Managing today and transforming for tomorrow

Seasoned tax leaders make key decisions every day to evolve their tax function and keep pace with unprecedented pressures, disruptive technological advancements, heightened compliance obligations and more – all while seeking to demonstrate value within the organisation and beyond.

For tax executives of multinational organizations, benchmarking against comparable tax functions can be a powerful tool for reflecting on your organisation's current position and planning how to prepare for the future. To help, KPMG International conducts an ongoing survey of the tax functions in multinational organisations around the world. The data gained offers insights into tax functions globally and how they are evolving in their structure, governance, priorities, and performance measures, through the use of technology and more.

What do the latest results tell us? Find out below.

About the survey

KPMG International’s Global Tax Function Benchmarking Survey charts the evolution of leading tax functions and identifies operational benchmarks for high-performing tax teams.

The selected findings in this summary report are based on a survey of almost 200 leaders in charge of tax policy and operations of companies in all major sectors, with participants from 22 jurisdictions worldwide.

Over 65% of respondent organisations have more than $5 billion in annual revenue or turnover. About 90% have global tax functions serving operations in multiple countries/jurisdictions.

Tax leaders can still participate in the survey. By doing so, you will have the opportunity to receive personalised insights into how your tax function compares across key areas. Contact tax@kpmg.com to learn more.

What do tax leaders from around the world have to say?

Structures and resources

From geopolitical turmoil and the pandemic’s long-term effects on the future of work to the challenges of technological transformation, today’s tax functions face disruption on all sides. At the same time, they are under intense pressure internally to cut costs, improve efficiency and add value.

See what tax leaders had to say:

Which of the following disruptors have had the greatest impacts on your organisation within the last year?

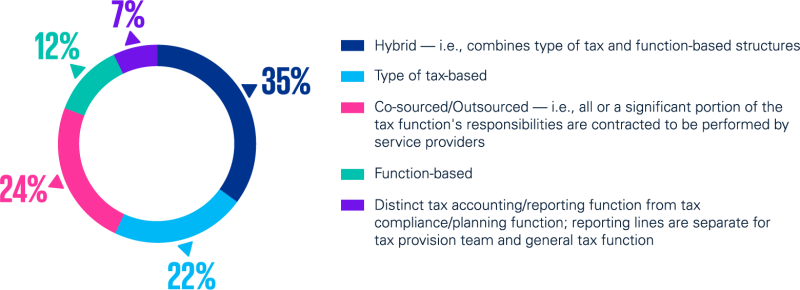

What organisational structure best illustrates your tax function?

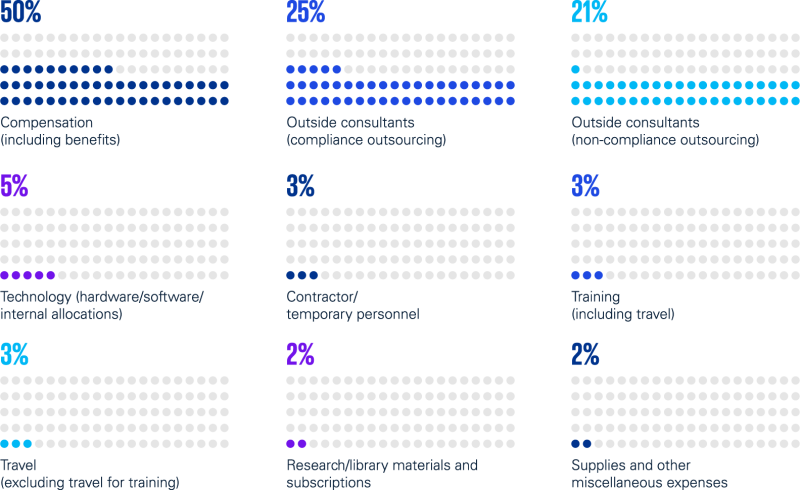

What portion of your company's total tax budget is devoted to the following costs?

Key takeaways

International tax reform, surging M&A activity, and tight markets for tax talent are the three biggest disruptors affecting tax functions today.

Most tax functions still fall within the finance function, although a significant proportion are independent. Only 2% of heads of tax report to the CEO directly.

Most companies have moved to centralise their tax operations to some extent, and the majority have moved to hybrid structures that combine types of tax with functional alignment, rather than organising along tax-specific or functional lines.

A majority of tax functions use shared services centres (SSCs) and tax service providers to perform tax compliance and other activities.

In addition to home and non-home country compliance (direct and indirect), the processes most commonly delegated are the following:

For SSCs – escheat/unclaimed property, trade and customs, and property taxes; and

For tax service providers – expatriate tax matters, property taxes, and escheat/unclaimed property.

Process, performance, and metrics

As tax functions continue to evolve, transformation projects are redesigning their processes to bring greater efficiency through centralisation, standardisation, and automation. These projects are also promoting more attention to oversight and measurement of the transformed function’s performance.

See what tax leaders have to say:

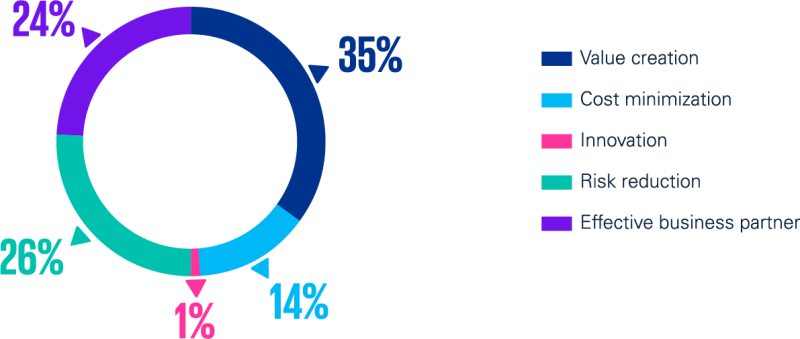

Which of the following themes most closely aligns with your tax function's primary strategy?

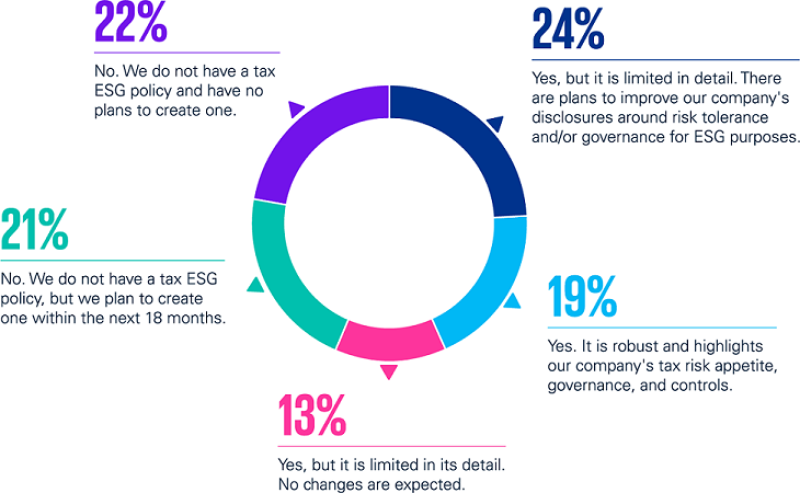

Does your company have a policy that considers the ESG impacts of tax-related business decisions?

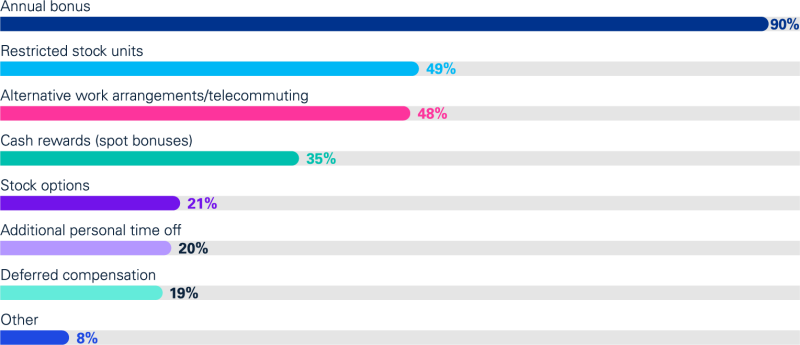

Please select the rewards or recognition systems used to encourage high performance from tax function staff

Key takeaways

The survey results confirm a long-term trend that has seen tax functions’ priorities shift from reactive compliance to proactive value creation.

More respondents said their tax function’s primary strategy is most closely aligned with value creation than those who said their strategies are aligned with risk reduction or cost minimisation.

To measure the performance of their tax function, management of respondent companies gave the most importance to how well the tax team manages tax risk, supports corporate strategy, and meets tax compliance deadlines.

Annual bonuses are the most popular rewards awarded to high-performing tax talent, while remote work and telecommuting has rapidly become one of the top three performance-related benefits.

The focus of standardisation and centralisation seems to be helping to improve the quality of the tax function’s work, but tax talent shortages may be putting this quality at risk.

Tax functions of the future

An efficient and effective tax function is structured to ensure that accountabilities are clear, the right mix of dedicated and shared resources are available, and standardised processes and technologies are leveraged to improve consistency, quality, and efficiency.

See what tax leaders had to say:

Are you considering any of the following to attract and/or retain talent?

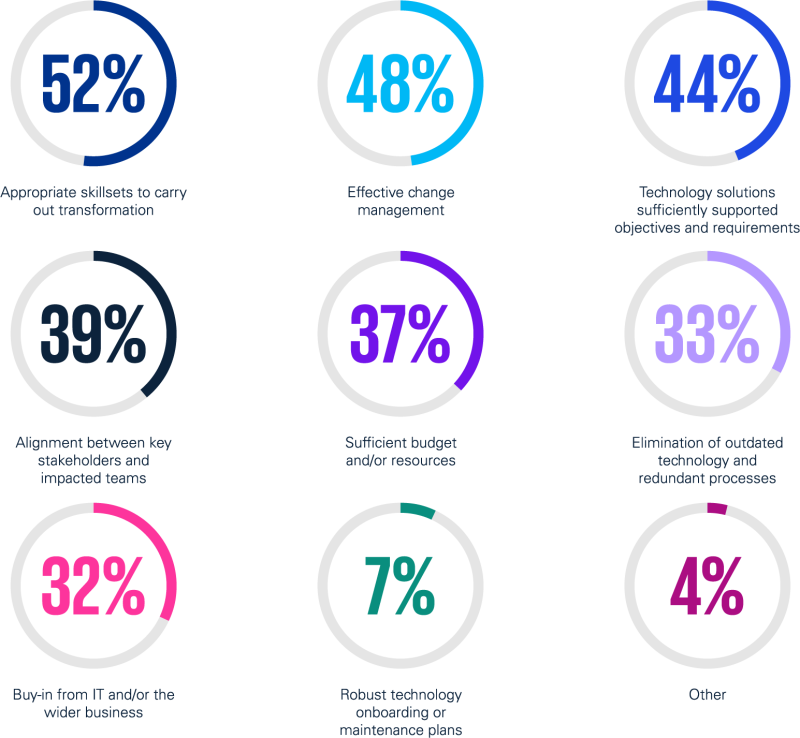

Why have your tax transformation or technology initiatives/projects been successful?

Within your tax function, do you have a dedicated tax technology or process improvement person or group focused exclusively on tax technology matters or tax process transformation?

Key takeaways

In the next five years, most companies expect to increase their number of full-time employees, as well as their use of co-source resources from SSCs, global business services, or centres of excellence.

With employee turnover among the top three disruptors facing respondent organisations, many of them are stepping up their efforts to attract and retain tax talent.

Upgrading the tax function’s skillsets is also on the agenda for many of the respondents, with strategic thinking the most-sought skill by far, followed by tax technical skills and team management.

Chief tax officers are starting to see the benefits of completed tax transformation projects, including shorter cycle times, improved data management and analytics, and reduced tax costs.

Future priorities for improvement include more process standardisation, making better use of tax data in the business planning process, and enhancing communication and collaboration within the tax team and with other functions.

Despite the emphasis on tecthe 2023 Global Tax Department Benchmarking Reporthnology and transformation, only a quarter of respondent tax functions have tax personnel dedicated exclusively to tax technology matters or tax process improvement.

Special focus reports

To accompany the 2023 Global Tax Department Benchmarking Report, KPMG zeroes in on the data through special reports taking on the lens of technology and data, ESG, and private companies.

Technology and data

A special report on tax, technology, and data from the 2023 Global Tax Department Benchmarking Survey.

ESG

A special report on ESG from the 2023 Global Tax Department Benchmarking Survey.

Private companies

A special report on private company tax functions from the 2023 Global Tax Department Benchmarking Survey.

Sector reports

In addition, KPMG dives into six sectors to provide at-a-glance highlights into each sector's structure and resourcing, performance measurement and metrics, use of technology and data, and initiatives supporting ESG.

Energy and natural resources

At-a-glance highlights from the energy and natural resources sector

Financial services

At-a-glance highlights from the financial services sector.

Healthcare and life sciences

At-a-glance highlights from the healthcare and life sciences sector.

Manufacturing

At-a-glance highlights from the manufacturing sector.

Consumer and retail

At-a-glance highlights from the consumer and retail sector.

Technology

At-a-glance highlights from the technology sector.

Read the original version of this article on KPMG’s website: Inside global tax functions.