating how tax integrates in the S/4 HANA solution can help the company in executing its ambitions:

1) Start by ensuring that your requirements are captured and explained in a way that non-tax people will understand.

2) You will likely have been using your current ERP/SAP system for over a decade. You have first-hand experience of what happens when you do not consider tax correctly, or do not future-proof your system.

3) Consider and ensure that you have captured all of your current issues/challenges with your system and where the gaps are to meet your current and future needs.

4) Ensure you understand the wider vision for S/4 HANA and the long-term plan from the business in getting to that end vision.

5) Define your strategy and roadmap for tax. Think big but narrow your focus on items that you can address. Pull together key themes and understand how these fit into the wider business vision for the S/4 HANA implementation programmes. This will help you to work out which ones can be solved within S/4 HANA and which ones might still require wider tax technology solutions.

To find out more about Deloitte’s SAP S/4HANA Tax insights, visit Deloitte.co.uk/TaxS4H.

Martin Krivinskas |

|

|---|---|

|

Tax partner Deloitte Martin Krivinskas is a tax partner based in Zurich. He has extensive experience supporting global multinationals solve complex tax challenges, helping them mitigate tax risk and manage their effective tax rates. He is also increasingly leading projects where tax technology plays a key role, and is part of Deloitte North-South Europe's tax S/4 HANA team. Martin is a chartered accountant and a member of the Chartered Institute of Taxation. |

Jan de Clercq |

|

|---|---|

|

Partner Deloitte Tel:+31 882886953 Jan de Clercq is a tax partner based in the Netherlands, leading the Deloitte European SAP tax efforts and supporting clients in aligning their tax technology strategy with the broader business transformation they go through. For more than 20 years, he has focused on delivering strategic guidance and innovative tax automation technologies to help businesses digitise and advance their tax functions including ERP tax integration and tax data management. Together with his team, he is leading efforts in re-imagining the tax function by leveraging new SAP tax analytics capabilities and emerging technologies such as artificial intelligence, machine learning and robotics. Jan holds a degree in accounting and tax and is a recognised tax advisor under the NOB (The Dutch Association of Tax Advisers) and IAB (Belgian Association of Tax Advisors). |