One of the first orders of business carried out by the Organisation for Economic Cooperation and Development (OECD) Working Party 6 (WP6) in the Base Erosion and Profit Shifting (BEPS) OECD/G20 project Actions 8-10 was to reaffirm the use of the arm's-length principle.

Formulary apportionment, on the other hand, remained specifically rejected at paragraph 1.21, Chapter I, Section C.2 of the Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (TPG).

The arm's-length principle was then clarified with the 2010 provisions of Chapter I Section D of the TPG deleted in their entirety, and replaced by new language. The clarification was substantial.

How the clarified provisions of Chapter I were to be interpreted in specific types of transactions was the subject of significant amendments to the guidance provided in Chapter VI (intangible), Chapter VII (low-value adding services), and Chapter VIII (cost contribution arrangements). The provisions of all of these chapters were deleted in their entirety and replaced with new ones.

Conforming adjustments to other chapters were introduced as well, mainly in Chapter II (transfer pricing methods) and Chapter IX (business restructuring).

Non-consensus changes to Chapter II (transfer pricing methods) were proposed on December 16 2014, and subsequently on July 4 2016; they are still in the works and not expected to become consensus guidance until later in 2017.

This early reaffirmation of the arm's-length principle did, however, contemplate the use of special measures that, in certain limited specific circumstances perceived as highly conducive to BEPS risks, could deviate from the arm's-length principle.

Specifically, the non-consensus draft issued on December 16 2014, entitled Discussion Draft on Revisions to Chapter I of the Transfer Pricing Guidelines (Including Risk, Recharacterisation, and Special Measures) (the Risk and Recharacterisation Draft) introduced five such options to address the BEPS Action Plan mandate to examine the use of special measures that are "either within or beyond the arm's-length principle".

The first option, called hard-to-value intangibles (HTVI), addressed the informational asymmetry between taxpayer and tax administrations, while the remaining four options addressed the attribution of inappropriate returns for providing capital.

Only one out of the five options proposed in the Risk and Recharacterisation Draft – the HTVI option – made it to the October 5 2015, OECD/G20 BEPS final deliverable (the final deliverable).

The other four options were dismissed without much explanation.

Since this final deliverable was adopted into the TPG in May 2016 (the 2016 TPG), it now controls the application of Article 9 of the OECD's Model Tax Convention on Income and on Capital. Some tax administrations are taking the view that the revised 2016 TPG apply prior to their formal adoption in May 2016 by the OECD Council by pointing that these revisions are merely clarification of the arm's-length principle that has always existed in nature, and therefore always applied.

The Risk and Recharacterization Draft stated (Part II at paragraph 6) that "some of these measures could be seen as within the arm's-length principle and others beyond. At this stage, it is not critical to determine whether a potential measure if on one side or the other of the boundary, but the aim is to consider the effectiveness of the measure," [Emphasis added]. However, it is likely that the four options were dismissed because they were perceived by some countries as deviating too substantially from the arm's-length principle.

Given public statements made by US Treasury officials shortly after the Risk and Recharacterization Draft came out, it is safe to conclude that the US was among those countries, and feared that adopting any of these options would create unmanageable daylight between US authorities (including Treasury regulations and court decisions) and the OECD TPG, or provide tax administrations with too much discretion to force non-arm's length outcomes in too many situations resulting in endless controversy. See, for example, Brian Jenn's comments at the American Bar Association tax section conference in Houston held January 30 2015. Jenn is an attorney advisor at U.S. Treasury (Office of Tax Policy), and a US representative at the OECD Working Party 6.

If the previous assumption turns out to be correct, then it must be the case that the US representatives at WP6 felt that the HTVI guidance was either close enough or entirely consistent with the US authorities' interpretations of the arm's-length principle.

The remainder of this article will attempt to understand where the concepts in the HTVI guidance came from, and explain what the views of the US government have historically been in connection with the arm's-length nature of such concepts. That discussion will encompass a simple theoretical discussion of the use of ex-post results to assess the arm's-length nature of ex-ante pricing as a means to set up one commonly cited reason to believe that the HTVI guidance may, in fact, go beyond the arm's-length principle, as commonly understood or interpreted.

Ultimately, our purpose is to provide useful insights as to what to expect from the OECD HTVI guidance, based on lessons learned from the US experience with the commensurate income (CWI) standard and the periodic adjustment rules.

Information asymmetries

The inspiration for the HTVI guidance came from the periodic adjustment rules of the US transfer pricing regulations. These periodic adjustment rules were enacted as a result of the US Tax Reform Act of 1986, and the introduction in the 482 statute of the CWI standard that states: "In the case of any transfer (or license) of intangible property (within the meaning of section 936(h)(3)(B)), the income with respect to such transfer or license shall be commensurate with the income attributable to the intangible." [Emphasis added].

The periodic adjustment rules of the US transfer pricing regulations and the HTVI guidance were designed to provide tax administrations with a tool to address the informational asymmetry occurring when taxpayers value intangible transfers upfront, based on projections that tax administrations cannot audit at the time, and typically have a very difficult time auditing years after the fact. "For such intangibles, information asymmetry between taxpayer and tax administrations, including what information the taxpayer took into account in determining the pricing of the transaction, may be acute and may exacerbate the difficulty encountered by tax administrations in verifying the arm's-length basis on which pricing was determined for the reasons discussed in paragraph 6.186." [Emphasis added] OECD 2016 TPG at paragraph 6.191.

There are several differences between the US periodic adjustment rules and the OECD HTVI guidance. The US periodic adjustment rules, for example, apply to any and all transfers of intangible rights, while the OECD HTVI guidance applies only to hard-to-value-intangibles within the meaning of paragraphs 6.189 and 6.190. To understand all these differences, see US Treas. Reg. §1.482-4(f)(2) and paragraphs 6.192-6.194 of the OECD TPG; such detailed understanding is not necessary for the purpose of the present discussion.

The US periodic adjustment rules and the OECD HTVI guidance generally provide that, in a transfer of intangible rights, when the ex-post results are substantially different from the ex-ante projections, tax administrations can use the ex-post results as presumptive evidence of the ex-ante projections. "In these circumstances, the tax administration can consider ex post outcomes as presumptive evidence about the appropriateness of the ex-ante pricing arrangements." [Emphasis added] OECD 2016 TPG at paragraph 6.192.

Under US rules, such presumptive evidence can be rebutted. See Treas. Reg. §1.482-4(f)(2)(ii)(D) (or Treas. Reg. §482-7(i)(6)(vi)(A)(2)(2011) for cost sharing arrangements). Under OECD 2016 TPG, satisfactory evidence of the adequacy and robustness of the ex-ante projections actually used by the taxpayer to price the transfer may protect from an HTVI adjustment initiated by a tax administration based on ex-post results. See OECD 2016 TPG at paragraph 6.193.

This is the sense in which US periodic adjustment rules and OECD HTVI guidance are designed to address the informational disadvantage of tax administrations vis-à-vis taxpayers.

Notwithstanding the aforementioned, the use of ex-post evidence to challenge an ex-ante valuation is conceptually problematic.

Perfectly arm's-length transactions could therefore easily end up being adjusted without cause other than, for example, the taxpayer's inability to (i) convincingly rebut the presumptive evidence of non-arm's length pricing (US rules), or (ii) satisfactorily demonstrate the adequacy and robustness of the ex-ante projections actually used (OECD HTVI guidance).

Why is the use of ex-post evidence to challenge an ex-ante valuation conceptually problematic? Clearly, the ex-ante valuation will price the possible upsides of the transaction, but also the possible downsides. As such, financial projections are not designed to predict the future outcome, they are designed to average all possible future outcomes to ensure a fair exchange of ex-ante value, in a probabilistic sense.

Ex-post outcomes, however, are not averages, they are actual realisation of one out of all the possible risk outcomes envisioned in the ex-ante average of all possible risk outcomes.

The OECD 2016 TPG are much clearer than the US regulations in prescribing financial projections used for valuation purpose to be weighed on probability. For example, the first exculpatory provision at paragraph 6.193 specifies that the HTVI guidance will not apply to transactions involving the transfer or use of HTVI when the taxpayer provides: "Details of the ex-ante projections used at the time of the transfer to determine the pricing arrangements, including how risks were accounted for in calculations to determine the price (e.g. probability-weighted), and the appropriateness of its consideration of reasonably foreseeable events and other risks, and the probability of occurrence…".

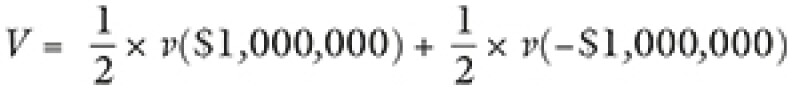

To illustrate the idea that ex-ante projections are probability-weighted averages whereas ex-post results are one-time actual realisation of risk, consider a simple game of chance whereby a fair coin is tossed. If the coin lands on heads, the player wins $1 million; if the coin lands on tails, the player loses $1 million. The ex-ante expected value of the game is thus:

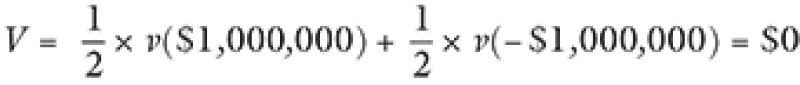

The function v(.) captures the attitude of the player towards risk – how cash translates into value for the player. A risk-neutral player values a win of $1 million equally to a loss of $1 million: v($1,000,000) = $1,000,000 = –v(–$1,000,000) . Therefore, for a risk-neutral player, the value of this game is such that |v(–$1,000,000)| = |v($1,000,000)|:

The operator |.| takes the argument and returns the absolute value of the argument. So if x < 0 then –x = |x| > 0 while if x > 0 then x = |x| > 0.

A risk-averse player, however, values the downside risk of losing $1 million more than the upside risk of winning $1 million. Therefore, for a risk-averse player, the value of this game is negative because |v(–$1,000,000)| > |v($1,000,000)|. To induce such a player to play the game, a payment of at least |v(–$1,000,000)| – |v($1,000,000)| is necessary to make the risk-averse player at least indifferent between playing the game and not playing the game, or better off.

A risk-loving player, finally, values the upside risk of winning $1 million more than the downside risk of losing $1 million. Therefore, for a risk-loving player, the value of this game is positive because |v($1,000,000)| > |v(–$1,000,000)| . Such a risk-loving player is therefore willing to pay up to |v($1,000,000)| – |v(–$1,000,000)| to play the game.

This is why casinos exist and are profitable – the odds are stacked against players in favor of the house; therefore, the house will be profitable. Risk-averse and risk-neutral players do not play, only risk-loving players are willing to forgo fair odds for the sake of gambling. This is the sense in which risk-loving players do pay-to-play; they do not pay cash to the casino to play and face fair odds, they pay by accepting unfair odds instead. The words "fair" and "unfair" refer to whether or not the ex-ante value of the game is zero or negative.

Regardless of the player's attitude toward risks, and thus regardless of whether the game has positive, zero, or negative expected value, the concept of "value" is clearly ex-ante value, the probabilities of heads and tails do appear in the definition of value.

Obviously, after the coin is tossed, either the player will have won or lost $1 million, plus or minus the side payment that was made. At that point, for a risk-neutral player, the ex-post value of the game will be $1 million (if the player win) or minus $1 million (if the player loses) – no side payment needs to be factored in. In the coin toss game, the ex-post value of the game will never be equal to the ex-ante value of the game.

The game of chance we described above is no different than the game of chance a pharmaceutical company plays when engaging in a research and development project. The technical risk of success or failure of the project is captured by probabilities of success or failure that appear in the ex-ante value of the project (the financial projections), but not in the ex-post value (the actual financial statements). There is nothing nefarious or suspicious about it, and yet the US periodic adjustments rules and the OECD HTVI guidance provide tax administrations with the authority to perform adjustments, under certain circumstances, when the difference between ex-ante value and ex-post value is above a certain threshold.

It is generally accepted that at arm's length, once parties have an ex-ante agreement as to their respective rights and obligations, unless specifically contractually allowed (and hence priced ex-ante), regardless of what the ex-post result is, each party will have to perform under the contract. What that means is that adjustments to ex-ante pricing are not possible using the benefit of hindsight. Forced renegotiation of the agreement is not possible.

Those who argue that the US periodic adjustment rules and OECD HTVI guidance are inconsistent with arm's-length pricing rely on this principle to make their case. In addition, they will argue that if the government has the authority to make upwards adjustments based on the benefit of hindsight, then taxpayers should have the authority to make downward adjustments based on the benefit of hindsight – if one can renegotiate one way (i.e. government favourable), one can equally renegotiate the other way (i.e. taxpayer favourable).

These arguments are diametrically opposed to the arguments the US government historically has put forth.

US government position

The issue of the consistency of the periodic adjustment rules with the arm's-length standard of Treas. Reg. §482-1(b)(1) is particularly important in light of the Altera Corp. v. Commissioner, 145 T.C. No. 3 (2015) decision.

In Altera Corp. v. Commissioner, the US Tax Court invalidated the Treasury regulations requirement that controlled participants in a cost sharing arrangement (CSA) share stock-based compensation costs.

Although the basis for invalidating the aforementioned regulatory requirement was grounded in administrative law and the Administrative Procedure Act (APA), Judge Marvel's decision (reviewed by the Tax Court) reaffirmed the decision by the Court of Appeals for the 9th Circuit in Xilinx, Inc. v. Commissioner, 598 F.3d 1191 (9th Cir. 2010) that the Treasury's implementation of the arm's-length standard to a transaction must be performed by reference to empirical evidence as to how uncontrolled participants in such a transaction actually price it.

This empirical view of the arm's-length standard could therefore suggest potential challenges to the periodic adjustment rules of Treas. Reg. §482-1(f)(2) insofar as a taxpayer adjusted under that rule could proffer empirical evidence that uncontrolled parties do not use ex-post evidence to modify an ex-ante deal, unless specifically authorised by their written agreement and priced accordingly.

The position of the IRS and Treasury in connection with the Xilinx decision is articulated in the Action on Decision 2010-03 issued July 16 2010: "The majority, however, mistakenly interprets the arm's-length standard to limit the behaviour of controlled taxpayers, or the transactions into which they may enter, based on the behaviour or transactions into which uncontrolled taxpayers may or may not enter. To the contrary, the regulations accept the controlled taxpayers' actual transaction, provided it has economic substance. The regulatory arm's-length standard asks what would have been the pricing that uncontrolled taxpayers would have adopted, had they entered into the same transaction in which the controlled taxpayers actually engaged." [Footnotes omitted].

Despite the government's nonacquiescence with the decision of the Court of Appeals for the 9th Circuit, judges decide the outcome of disputes between the IRS and taxpayers, not IRS Chief Counsel. It is therefore particularly instructive to understand what the starting position of the IRS and Treasury is, insofar as the arm's-length nature of the periodic adjustment rules is concerned.

Note that the mere finding by a court that Treas. Reg. §482-4(f)(2) conflicts with the arm's-length standard of Treas. Reg. §482-1(b)(1) does not automatically and necessarily invalidate the periodic adjustment rules of Treas. Reg. §482-4(f)(2). Even when the IRS maintains its position that the periodic adjustment rules of Treas. Reg. §482-4(f)(2) are consistent with the arm's-length standard, Chevron deference by the court would avoid invalidation of the periodic adjustment rules.

Xilinx and Altera, however, have made that scenario much less likely to occur.

The words "fair" and "unfair" refer to whether or not the ex-ante value of the game is zero or negative.

RS will follow a significant non-appealed adverse opinion by the court. An action on decision alerts IRS personnel to the Chief Counsel's current litigation position, and it is issued to enhance IRS consistency for future litigation or dispute resolution. Although actions on decision are published in the Internal Revenue Bulletin, they are not intended to serve as statements of IRS positions that can be relied on by the public, and they are not to be cited as precedent. An action on decision is issued by the Office of Associate Chief Counsel with subject matter jurisdiction over the substantive issue addressed in that action on decision.

The white paper

In addition to adding the CWI standard to the 482 statute, and still in the context of the Tax Reform Act of 1986, Congress instructed the IRS to perform a comprehensive study of the Internal Revenue Code (IRC) Section 482 intercompany transfer pricing rules to assess whether those rules ought to be amended. H.R. Conf. Rep. No. 841, 99th Cong., 2d Sess. II-638 (1986).

The IRS complied with Congress's request by issuing in 1988 Notice 88-123, "A Study of Intercompany Pricing under Section 482 of the Code", 1988-2 CB 458, colloquially referred to as the "white paper".

"Congress intended the commensurate with income standard to be consistent with the arm's-length standard. And it will be so interpreted and applied by the Internal Revenue Service and the Treasury," the white paper states at page 458.

Since the interpretation by the IRS and Treasury of the CWI standard can be found in the periodic adjustment rules of the Treasury regulations, the white paper makes it clear that the periodic adjustment rules, as written in Treas. Reg. §482-4(f)(2), were intended to be consistent with the arm's length standard of Treas. Reg. §482-1(b)(1).

The periodic adjustment rules of Treas. Reg.§482-4(f)(2)

The second sentence of Treas. Reg. §1.482-4(f)(2)(i) mandates that adjustments made pursuant to the periodic adjustment rules should be consistent with the arm's-length standard and the provisions of Treas. Reg. §1.482-1: "Adjustments made pursuant to this paragraph (f)(2) shall be consistent with the arm's length standard and the provisions of § 1.482-1." [Emphasis added].

The generic legal advice memorandum 2007-007

Remember that the second sentence of the IRC Section 482 statute (added in 1986) reads: "In the case of any transfer (or license) of intangible property (within the meaning of section 936(h)(3)(B)), the income with respect to such transfer or license shall be commensurate with the income attributable to the intangible." [Emphasis added].

A possible interpretation of "income attributable to the intangible" can be found in Treas. Reg. §1.482-4(c)(2)(iii)(B)(1)(ii). According to that guidance, it is the net present value of the benefits to be realised based on prospective profits to be realised or costs to be saved through the use or subsequent transfer of the intangible.

Consistent with that definition of "income attributable to the intangible," the Generic Legal Advice Memorandum 2007-007 (GLAM 2007-007) provides a detailed discussion of how the use of ex-post results envisioned in the periodic adjustment rules fits within the arm's-length standard of Treas. Reg. §1.482-1(b)(1).

More specifically, GLAM 2007-007 states that the IRS must exercise its periodic adjustment authority consistent with what would have been a conscientious upfront valuation.

In other words, "income attributable to the intangible" must be construed to mean the reasonably anticipated net present value of the benefits to be realised by the exploitation or subsequent transfer of the intangible measured at the time the transaction is entered into – i.e. the upfront valuation.

Bringing it all together

Many taxpayers tend to view the periodic adjustment rules as providing the IRS with the authority to unilaterally obtain an ex-post renegotiation of the upfront deal when the US taxpayer faces an adverse realisation of risk – for example, the outbound license of a US intangible turned out to be more profitable than the US licensor and foreign licensee envisioned at the time of the transfer; hence, the price paid by the licensee to the licensor is less than it would have been had the parties known how profitable the intangible was going to be.

These taxpayers see the periodic adjustment rules as inconsistent with the arm's-length standard.

The US government, on the other hand, tends to view the periodic adjustment rules as providing the IRS with the authority to challenge the financial projections used by the taxpayer in the ex-ante valuation by performing an alternative ex-ante valuation using a different set of financial projections (the ex-post financial results). Despite the fact that such exercise is carried out on an ex-post basis, it is still an ex-ante valuation, or a conscientious upfront valuation in the parlance of GLAM 2007-007, because other than the different set of financial projections used, no information that was not available at the time of the upfront valuation can be used – see GLAM 2007-007.

Because the government has no meaningful way to audit the ex-ante financial projections used at the time the transaction was entered into, it reserves the right through the periodic adjustment rules to perform the ex-ante valuation using the ex-post financial results as presumptive evidence of the ex-ante financial projections.

In the US government's view, this has nothing to do with using the benefit of hindsight to renegotiate a transaction.

Thus, the US government sees the periodic adjustment rules as consistent with the arm's-length standard.

Lessons learned

The language used by WP6 in drafting the HTVI guidance strongly suggests that it benefitted from lessons learned in the US regarding the lack of a common understanding between taxpayers and the government as to the ultimate purpose of CWI and periodic adjustments discussed herein.

There is no ambiguity left in the HTVI guidance that its purpose is to resolve information asymmetries between taxpayers and tax administrations. It also very clearly articulates that taxpayers have the opportunity to resolve information asymmetries by providing tax administrations with details of the ex-ante projections used at the time of the transfer to determine the pricing arrangements, and reliable evidence that any significant difference between the financial projections and actual outcomes is either due to unforeseeable events, or to the playing out of reliable probabilities used in the financial projections.

In other words, if taxpayers volunteer reliable ex-ante information to proactively eliminate the information asymmetry tax administrations suffer from, then there is no reason left to authorise tax administrations to use ex-post information to adjust the ex-ante deal – that would be inconsistent with the arm's-length principle.

As a practical matter, though, tax administrations will have great latitude in determining whether the exculpatory provisions of paragraph 6.193 are met or not; this determination involves a level of subjectivity that may not be particularly reassuring to taxpayers.

HTVI is a blunt tool that can easily be abused. As noted in this article, ex-post results will always be different from ex-ante projections because ex-post outcomes reflect a single realisation of all possible risk outcomes, while the ex-ante projections reflect the average of all possible risk outcomes. Thus, authorising tax administrations to perform an HTVI adjustment solely based on the size of the spread between the average risk outcome and the actual risk outcome could easily and often result in large adjustments that may be difficult for taxpayers to contest.

This issue will be particularly salient in industries that require risky intangible development activities, when the actual realisation of risk outcomes may be far away from their ex-ante average just because of the level of risk involved.

In the US, it is no secret that the IRS has been extremely restrained in its reliance on the periodic adjustment rules as its sole reason to adjust taxpayers. One possible explanation of that extreme restraint is the way the periodic rules are written, and especially the exculpatory provision (rebuttal) of Treas. Reg. §1.482-4(f)(2)(ii)(D).

Once a taxpayer rebuts the presumptive evidence of the inappropriateness of the ex-ante pricing based on ex-post results, it is unclear what information the government would have, at that point, to actually rebut the taxpayer's rebuttal when the whole premise and reason for being of the periodic adjustment rules is that the government is at such a severe information disadvantage in the first place.

The irony of the rebuttal provision of Treas. Reg. §1.482-4(f)(2)(ii)(D) is that it relies on private information that a taxpayer has, but that the IRS almost certainly does not have. The information asymmetries between taxpayers and tax administrations go much deeper than just financial projections.

Once an IRS-initiated proposed periodic adjustment has been rebutted by a taxpayer, short of a smoking gun hinting at fraud, or some other clear evidence of nefarious behaviour by the taxpayer, the US periodic adjustment rules may well be ineffective in achieving their intended goal, because of the way they are written – the exception has swallowed the rule.

This, however, may not be the case with the HTVI guidance. And because the HTVI guidance was written very differently from the US periodic adjustment rules, we may currently be in a world where tax administrations are endowed with a very blunt tool they will be able to use with few safeguards protecting taxpayers from abusive use.

WP6 should keep that in mind when issuing the HTVI implementation guidance expected in 2017.

|

|

Philippe PenelleManaging principal, Washington National Tax Transfer Pricing Service Line Deloitte Tax LLP Tel: +1 213 220 2601 Philippe Penelle is the managing principal of Deloitte Tax LLP's Washington National Tax Transfer Pricing Service Line. He specialises in designing, valuing, and defending transactions that involve the transfer of intellectual property rights. Philippe brings 18 years of professional transfer pricing experience assisting his multinational clients set-up, maintain, document and defend transfers of intellectual property rights through cost sharing arrangements, contributions to international partnerships, contributions to CFCs, and licensing arrangements involving specific allocations of fixed cost funding commitments. His practice includes advising and representing clients in high profile cost sharing controversy cases involving billions of dollars of potential adjustments. Philippe has published a number of articles developing valuation methodologies relevant to various intellectual property structures consistent with the OECD Transfer Pricing Guidelines, the Internal Revenue Code and the Treasury regulations promulgated thereunder. Philippe currently serves as the co-chair of the US Council for International Business (USCIB) Transfer Pricing Subcommittee. He is actively involved in the Base Erosion and Profit Shifting (BEPS) conversations with the OECD, the US Treasury Department, and with the international business community. His involvement has included the drafting of comments submitted on behalf of Deloitte to the OECD, providing input to the USCIB and to the Business and Industry Advisory Committee to the OECD (BIAC), as well as being an invited speaker at the OECD public consultations in Paris, France. Philippe is a frequent guest speaker at international conferences including at the OECD International Tax Conference held annually in Washington, DC. He is regularly cited and quoted in the tax press. In addition, Philippe is currently recognised by Euromoney Legal Media Group as one of the world's leading transfer pricing advisers. All opinions expressed in Philippe's publications and in the comments submitted by USCIB and BIAC to the OECD represent the views of the author and of these organisations, respectively, and should in no way be construed as representing those of Deloitte Tax LLP, or of any of the Deloitte Touche Tohmatsu Limited member firms. |