The past several years have been defined by a number of pre-eminent themes. Economic growth supported by a long-term low interest rate environment abruptly ended in 2022 due to rapid global inflation; disruptions to traditional supply chains and workforces stemming from the pandemic and growing geopolitical tensions; and the unrelenting development and reach of technology that is disrupting all business models. In 2022-2023, the insurance industry witnessed the collision of these themes, bringing us to an inflection point that will impact the sector for the next decade.

Firstly, rising inflationary pressures impact profitability through increasing claims costs and overheads. To put this in context, the Deloitte Centre for Financial Services 2023 Insurance Outlook report noted that as early as mid-2022, average replacement costs were up 16.3% - nearly twice the consumer price index. Combined with often saturated market competition, the challenge for insurers is often how much can be passed on to policyholders before becoming non-competitive.

Secondly, rapidly increasing interest rates may have notable impacts on investment returns, including potential for significant unrealised losses in the shorter term for insurers with a higher concentration of long-dated fixed income investments. Volatility in investment returns puts the spotlight on multinationals’ intragroup asset management policies, and indirectly their reinsurance arrangements to ensure those are sufficiently profitable to counteract short term investment losses. Conversely, higher discount rates on anticipated future claims costs can result in improved profitability but have the potential to make policies less attractive to existing policyholders. Intragroup reinsurers face heightening cost of capital requirements which emphasises establishing robust arm’s length pricing, and demonstrating the commercial rationale for intragroup reinsurance that adequately considers the perspectives of both the cedant and the reinsurer.

Thirdly, overlaying these two macroeconomic themes is the continuous evolution and scope of technology that provides both opportunities and challenges to insurance groups. The combination of a globalised economy, growing wealth in maturing markets and recent significant macroeconomic and geopolitical events, has resulted in rising risk awareness and an explosion of potential new customers and portfolio of insurable risks. Those insurance groups that can best harness technologies to access growth markets, develop new offerings and identify emerging trends and risk appetites will be better equipped to operate sustainably and competitively over the next decade. How technology is considered in insurance groups’ TP models will be of critical importance going forward.

This article examines the impact of these emerging issues on several key aspects of insurance businesses, such as the investment management function, cost of capital, centralised service centres and technology and data.

Investment management

Investment management activities are fundamental to the operations of (re)insurance businesses and their profitability. The global insurance sector is estimated to comprise more than $25 trillion of balance sheet assets and it is reasonable to expect this amount to increase further in the coming years, with forecasts of a 7.5% increase in global insurance premium income in 2023 and a further 5.5% in 2024.

Following the COVID-19 pandemic and the conflict in Ukraine, which caused global inflation rates to soar, insurers are facing new investment risks in 2023. BlackRock in its 2022 Global Insurance Report observed that portfolio construction and asset allocation are front-of-mind for many leading insurance groups. Some group Chief Investment Officers are calling for reviews on long-term investment assumptions and risk frameworks to be brought-forward due to the recent pivot in markets. Whilst it seems in the short-term that traditional portfolios will remain intact, with fixed income assets attracting a majority of insurance monies, other asset classes such as commodities are seeing an increased allocation due to the natural inflation hedge offered. There should continue to be market opportunities for insurers to maximise returns through increased yields in fixed income products, and manage risks through other less traditional private investments so long as interest rates and inflation remain high.

Central banks almost universally respond to inflation by increasing interest rates. Whilst the increased yields on investments can provide insurers with strong returns in the near term, sharp interest rate rises such as the ones seen in late 2022 and early 2023 can lead to an increase in disintermediation risk. Policyholders may decide to take up higher rates offered by competitors, leaving insurance businesses with depressed asset values which negatively impact balance sheets and potentially lead to losses on sale.

Against the backdrop of an uncertain and volatile investment landscape, insurers could see irregular results under existing TP models. Adjustments to fee data (e.g. to account for the captive nature of the business) and fee split methodologies may come under increased scrutiny by tax authorities, meaning there is additional importance in maintaining contemporaneous and robust TP documentation. In certain cases, insurers may need to revisit their TP policies considering the impact of recent macro-economic trends, to ensure that their investment management service fee charges remain arm’s length and that market data continues to support the policies.

Cost of capital

Cost of capital is the expected rate of return that insurers need to pay for the equity they utilise. Insurance regulators generally require licensed insurers to maintain a certain minimum level of capital to act as a protection for policyholders, and this represents a cost of business.

Rising interest rates and the volatile macroeconomic climate is increasing the cost of capital for insurers. McKinsey has reported that insurers need to fundamentally rethink their business models, with many of the alternative approaches being discussed. These involve a move away from the traditional capital-intensive insurance model into a more agile capital-light model which will naturally mitigate some of the risk associated with rising capital costs.

The reinsurance sector is also experiencing pressures from increased interest rates with Aon (Reinsurance Market Dynamics, January 2023) reporting that global reinsurance capital fell by 17% during the first nine months of 2022, mainly linked to unrealised losses in investment portfolios. As the reinsurance industry attempts to adopt a longer-term outlook of capital management, this can have a knock-on effect for insurers who may feel the impact on their earnings as a result.

The pricing of reinsurance transactions between related parties can be complex and there are often limitations for benchmarking studies related to available comparable data. We have seen pricing models based on a required rate of return on capital set by group reinsurers leaving group insurers breaking even or in some cases making losses. In the Asia Pacific region, tax authorities have been known to question the commerciality of certain reinsurance arrangements. The macro-economic conditions impacting the industry in 2023 is a good chance to revisit current TP policies, assess if they remain arm’s length in the new environment and make changes where needed.

Service centres

The impact of rising inflation has several direct impacts on (re)insurance groups' businesses, including increasing staff and overhead costs, and rising claim costs.

For multinational groups with central/shared service centres experiencing the impacts of inflation on their costs, tax authorities globally, but particularly in Asia, will focus on ensuring that any increases to the service charges are demonstrably linked to benefits provided to recipients. Where the cost of employing local staff is higher in a service provider’s location compared to the recipient’s jurisdiction, service recipients will face greater challenges in defending the charges.

Where groups operationalise their service charges using allocation keys that have been intrinsically impacted by inflation pressures (e.g. claims costs), it will be important to clearly articulate in TP documentation the nexus between the allocation key and the benefits conveyed to the service recipient.

Groups that prepare quality TP documentation, which makes clear the commercial rationale for entering into the service arrangements, the suite of benefits provided and demonstrates how the cost base and any profit component are consistent with the arm’s length principle, will have a better experience in their engagements with tax authorities.

Insurance groups should also be mindful of how changes to financial reporting resulting from IFRS 17 may impact their TP policies. For example, care should be taken to ensure service relying on revenue as allocation mechanism remain an appropriate proxy for allocating charges in line with the benefits provided. Further, for benchmarking analyses that seek to observe insurance/reinsurance company’s profitability, it will be important to monitor financial results for years analysed pre- and post-IFRS 17 and explain in documentation where trends in profitability are impacted by changes in reporting standards.

Technology and data

The insurance industry is benefitting structurally from long-term growth drivers, such as the expansion of the insurable risk universe, an increased aversion to risk (and consequently a greater demand for cover) and the gradual reduction of the protection gap in both emerging markets and industrialised countries.

Just as technology has played a disruptive role in other financial service sectors (for example, mobile phone applications providing access to ‘unbanked’ populations, emergence of digital currencies and the use of AI in trading strategies), so too can it offer solutions (and challenges) in the insurance sector.

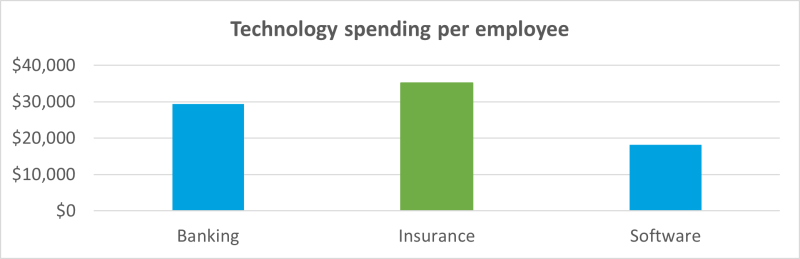

What is clear is that insurance groups are aware of the role technology can and must play to remain competitive. The graph below depicts information from Gartner: IT Key Metrics Data 2023, and illustrates that technology spend on a per employee basis in the insurance sector is higher than both the banking and software industries.

The impact of technology is different but pronounced in different insurance market segments. For example, insurers can rely on abundant and granular data to assist in the distribution of high-frequency, relatively low-severity risks. For example, 15 years ago the process to assess and quote on a car insurance application would have taken three to five days. But now, that process can be completed in a matter of minutes through mobile phone applications, powered by technology and intelligent use of big data.

At the opposite end of the spectrum, technology and data are assisting insurance groups to better understand risks associated with extreme events (e.g. extreme weather or natural catastrophes that may impact farmers) to be covered by parametric insurance.

Looking forward, emerging technologies like generative AI have the potential to further disrupt insurance value chains. Generative AI can map patterns and connections across tremendous volumes of both structured and unstructured data, constantly learning and improving its predictions and natural language capabilities. Oliver Wyman observes that generative AI could transform all aspects of the insurance value chain – such as improving underwriters risk assessment quality through efficient use of more resources, reducing claims leakage and improving speed of appraisals through efficient analysis of larger data sets.

The younger population’s familiarity and comfort with technology and sharing of personal data (Gen Z was observed as being more than three times as likely to use an online claims service and over 50 times more likely to use an app than the Silent Generation ((Source: SCOR Activity Report 2022)) - is an indication of the need to invest in technologies to service the future customer base effectively.

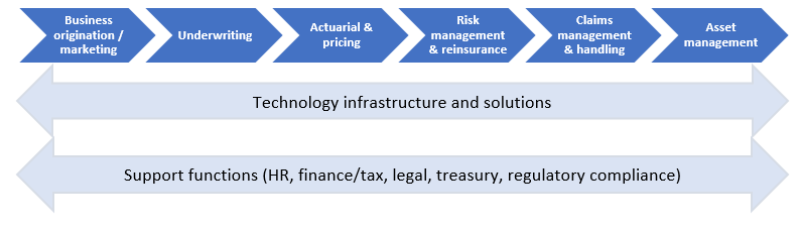

How could these trends impact an insurance group’s TP models? The diagram below summarises the traditional value chain of an insurance group.

In a TP context, the entity(ies) undertaking functions with both the capability and capacity to assume insurance risk are those entities that are considered to assume and control the risk. As such, those entities would be viewed as entitled to the residual share in the profits/losses from the insured risks.

Traditionally, the underwriting function was viewed as the key risk-taking role (i.e. the decision to accept risk, on what terms and the degree to which to ‘set off’ or reinsure that risk).

However, the degree to which technology can contribute to and influence those risk-taking decisions is growing exponentially and impacting all aspects of the value chain – as depicted in the examples above.

Insurance players should act now to review existing and planned technologies and assess how these may impact their TP models. The first step is to prepare. This could include taking steps to understand your business’s technology/digitisation strategy; seeking to understand who is making the key decisions regarding the funding and strategic development of those technologies; and reviewing technology development budgets and monitoring outcomes (financial and strategic) from technology roll outs to begin to determine what technology/IP might have value.

Simply because a technology asset exists, does not mean that it is valuable and should attract premium returns or a share in residual profit/loss. However, where fact finding does identify valuable technology/intangible assets, this may have implications on TP models.

In those instances, it is imperative to determine the location and relative importance of the development, enhancement, maintenance, protection and exploitation (DEMPE) activities associated with the technology/intangible, as those activities may appropriately be rewarded with a return, either as a part of or distinct from existing TP charges.

Outlined below are some situations that might merit reviewing existing TP models in view of the use of technology across the insurance value chain:

· A cost plus return for a claims handling function may generally be appropriate, but to the extent that this is enabled by technology such that the group is differentiated to its competitors and derives increased profitability (e.g. through efficiencies, improved customer retention rates) then the appropriateness of a routine cost plus return should be scrutinised;

· Does the use of technology in the customer sales/relationship processes have an impact on the ceding commission rates attached to intra-group reinsurance;

· Cost contribution arrangements for technology development should be actively monitored to consider if they remain appropriate in light of evolving DEMPE, in particular for significant technology capex and/or known specific valuable technology IP; and

· Does the use of technology through the underwriting process vary the importance or economic location of those functions?

Importantly, technology without human involvement to decide on how to develop it, control it and exploit it cannot have significant value or control over risk in and of itself. However, the way in which technology is used in combination with traditional human capital-intensive functions (e.g. actuarial, underwriting, risk management) could certainly change the way that value and control over risk is allocated amongst members of multinational insurance groups for TP purposes.

With the advent of BEPS Pillar 2 and public country-by-country reporting in the winds, insurance groups’ value chains and TP models will soon be under the increased scrutiny of both the public and tax authorities. A short window remains for insurance groups to consider value chain alignment and prepare for these additional reporting measures, in view of the key emerging themes discussed in this article.